Welcome to our round up of the latest business and Covid-19 news for our clients. Please contact us if you want to talk about how these updates affect your business. We are here to support you!

Covid-19 Update

Last week the milestone of more than 35 million adults receiving both doses of a COVID-19 vaccine (more than two thirds of the adult population) was passed.

From today all remaining limits on social contact are removed and there will be no more restrictions on how many people can meet in any setting, indoors or outdoors.

All settings will be able to open, including nightclubs. Large events, such as music concerts and sporting events can resume without any limits on attendance or social distancing requirements.

All restrictions on life events such as weddings, funerals, bar/bat mitzvahs and baptisms will be removed, including the remaining restrictions on the number of attendees. There will be no requirement for table service at life events, or restrictions on singing or dancing.

The legal requirements to wear a face covering is now lifted. To help reduce the spread of COVID-19, published guidance will advise that wearing a face covering will reduce your risk and the risk to others, where you come into contact with people you don’t normally meet in enclosed and crowded spaces.

Masks do remain compulsory on London transport and other transport providers are imposing similar requirements.

Social distancing rules are now removed.

It is no longer necessary for Government to instruct people to work from home. Employers can start to plan a return to workplaces.

Regulations that place COVID-secure requirements on businesses, including table service, and distancing between tables, are now removed. ‘Working Safely’ guidance will be updated to provide examples of sensible precautions that employers can take to reduce risk in their workplaces. Employers should take account of this guidance in preparing the risk assessments they are already required to make under pre-pandemic health and safety rules.

Businesses must not require a self-isolating worker to come to work and should make sure that workers and customers who feel unwell do not attend the setting.

Businesses will be encouraged to display QR codes for customers to check in using the NHS COVID-19 app, to support NHS Test and Trace, although it will no longer be a legal requirement.

The following protections at step 4 remain from today:

- testing when you have symptoms and targeted asymptomatic testing in education, high risk workplaces and to help people manage their personal risk.

- isolating when positive or when contacted by NHS Test and Trace.

- border quarantine: for all arriving from red list countries and for those people not fully vaccinated arriving from amber list countries.

- cautious guidance for individuals, businesses and the vulnerable whilst prevalence is high including:

- whilst government is no longer instructing people to work from home if they can, the government would expect and recommend a gradual return over the summer

- the government expects and recommends that people wear face coverings in crowded areas such as public transport;

- being outside or letting fresh air in

- minimising the number, proximity and duration of social contacts.

- encouraging and supporting businesses and large events to use the NHS COVID Pass in high risk settings. The government will work with organisations where people are likely to be in close proximity to others outside their household to encourage the use of this. If sufficient measures are not taken to limit infection, the government will consider mandating certification in certain venues at a later date.

For the full list of changes see: COVID-19 Response: Summer 2021 – GOV.UK (www.gov.uk)

Red, Amber, and Green List Rules for Entering England

The Balearic Islands, amongst others, have been added to England’s travel amber list from today. It means those who are not fully vaccinated or under 18 will have to quarantine on their return.

This page lists countries and territories as red, amber or green and tells you what you must do if you have been in those countries or territories.

You can also read an overview of all the things you need to do to:

See: Red, amber, and green list rules for entering England – GOV.UK (www.gov.uk)

Fully Vaccinated Arrivals from France to England must continue to Quarantine

Anyone arriving from France to England must continue to quarantine for 10 days at home or in other accommodation.

See: Fully vaccinated arrivals from France to England must continue to quarantine – GOV.UK (www.gov.uk)

Summer Staff: National Minimum Wage rate reminder for employers

All workers are legally entitled to be paid the National Minimum Wage (NMW). This includes temporary seasonal staff, who often work short-term contracts in bars, hotels, shops and warehouses over the summer.

The National Minimum Wage hourly rates from 1 April 2021 are:

- £8.91 – age 23 or over (National Living Wage)

- £8.36 – age 21 to 22

- £6.56 – age 18 to 20

- £4.62 – age under 18

- £4.30 – apprentice

Employers who do not pay the NMW can be publicly ‘named and shamed’ and those who blatantly fail to comply can face criminal prosecution.

Employers can contact the Acas helpline for free help and advice or visit GOV.UK to find out more.

UK Trade Tariff: Duty Suspensions and Tariff Quotas

Duty suspensions are designed to help UK and Crown Dependency businesses remain competitive in the global marketplace. They do this by suspending import duties on certain goods, normally those used in domestic production.

These suspensions do not apply to other duties that may be chargeable like VAT or the anti-dumping duty. Duty suspensions allow unlimited quantities to be imported into the UK at a reduced tariff rate. Autonomous Tariff Quotas (ATQs) allow limited quantities to be imported at a reduced rate.

Duty suspensions and ATQs are temporary and can be used by any UK business while in force. They are applied on a ‘Most Favoured Nation’ (‘MFN’) basis. This means that goods subject to these suspensions or quotas can be imported into the UK from any country or territory at the specified reduced tariff rate. Find the current duty suspensions and quotas using the Trade Tariff Lookup Tool.

The 2021 window to apply for a duty suspension will close on 31 July 2021.

For further information see: UK Trade Tariff: duty suspensions and tariff quotas – GOV.UK (www.gov.uk)

Delaying Declarations for EU Goods Brought into Great Britain

Businesses can delay sending HMRC full information about goods by up to 175 days before the deadline of 31 December 2021. After that full customs declarations must be made at the point of import for all goods.

For goods brought into Great Britain (England, Wales, and Scotland) from the EU, you (or someone who deals with customs for you) may be able to delay sending HMRC the full information about your goods by up to 175 days after import.

However, you cannot delay declarations and must follow the normal rules for making an import declaration if either:

- your goods are controlled

- HMRC has told you to because you have a poor compliance record

You can delay declarations if you import goods into free circulation in Great Britain from EU free circulation between 1 January and 31 December 2021, your goods are not controlled and HMRC has not told you that you cannot delay declarations.

See: Delaying declarations for EU goods brought into Great Britain – GOV.UK (www.gov.uk)

Making a Full Customs Declaration

From 1 January 2022 if you are moving goods into Great Britain, into Northern Ireland from Great Britain, or into Northern Ireland from outside the EU, you will need to make an entry summary declaration.

See: Making an entry summary declaration – GOV.UK (www.gov.uk)

VAT Postponement

Businesses are still able to use postponed VAT accounting (PVA) to account for import VAT on their VAT returns.

Accounting for import VAT on your VAT Return means you will declare and recover import VAT on the same VAT return, rather than having to pay it upfront and recover it later.

You will need to get your monthly postponed import VAT statement to do this.

The normal rules about what VAT can be reclaimed as input tax will apply.

See: Check when you can account for import VAT on your VAT Return – GOV.UK (www.gov.uk)

Intellectual Property Office Launches Digital IP Renewal Service

Following a successful trial period, the Intellectual Property Office (IPO) has officially launched their new digital renewals service.

The online service offers IPO’s customers a way to renew up to 1,500 intellectual property (IP) rights in a single digital transaction. These rights include combinations of patents, trademarks and designs.

The service offers several benefits to the IPO’s customers. It:

- streamlines the bulk renewals process

- provides instant validation of renewal applications

- eliminates errors resulting from a manual process

Customers also benefit from automated electronic delivery of correspondence and receipts, certificates, and the ability to complete transactions at the time and place that suits them.

The renewals service offers a taster of what you can expect from the IPO in the future. As part of their One IPO Transformation Programme, work is underway to develop a single, integrated system for all registered IP rights. The new, paper-free system would allow IP owners to access all IPO’s services through one digital account, and easily manage all of their IP rights in one place.

For updates about the IPO’s transformation programme, you can email [email protected].

Off-Payroll Working – Will HMRC Accept CEST result?

Since 6 April 2021 large and medium-sized organisations, based on the Companies Act criteria, have had to determine whether or not a worker supplying his services via their own personal service company would be treated as an employee if directly engaged. This replaced the IR35 rules for these larger organisations.

HMRC suggest organisations use their Check Employment Status for Tax (CEST) tool on their website to check the worker’s status, although that is not obligatory. The tool is an interactive database of questions and will normally provide a ruling after 15 to 20 questions depending on the answers given about the contractual relationship.

See: Check employment status for tax – GOV.UK (www.gov.uk)

HMRC have recently confirmed that they will be bound by the result of the software provided the information is accurate and it is used in accordance with their guidance.

See: ESM11010 – Employment Status Manual – HMRC internal manual – GOV.UK (www.gov.uk)

HMRC have also stated that they will not stand by results achieved through contrived arrangements that have been deliberately created or designed to get a particular outcome. They would see that as deliberate non-compliance, and potentially levy financial penalties.

Note that the end-user organisation is required to issue a Status Determination Statement to the worker with a copy to any agency to be passed to any fee payer in the labour supply chain making payments to the personal service company.

COVID-19 Government Support News

Below is our weekly roundup of changes to government support information generally and for businesses, employers and the self-employed.

Coronavirus Job Retention Scheme (CJRS) – Update

The CJRS has been extended until 30 September 2021. From 1 July 2021, the government will pay 70% of wages up to a maximum cap of £2,187.50 for the hours the employee is on furlough.

Employers will top up employees’ wages to make sure they receive 80% of wages (up to £2,500) in total for the hours the employee is on furlough. The caps are proportional to the hours not worked.

From 1 August 2021, the government will pay 60% of wages for furlough employees up to £1,875. From 1 July 2021, employers will top up employees’ wages to make sure they receive 80% of wages (up to £2,500).

Download a template if you’re claiming for 16 or more employees through the Coronavirus Job Retention Scheme

Complete a template with the details of the employees you’re claiming for and upload this when you claim (for claims on or after 1 July 2020). These templates have been updated.

Self-Employment Income Support Scheme (SEISS) – Get Ready to Claim the Fifth Grant

HMRC has provided a new video about the SEISS fifth grant.

See: Help and support if your business is affected by coronavirus (COVID-19) – GOV.UK (www.gov.uk)

Work out your turnover so you can claim the fifth SEISS grant

The introduction to the guidance has been edited to explain that you would need to tell HMRC about your turnover if you traded in 2019 to 2020 as well as any of the other tax years listed. The section ‘How to work out your April 2020 to April 2021 turnover’ has been updated with examples of start dates you can use.

See: Work out your turnover so you can claim the fifth SEISS grant – GOV.UK (www.gov.uk)

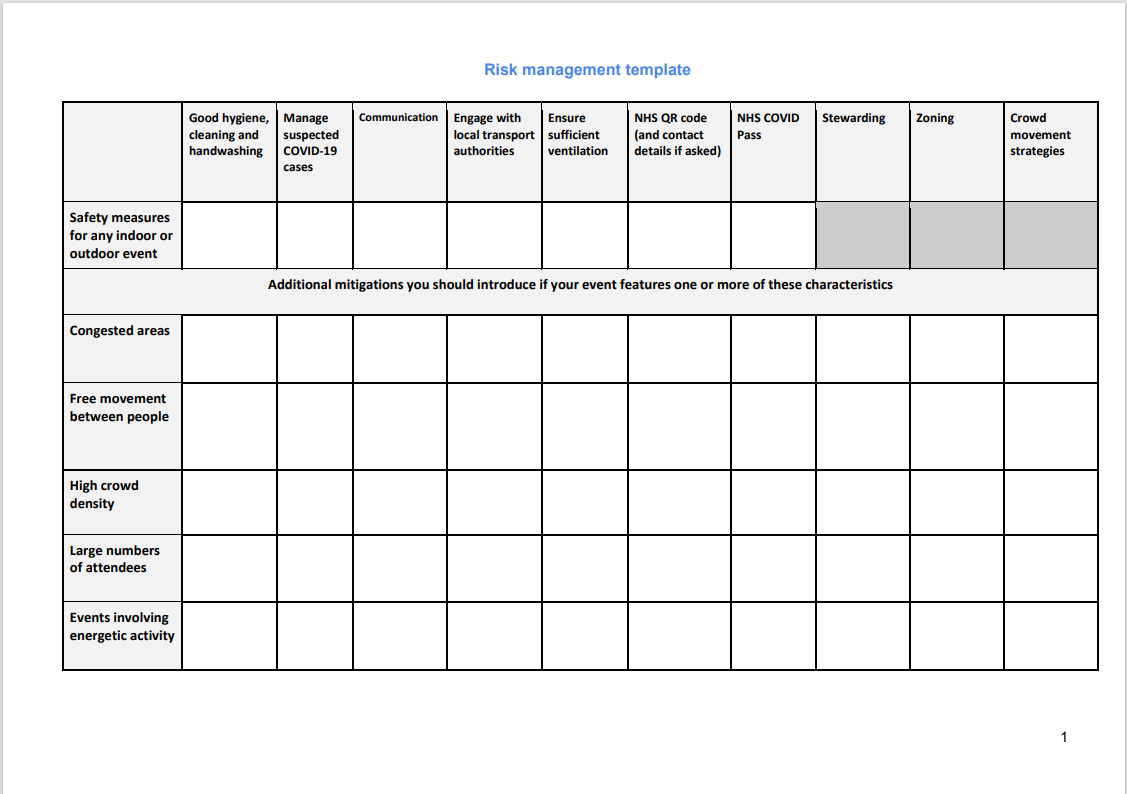

Risk Management Template for Event Organisers

The Department for Digital, Culture, Media & Sport has provided a resource to help event organisers to reduce the risk of COVID-19 transmission in event settings. This resource sets out examples of the types of risk mitigation measures event organisers can put in place to reduce the risk of COVID-19 transmission at events.

This should be used in conjunction with the events and attractions guidance, which explains the types of events which may need to take additional measures and how these measures can help to reduce risk. It also includes more detail on how you can put these measures in place in different settings.

See: Risk management template for event organisers – GOV.UK (www.gov.uk)