Welcome to our round up of the latest business news for our clients. Please contact us if you want to talk about how these updates affect your business. We are here to support you!

Over 10 Million People in the UK Receive COVID-19 Booster Jabs

Over ten million people have now received their COVID-19 booster jab, ensuring the protection they have secured from their first two doses is maintained over the winter months.

Recent figures follow hundreds of thousands of vaccinations over the weekend. People who are eligible are also able to get a booster at hundreds of walk-in sites across the country, as long as it’s been six months since their second dose. The third vaccine dose will be offered to 30 million people over 50, medical staff, and younger adults with some health conditions.

New Recovery Loan Fund Launched

Charities and social enterprises that have been operating for a minimum of two years can now apply for loans worth up to £1.5 million from Social Investment Business (SIB).

Eligible organisations can apply for loans of £100,000 to £1.5 million with a one-to-six-year term, and no early repayment penalty. BAME-led organisations and those based in Wales or Scotland will be able to apply for loans upwards of £50,000.

The new Recovery Loan Fund is the successor of the Resilience and Recovery Loan Fund and aims to help organisations that have been affected by Covid-19. It is also open to organisations looking to refinance short-term debt – all loan purposes will be considered, including refinancing.

The deadline is Sunday, 21 November 2021 and applications will be reviewed on a first-come, first-served basis.

See: Recovery Loan Fund (sibgroup.org.uk)

Help to Grow your Business

Small business leaders can now register their interest in Help to Grow Management, a 12 week-programme delivered by leading business schools across the UK. Designed to be manageable alongside full-time work, this programme will support small business leaders to develop their strategic skills with key modules covering financial management, innovation and digital adoption.

Who is it for?

UK businesses from any sector that have been operating for more than 1 year, with between 5 to 249 employees are eligible.

The participant should be a decision maker or member of the senior management team within the business e.g. Chief Executive, Finance Director etc. Charities are not eligible.

See: Help to Grow – Take your business to the next level (campaign.gov.uk)

Intellectual Property and Your Work

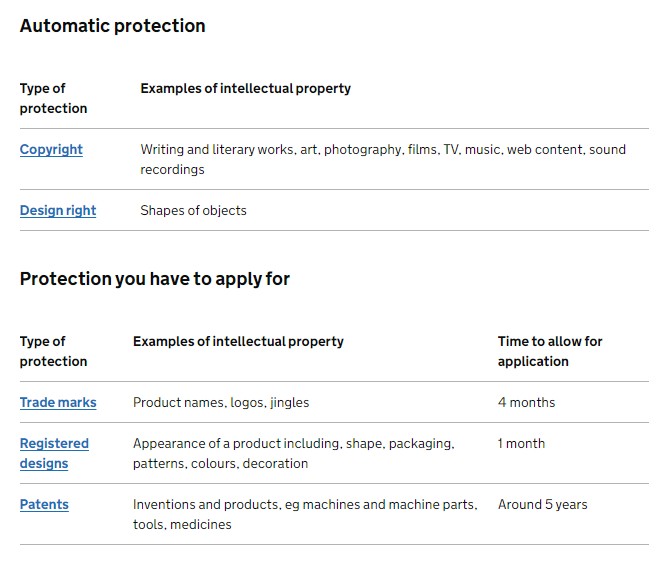

Protecting your intellectual property makes it easier to take legal action against anyone who steals or copies it. The type of protection you can get depends on what you have created. You get some types of protection automatically, others you have to apply for.

For more guidance see: Intellectual property and your work: Protect your intellectual property – GOV.UK (www.gov.uk)

Return to your Claim for the Self-Employment Income Support Scheme

A Section has been added with links to guidance for the fifth grant and previous grants. A link to guidance on how to pay back a grant has also been added.

You can use the online service to check the status of your payment, update your details, see how much you were paid or if you think the grant amount is too low.

If you have made a claim, HMRC will check your details and pay your grant into your bank account in the next 6 working days. They will send an email when your payment is on its way.

Contact HMRC if you haven’t heard from them after 10 working days since you made your claim and you’ve not received your payment in that time.

If you’ve received a letter from HMRC stating you need to pay back some or all of the grant then see a new section which been added to the guidance called ‘Check how to tell HMRC and pay money back’. You can use the service to check whether you need to tell HMRC and pay back a grant.

See: Return to your claim for the Self-Employment Income Support Scheme – GOV.UK (www.gov.uk)

Foreign Travel Insurance

The guidance has been updated on using an EHIC or GHIC to access healthcare in Switzerland.

Before travelling, government advice is you should check the travel advice for your destination. If you travel internationally during the COVID-19 pandemic, make sure you have appropriate travel insurance.

If you already have a travel insurance policy, you should check what cover it provides for coronavirus-related events, including medical cover and travel disruption. If you are choosing a new policy, make sure you check how it covers these issues.

If you do not have appropriate insurance before you travel, you could be liable for emergency costs including medical treatment. We recommend you buy your travel insurance as soon as possible after booking your trip.

See: Foreign travel insurance – GOV.UK (www.gov.uk)

Coronavirus (COVID-19): Advice for Pregnant Employees

The government advice is for you if you are pregnant and working as an employee. This includes pregnant healthcare professionals. It will help you discuss with your line manager and occupational health team how best to ensure health and safety in the workplace.

The advice has been updated to reflect changes surrounding shielding requirements and to provide more information on vaccines.

See: Coronavirus (COVID-19): advice for pregnant employees – GOV.UK (www.gov.uk)

Finding and Choosing a Private Coronavirus (COVID-19) Test Provider

The lists of and information about private test providers, to help you get the private COVID-19 tests you need, have been updated.

See: Finding and choosing a private coronavirus (COVID-19) test provider – GOV.UK (www.gov.uk)

Applying for Advance Assurance Before Raising Venture Capital

HMRC have updated their guidance to companies applying for Advance Assurance that the company seeking finance qualifies for one of the generous venture capital tax reliefs that are currently available.

Individual investors may obtain an income tax deduction of 50% if the company qualifies for Seed Enterprise Investment Scheme (SEIS) or 30% income tax relief where the company qualifies for EIS relief. In addition there is potentially a CGT exemption when the shares are sold and also deferral or relief from CGT on other disposals. Although not mandatory, Advance Assurance that the company and trade qualifies for tax relief may encourage more external investors to invest in the company.

There are numerous detailed conditions that need to be satisfied for the company to qualify and lots of details such as business plans need to be supplied to obtain Advance Assurance. HMRC will not comment on whether a particular investor would qualify for relief, however the company will normally be required to give details of potential investors for HMRC to consider the application. Note that the generous tax reliefs are not normally available to an investor who is connected to the company, typically an existing employee or someone who will own more than 30% of the company’s capital.

The HMRC guidance also covers Advance Assurance that the company qualifies under the Social Investment Tax Relief and Venture Capital Trust rules.

Applications for Advance Assurance may be emailed to: [email protected].

Or alternatively posted to the HMRC Venture Capital Reliefs Team.

For updated guidance see: Apply for advance assurance on a venture capital scheme – GOV.UK (www.gov.uk)

Innovate UK Smart Grants: Autumn 2021

Smart is Innovate UK’s ‘open grant funding’ programme. It provides an opportunity for UK registered organisations to apply for a share of up to £25 million to deliver disruptive research and development (R&D) innovations that can significantly impact the UK economy.

All proposals must be business-focused. Applications can come from any area of technology and be applied to any part of the economy, such as, but not exclusively:

- the arts, design and media

- creative industries

- science or engineering

Innovate UK welcomes projects that overlap with the Industrial Strategy grand challenge areas, but this is not a requirement.

See: Competition overview – Innovate UK Smart Grants: October 2021 – Innovation Funding Service (apply-for-innovation-funding.service.gov.uk)

Biomedical Catalyst 2021: Round 2 Competition

Innovate UK, part of UK Research and Innovation, will invest up to £12 million for businesses to develop innovative healthcare products, technologies and processes.

This competition combines two strands of the Biomedical Catalyst:

- Feasibility Award – this award is designed for projects that have developed an innovative concept or carried out experimental proof of concept but have not validated the technology.

- Primer Award – this award is for conducting a technical evaluation of an idea through to proof of concept in a model system.

Your project must focus on the development of a product or process that is an innovative solution to a health and care challenge. Your project can focus on:

- disease prevention and proactive management of health and chronic conditions

- earlier and better detection and diagnosis of disease, leading to better patient outcomes

- tailored treatments that either change the underlying disease or offer potential cures

See: Competition overview – Biomedical Catalyst 2021 Round 2: Feasibility & Primer Awards – Innovation Funding Service (apply-for-innovation-funding.service.gov.uk)

EUREKA GlobalStars Taiwan: Digital Industrial Collaborations

Innovate UK, part of UK Research and Innovation, is investing up to £865,000 to fund collaborative research and development (R&D) projects focused on industrial research.

The funding will be awarded through a EUREKA Globalstars competition to facilitate collaboration between UK and Taiwanese businesses and encourage innovation and deployment of novel digital technologies for manufacturing.

See: Competition overview – EUREKA GlobalStars Taiwan digital industrial collaborations – Innovation Funding Service (apply-for-innovation-funding.service.gov.uk)

Good Ventilation can Help Reduce the Spread of COVID-19 in the Workplace

HSE is continuing to update its ventilation guidance encouraging all workplaces to continue to work safely. As more people have returned to the workplace, using good ventilation can help to reduce how much virus is in the air. This helps reduce the risk from aerosol transmission and the spread of COVID-19 in the workplace.

See: Work equipment and ventilation during the coronavirus (COVID-19) pandemic – HSE

High Street Scheme: Guidance for Businesses

The High Street Scheme will officially close on 14 December 2021, when all cards will be deactivated, and no more spend on the card can occur.

Guidance for retailers and for the public can be found on the website below.

See: High Street Scheme | Department for the Economy (economy-ni.gov.uk)

Living Places and Spaces Grant Fund opens

The Department for Infrastructure’s £500,000 Living Places and Spaces grant scheme is now open to applications. The fund is being administered in partnership with the National Lottery Community Fund. It offers small scale capital grants of between £1,000 and £10,000. This is to support communities by creating more sustainable and resilient outdoor spaces through:

- greening – planting more trees and plants in an area

- rewilding – allowing nature to take over an area

- water management – slowing rainwater before it gets to the drainage systems.

The types of projects that could be funded include:

- community gardens (a single piece of land gardened collectively by a group of people)

- pocket parks and forests (small urban or rural forests)

- allotments (an area of land used for growing fruit and vegetables)

- rain gardens (an area which is planted so that rainwater from roofs, driveways, etc runs into it and soaks into the ground, and therefore does not cause flooding or other problems)

- green roofs (a roof that is partially or completely covered with vegetation)

- ponds and living walls or vertical gardens (vertical structures that have living plants or other greenery attached to them).

- installation of outdoor furniture or features to encourage usage

- measures to encourage walking, wheeling and cycling

Not-for-profit companies or community interest companies can apply, however applications from sole traders and organisations that are aimed at generating profits primarily for private distribution will not be accepted.

Applications will be accepted until 5pm on 17 December 2021.

See: Living Places and Spaces Grant Fund opens (nibusinessinfo.co.uk)

Kick Start 2 Programme for Fermanagh and Omagh

The Kick Start 2 programme forms part of the Fermanagh and Omagh District Council Innovating Business Growth Programme.

The programme aims to support early-stage micro-businesses to ensure their survival and growth and is focused on:

- Business development

- Sales, marketing and ICT

- Business processes and efficiencies

- Specialist areas – HR, innovation, product development, legal

- Introduction to e-Commerce

- Social Media Marketing – Facebook and Instagram

- HR and Employment

- Social Media Marketing – TikTok and YouTube

- Skills development workshops

To be eligible for support, your business must:

- be based in the Fermanagh and Omagh District Council area

- be trading for less than three years

- employ less than 10 full-time equivalent (FTE) people

- demonstrate potential for job creation

See: Kick Start 2 programme for Fermanagh and Omagh (nibusinessinfo.co.uk)

Defra Webinars on the EU to GB Import Requirements from January 2022

New requirements for importing products of animal origin (POAO) and animal by products (ABP) from the European Union (EU) into Great Britain (GB) will come into force from 1 January 2022. To support you with preparing for these changes, Defra will be hosting webinars from November 2021.

These webinars will cover:

- New requirements from 1 January 2022 and the steps to undertake to continue importing from the EU;

- Pre-notification and the information you require to pre-notify using the Import of Products, Animals, Food and Feed System (IPAFFS). The webinar will also include a step-by-step demonstration of how to complete a pre-notification;

- Updated information on specific policies and commodities.

There will be a short Q&A session at the end of each webinar.

See: Defra webinars on the EU to GB import requirements from January 2022 (nibusinessinfo.co.uk)

Online Workshop: Emerging Digital Tools and Technologies for Small Businesses

This Belfast City Council workshop is for business owner/managers, cooperatives, social enterprises and employees whose businesses are:

- based in the Belfast City Council area

- employing fewer than 50 full time equivalent staff members

In this session, participants will:

- Share some of the digital tools that have transformed businesses in many areas – from sales to marketing and operations.

- Learn how to find keywords for your website for free, through to how you keep tabs on all your customers or prospects that you have met on your journey.

- Learn how Digital Tools and Technologies can be invaluable to all business owners.

Date: Wednesday 17 November 2021, time: 09:30 – 12:00, cost: Free

Armagh City, Banbridge and Craigavon Enterprise Week 2021

Armagh City, Banbridge and Craigavon Borough Council is inviting businesses across the borough to sign up for a series of inspirational podcasts and webinars during Enterprise Week, which is running from today 8th to Friday 12th November 2021.

Aimed at the whole business sector from budding entrepreneurs to well-established businesses, the events will focus on resilience, vision and wellbeing as well as the importance of digital platforms to sell, promote and engage with consumers.

Participants will hear about first-hand experiences from industry-respected guests and motivational speakers, providing a wealth of opportunities to gain new insights, acquire new skills and engage in knowledge-sharing throughout the week.

See: Enterprise Week 2021 – Armagh City, Banbridge and Craigavon Borough Council (armaghbanbridgecraigavon.gov.uk)

HMRC Webinars – November and December 2021

Below are details of upcoming webinars this November and December from HM Revenue & Customs (HMRC) to help employers, businesses and the self-employed understand tax issues that affect them

There are a number of webinars available this November and December from HMRC that will help employers with payroll, give the self-employed an understanding of key taxes that affect them and help those individuals and businesses trading outside Northern Ireland get to grips with import and export procedures. The webinars are free and last around an hour.

See: HMRC webinars – November and December 2021 (nibusinessinfo.co.uk)