Bookkeeping Services in London

Keep your records intact with our Bookkeeping Services

Bookkeeping Services in London

A sharp business owner understands that accurate accounting and bookkeeping are important to their ability to make reliable business decisions. Our team of expert accountants knows the value of keeping your documents and receipts secure. Bookkeeping is very important for businesses because it helps them build a strong financial system. A good bookkeeping framework also saves you from obnoxious experiences while filing taxes. Bookkeepers maneuver through your records keeps them in prime shape for you so you will get any detail about your sale or purchase in an instant whenever you need it. Our bookkeeping services in London are unparalleled in quality and caliber and characteristic in privacy where we know the value of keeping your documents and receipts secure.

Maintain Steady Cash Flow With Our Bookkeeping Services in London

Is it getting hard for you to attain a smooth cash flow? The reason behind it can be your negligence towards bookkeeping. How are you going to determine where your money is going and coming from without record-keeping? This problem can be solved by employing Accotax bookkeepers.

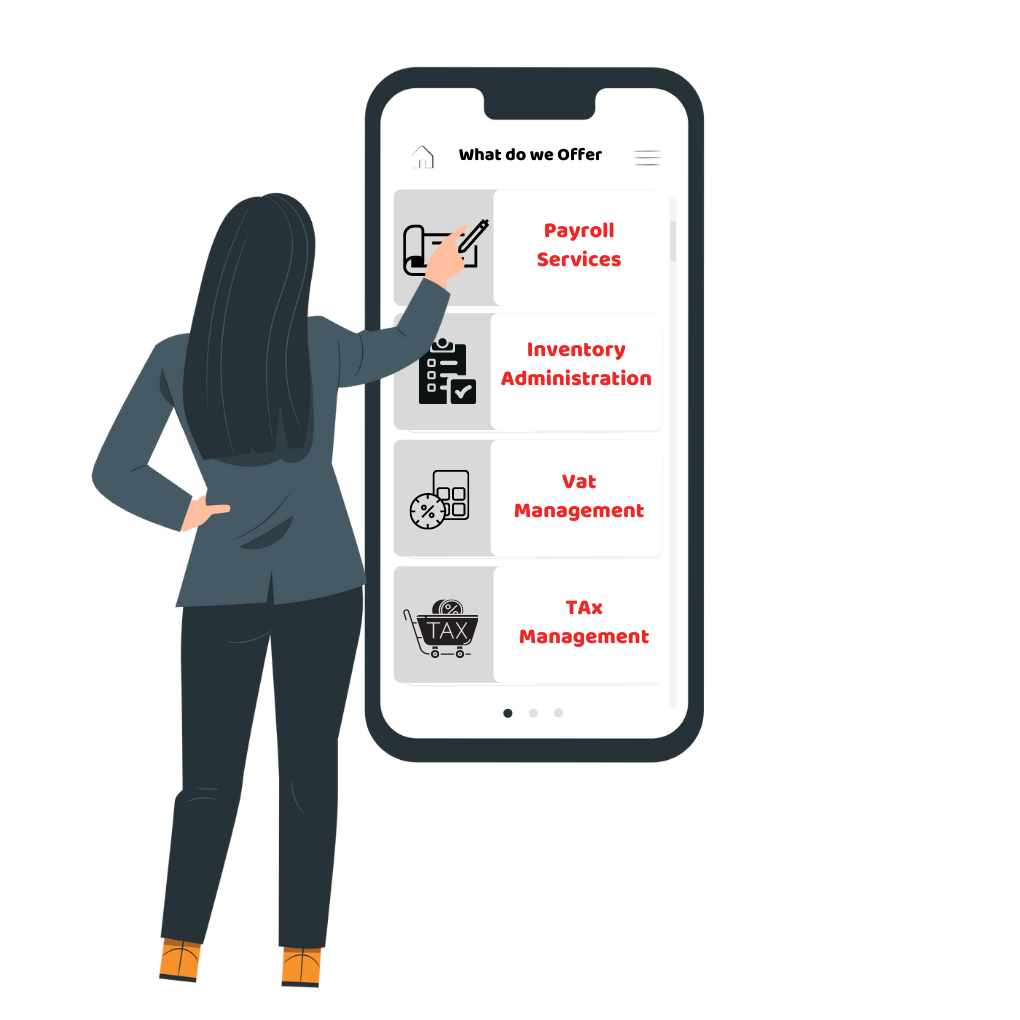

What Do We Offer?

We offer a variety of accounting services from the administration of skilled professional bookkeepers. Our bookkeeping services in London include:

- Inventory Administration.

- Accounts reconciliations / Bank reconciliations.

- Payroll services

- Part-time bookkeeping services.

- Full Charge Bookkeeping Services.

- VAT and tax management

Get Started Today!

Make a wise decision and don’t leave things hanging. The transactions and sale and purchase records do mix easily if left unattended, they come back to haunt you at the end-of-year accounts. Book your accountant today before you make a mess of your receipts and records. We are one call away and always available for any type of assistance.

Start availing of our Bookkeeping services in London and we will give you a free tax guide. So what are you waiting for? Contact us today!