Welcome to our round up of the latest business and Covid-19 news for our clients. Please contact us if you want to talk about how these updates affect your business. We are here to support you!

Covid-19 Update

The Executive has decided that from 26 July, to be ratified on 22 July:

- In indoor domestic settings a maximum of 10 people from no more than three households will be permitted. If one household has ten or more members, the maximum is increased to 15 from no more than three households. Children aged 12 and under are not counted in the total number.

- At outdoor domestic settings, a maximum of 15 people from an unlimited number of households will be permitted. Children aged 12 and under are not counted in the total number.

- As a consequence of these relaxations for indoor and outdoor domestic settings, the linked households/bubble provision will be removed from the regulations.

- Within close contact services, the requirement for an appointment will be removed and overlapping appointments will be allowed.

- Where a legal requirement to socially distance exists it will be reduced to 1 metre for indoors activities and removed for all outdoor activities. It is still recommended that social distancing at 2 metres is maintained where possible and if not, a minimum of 1 metre is facilitated for indoor events.

- Public transport is exempt from the social distancing requirement however guidance is that it should be 1m unless not possible, in which case other mitigations must be in place.

- Audiences will be able to return to seated theatres and concert halls and other such venues. Entry to performances for audiences will be by ticket only. Tickets must be purchased in advance of the performance. Audiences for indoor events must have allocated seating and remain seated. Social distancing of 1m will be required.

- In Concert venues, theatres and other indoor venues, live music will be permitted for rehearsals and performances with no restriction to background or ambient levels of volume. Entry to performances for audiences will be by ticket only. Tickets must be purchased in advance of the performance.

- Audiences for indoor events must have allocated seating and remain seated (unless using facilities) and are not permitted to dance. Social distancing of 1m will be required.

- This can include a space within larger premises – for example, a function room or conference suite within a hotel. In such circumstances, access to the venue must be effectively controlled and managed and the venue must be sufficiently isolated from the rest of the premises to ensure that the volume of the music in the venue does not breach ambient or background levels in other parts of the premises.

- Entry to performances for audiences will be by ticket only. Tickets must be purchased in advance of the performance. Audiences for indoor events must have allocated seating and remain seated.

During August, the Executive will also consider issues relating to working from home, further relaxations in domestic settings, the remaining mitigations in the hospitality sector, the return of further and higher education and the return of live music and dancing without restrictions.

For the full list of indicative changes see: Coronavirus (COVID-19) regulations and guidance: what they mean for you | nidirect

International Travel Update

A number of changes to Northern Ireland’s international country travel lists have been confirmed and guidance for fully vaccinated passengers returning from Amber list countries has also been updated.

From 4am on Monday 19 July, the following changes will be introduced.

Bulgaria, Hong Kong, Croatia and Taiwan have been added to the Green list.

Anyone travelling to Northern Ireland from a country on the Green list must:

- provide proof of a negative COVID-19 test result taken up to three days before departure

- book and pay for a day two COVID-19 PCR test

- complete a UK passenger locator form within 48 hours of departure

There is no requirement to self-isolate or book a day eight COVID-19 PCR test if travelling to Northern Ireland from a country on the Green list.

The Balearic Islands and British Virgin Islands will be removed from the Green list and added to the Amber list.

Anyone travelling to Northern Ireland from a country on the Amber list before 19 July must:

- provide proof of a negative COVID-19 test result taken up to three days before departure

- book and pay for a day two and eight COVID-19 PCR test

- complete a UK passenger locator form within 48 hours of departure

- self-isolate for 10 days

From Monday 19 July, people who have been fully vaccinated in the UK will not have to self-isolate if arriving into NI from an amber country. However they must still:

- provide proof of a negative COVID-19 test result taken up to three days before departure

- book and pay for a day two COVID-19 PCR test

- complete a UK passenger locator form within 48 hours of departure

UK residents under the age of 18, who are returning to Northern Ireland and people taking part in formally approved COVID-19 vaccine clinical trials are exempt from requirements to self-isolate and the day 8 test.

Cuba, Indonesia, Myanmar and Sierra Leone will be added to the Red list.

Anyone travelling to Northern Ireland from a country on the Red list must:

- provide proof of a negative COVID-19 test result taken up to three days before departure

- complete a UK passenger locator form within 48 hours of departure

- book and enter managed isolation (hotel quarantine) for 10 days, which includes post-arrival tests

A decision of arrivals from France is expected to be announced this week.

See: International Travel Update – 15 July | Department of Health (health-ni.gov.uk)

Summer Staff: National Minimum Wage Rate Reminder for Employers

All workers are legally entitled to be paid the National Minimum Wage (NMW). This includes temporary seasonal staff, who often work short-term contracts in bars, hotels, shops and warehouses over the summer.

The National Minimum Wage hourly rates from 1 April 2021 are:

- £8.91 – age 23 or over (National Living Wage)

- £8.36 – age 21 to 22

- £6.56 – age 18 to 20

- £4.62 – age under 18

- £4.30 – apprentice

Employers who do not pay the NMW can be publicly ‘named and shamed’ and those who blatantly fail to comply can face criminal prosecution.

Employers can contact the Acas helpline for free help and advice or visit GOV.UK to find out more.

Movement Assistance Scheme Extended

The Movement Assistance Scheme helps traders to move agrifood goods into Northern Ireland by covering the costs of inspection and certification. The scheme will now run until the end of December 2021.

Under the scheme, traders do not need to pay for the inspection or certification of:

- live animals and animal products

- plants and plant products

- some categories of high risk food and feed not of animal origin

- organic products

Official veterinarians and other certifiers must not charge traders for inspecting or certifying – they can invoice the government.

Updates to the scheme

Key updates to the scheme include:

- the full cost of testing for scrapie disease is covered by the scheme

- from 1 August 2021, traders can get financial help to pay for International Seed Testing Association (ISTA) sample testing and certification – certifiers must not charge traders from this date

- from 1 August 2021, traders will be able to get financial support from the government for some costs they incur to move organics from Great Britain solely to Northern Ireland or receive organics in Northern Ireland solely from Great Britain

For more information see Movement Assistance Scheme: get help with moving agrifood goods to Northern Ireland.

Intellectual Property Office Launches Digital IP Renewal Service

Following a successful trial period, the Intellectual Property Office (IPO) has officially launched their new digital renewals service.

The online service offers IPO’s customers a way to renew up to 1,500 intellectual property (IP) rights in a single digital transaction. These rights include combinations of patents, trademarks and designs.

The service offers several benefits to the IPO’s customers. It:

- streamlines the bulk renewals process

- provides instant validation of renewal applications

- eliminates errors resulting from a manual process

Customers also benefit from automated electronic delivery of correspondence and receipts, certificates, and ability to complete transactions at the time and place that suits them.

The renewals service offers a taster of what you can expect from the IPO in future. As part of their One IPO Transformation Programme, work is underway to develop a single, integrated system for all registered IP rights. The new, paper-free system would allow IP owners to access all IPO’s services through one digital account, and easily manage all of their IP rights in one place.

For updates about the IPO’s transformation programme, you can email [email protected].

Off-Payroll Working – Will HMRC Accept CEST Result?

Since 6 April 2021 large and medium-sized organisations, based on the Companies Act criteria, have had to determine whether or not a worker supplying his services via their own personal service company would be treated as an employee if directly engaged. This replaced the IR35 rules for these larger organisations.

HMRC suggest organisations use their Check Employment Status for Tax (CEST) tool on their website to check the worker’s status, although that is not obligatory. The tool is an interactive database of questions and will normally provide a ruling after 15 to 20 questions depending on the answers given about the contractual relationship.

See: Check employment status for tax – GOV.UK (www.gov.uk)

HMRC have recently confirmed that they will be bound by the result of the software provided the information is accurate and it is used in accordance with their guidance.

See: ESM11010 – Employment Status Manual – HMRC internal manual – GOV.UK (www.gov.uk)

HMRC has also stated that they will not stand by results achieved through contrived arrangements that have been deliberately created or designed to get a particular outcome. They would see that as deliberate non-compliance, and potentially levy financial penalties.

Note that the end-user organisation is required to issue a Status Determination Statement to the worker with a copy to any agency to be passed to any fee payer in the labour supply chain making payments to the personal service company.

COVID-19 Government Support News

Below is our weekly roundup of changes to government support information generally and for businesses, employers, and the self-employed.

Coronavirus Job Retention Scheme (CJRS) – Update

The CJRS has been extended until 30 September 2021. From 1 July 2021, the government will pay 70% of wages up to a maximum cap of £2,187.50 for the hours the employee is on furlough.

Employers will top up employees’ wages to make sure they receive 80% of wages (up to £2,500) in total for the hours the employee is on furlough. The caps are proportional to the hours not worked.

From 1 August 2021, the government will pay 60% of wages for furlough employees up to £1,875. From 1 July 2021, employers will top up employees’ wages to make sure they receive 80% of wages (up to £2,500).

Download a template if you’re claiming for 16 or more employees through the Coronavirus Job Retention Scheme

Complete a template with the details of the employees you’re claiming for and upload this when you claim (for claims on or after 1 July 2020). These templates have been updated.

Self-Employment Income Support Scheme (SEISS) – Get Ready to Claim the Fifth Grant

HMRC have provided a new video about the SEISS fifth grant.

See: Help and support if your business is affected by coronavirus (COVID-19) – GOV.UK (www.gov.uk)

Work out your turnover so you can claim the fifth SEISS grant

The introduction to the guidance has been edited to explain that you would need to tell HMRC about your turnover if you traded in 2019 to 2020 as well as any of the other tax years listed. The section ‘How to work out your April 2020 to April 2021 turnover’ has been updated with examples of start dates you can use.

See: Work out your turnover so you can claim the fifth SEISS grant – GOV.UK (www.gov.uk)

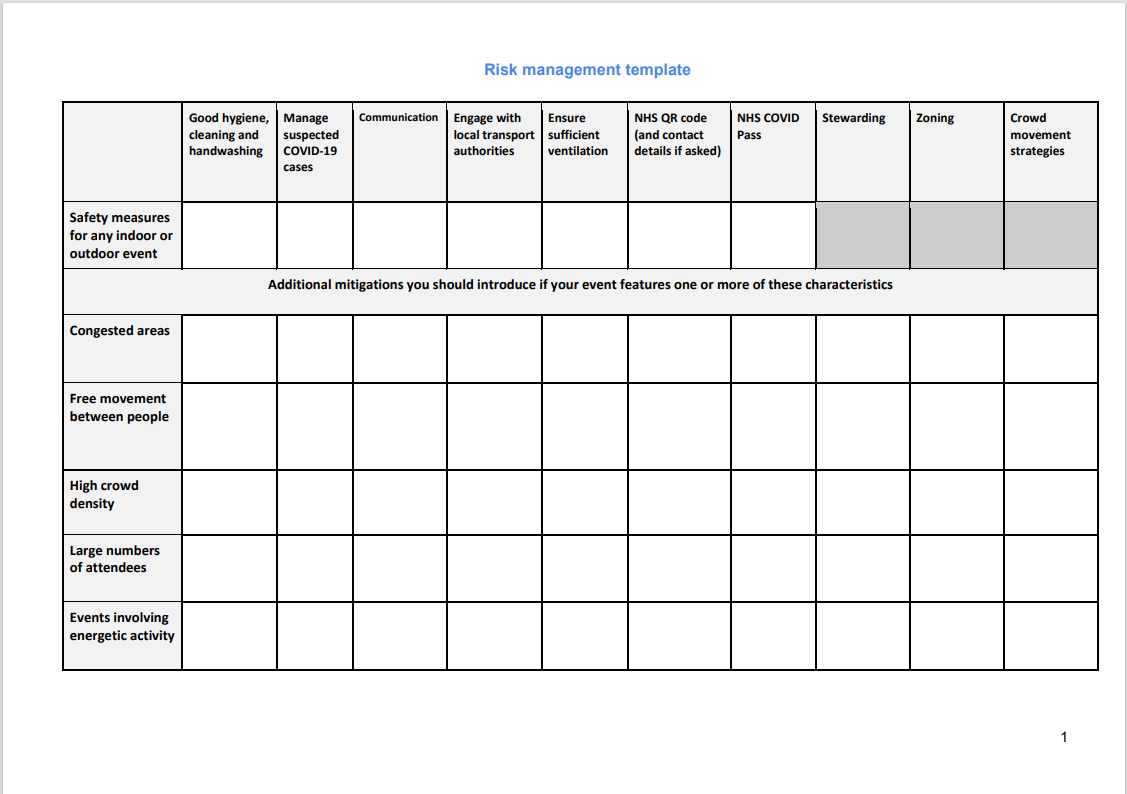

Risk Management Template for Event Organisers

The Department for Digital, Culture, Media & Sport has provided a resource to help event organisers to reduce the risk of COVID-19 transmission in event settings. This resource sets out examples of the types of risk mitigation measures event organisers can put in place to reduce the risk of COVID-19 transmission at events.

This should be used in conjunction with the events and attractions guidance, which explains the types of events which may need to take additional measures and how these measures can help to reduce risk. It also includes more detail on how you can put these measures in place in different settings.

See: Risk management template for event organisers – GOV.UK (www.gov.uk)

Rural Business Development Grant Scheme – Funding Workshops

The Rural Business Development Grant scheme is funded by the Department of Agriculture, Environment and Rural Affairs (DAERA) and administered by the councils.

The grant scheme is open until Friday 30 July 2021. Lisburn and Castlereagh City Council will be administering the scheme for rural businesses from Lisburn, Castlereagh and Belfast on this occasion.

The capital grants are capped at £4,999 at a match-funding rate of 50 per cent from DAERA and 50 per cent from participating businesses. The minimum grant awarded will be £500. Eligible applications must be from existing micro-businesses with less than 10 full time employees. The capital costs must be between £1000 and £20,000. Those who have previously benefitted from awards of financial assistance under this scheme cannot apply.

Lisburn and Castlereagh City Council is holding online funding workshops to support applications to the scheme.

The workshops will provide further advice about making an application, so Lisburn and Castlereagh City Council is requesting that businesses attend on one of the following dates:

- Friday 23 July – 13:30

- Monday 26 July – 18:30

When you book a place at a workshop you will be sent a zoom link for the meeting.

You can register for the workshop by emailing [email protected] or calling Tel 028 92 447447.