Welcome to our round up of the latest business news for our clients. Please contact us if you want to talk about how these updates affect your business. We are here to support you!

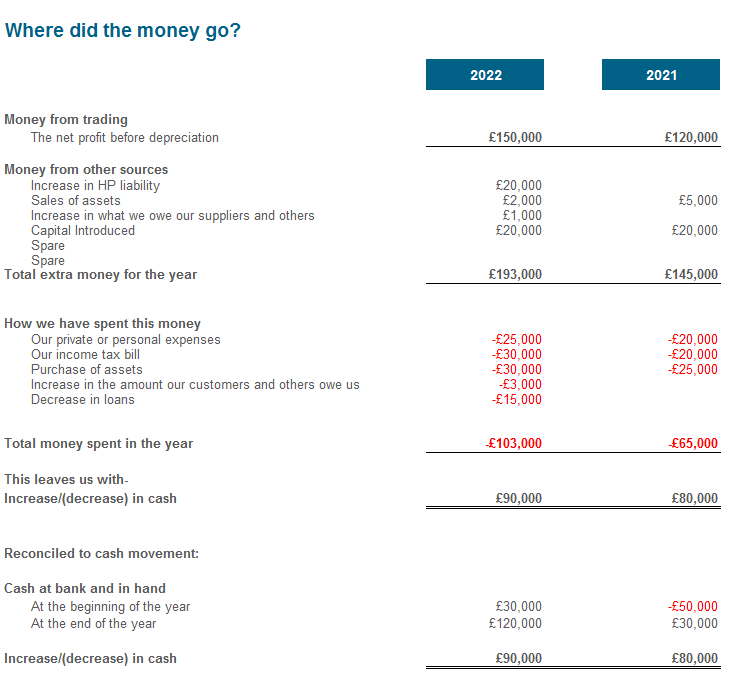

Where Does the Money Go?

With ever increasing supplier prices, managing your businesses cash and understanding the flow are now vital tools in maintaining resilience and being able to adopt flexible strategies for success.

Fund flows are a reflection of all the cash that is flowing in and out of a business. Owners can look at the direction of the cash flows for insights about the health of specific products or services and overall market patterns.

Some types of business are more likely to run into cash flow problems, while other types appear to be more resilient. If you are a business owner, you might be wondering which category your business falls into. No matter how inventive or simple your business model is, you can still have problems with cash flow. Here are our thoughts on managing the flow of cash in your business:

The first stage of understanding and predicting how funds flow is to perform a health check on your accounts. Look at your latest profit and loss statement and check that your income is sufficient to cover your expenses. If your profit is falling behind your expenses and cash flow is slowing down you might need to take action. Prepare a funds flow statement so you know where the money goes.

Next create a yearly budget and look where cash could become tight and months where you can save to cover off the quieter times. Look at those quieter months and think about flexible work scheduling, new products or services or other activities to tide you over.

Finally make sure you collect your money from those who owe you quickly. Reward customer loyalty by offering early bird discounts, set credit limits and payment terms to ensure customers follow the rules. If you take on new customers make credit checks. Penalise late payers and request up front deposits or payment.

Talk to us about preparing a funds flow statement and annual budget so that you can work on your business for maximum success!

Ransomware Attacks on Businesses Growing

UK, US and Australian cyber security authorities are warning of a growing wave of increasingly sophisticated ransomware attacks which could have significant consequences for businesses and organisations across the world.

In their joint advisory, they reveal that the tactics of ransomware groups evolved last year. Trends observed in 2021 include:

- targeting organisations on public holidays and weekends

- attacking industrial processes and the software supply chain

- targeting cloud services

- disrupting work and shutting down services

- holding organisations to ransom until demands have been paid

- increased use of cybercriminal ‘services-for-hire’

- sharing of victim information between different groups of cyber criminals

- diversifying approaches to extorting money

Businesses and organisations are encouraged to familiarise themselves with the risks and ensure their IT teams are taking the correct actions to bolster resilience.

The advisory suggests ways to mitigate risk of compromise by ransomware by implementing a requirement for multi-factor authentication, Zero Trust architecture, and a user training programme with phishing exercises.

The advisory follows the NCSC’s recently launched Ransomware Hub, which is a one-stop shop for advice on how ransomware works, on whether a ransom should be paid, and how to prevent a successful attack.

UK organisations which fall victim to a cyber-attack should report the incident to the NCSC’s 24/7 Incident Management team.

See: Joint advisory highlights increased globalised threat of… – NCSC.GOV.UK

Average Weekly Earnings in Great Britain: February 2022

Recent figures from the Office for National Statistics (ONS) show Growth in average total pay (including bonuses) was 4.3% and growth in regular pay (excluding bonuses) was 3.7% among employees in October to December 2021. This means UK wage growth continues to lag behind the rising cost of living.

In real terms (adjusted for inflation), in October to December 2021, total and regular pay fell on the year at negative 0.1% for total pay and negative 0.8% for regular pay.

Single-month growth in real average total weekly earnings for December 2021 increased 0.1% on the year because of an increase in bonus payments compared with December 2020; whereas the single-month growth in real average regular weekly earnings fell on the year in both November 2021 and December 2021, at negative 1.0% and negative 1.2% respectively.

Average total pay growth for the private sector was 4.6% in October to December 2021, while for the public sector, it was 2.6%; all industry sectors saw growth, with the finance and business services sector seeing the largest growth rate at 8.1% following an increase in bonus payments compared with December 2020.

See: Average weekly earnings in Great Britain – Office for National Statistics (ons.gov.uk)

Changes To Accounting for VAT On Imports for Users of Flat Rate Scheme

There are important changes from 1 June 2022 for small businesses using the Flat Rate Scheme who are importing goods and using postponed VAT accounting.

Those businesses using the Flat Rate Scheme must currently add the value of imported goods to the total of all their supplies before they carry out the scheme calculation.

For VAT return periods starting on or after 1 June 2022, they should no longer include import VAT accounted for using postponed VAT accounting in their flat rate turnover. The VAT due on any imports should be added to box 1 of the return after completing the Flat Rate Scheme calculation.

HMRC have issued the following updated guidance:

Complete your VAT Return to account for import VAT – GOV.UK (www.gov.uk)

Importers Not Using the VAT Flat Rate Scheme

HMRC have also updated their guidance for VAT registered importers not using the Flat Rate Scheme:-

Complete your VAT Return to account for import VAT – GOV.UK (www.gov.uk)

These traders must account for postponed import VAT on their VAT returns for the accounting period which covers the date they imported the goods. The normal rules apply for what VAT can be reclaimed as input tax and the trader’s monthly statement will contain the information to support their claim.

HMRC is aware of the problems some importers are having when trying to access their monthly VAT statements. If you cannot access your statement or you’re having problems when viewing your statement, you should follow the guidance on how to complete a VAT Return if you’re having problems with your monthly statements.

As long as you take reasonable care to follow the guidance, there will be no penalty for errors.

Payrolling Benefits in Kind

HMRC are encouraging more employers to payroll employee benefits in kind rather than declaring benefits on the end of year P11D. They have included guidance on registering to use the scheme in their latest employer bulletin.

If employers haven’t already done so they should register online now or before 5 April 2022 to payroll employee benefits for the 2022/23 tax year.

The advantages of payrolling benefits in kind are:

- employers no longer need to submit P11D and P46(Car) forms to HMRC

- simpler PAYE codes mean HR teams receive fewer queries from employees regarding tax

- tax deductions in monthly payroll will be more accurate

- tax codes for individuals should change less frequently

- fewer forms for employers to complete at year-end

If you are not yet in a position to move to payrolling you can still move away from legacy paper P11D forms by submitting them online. You can submit them in one click without worrying about posting them to HMRC. It is also a useful first step towards payrolling of benefits in kind and bringing your payrolling processes into the digital age.

Upcoming HMRC Webinars

Plastic Packaging Tax – admin and technical aspects – 22 February

In this webinar you’ll find more detail about the administrative and technical aspects of the new Plastic Packaging Tax.

See: Registration (gotowebinar.com)

Making Tax Digital for VAT – 22 February

This webinar will provide some of the basics of Making Tax Digital for VAT. This will include what’s changing, using software and keeping digital records, plus an introduction to penalty reform.

From April 2022, these requirements will apply to all VAT-registered businesses, to include those that have a turnover below the VAT threshold.

See: Registration (gotowebinar.com)

Introduction to Plastic Packaging Tax – 25 February

Find out about the new Plastic Packaging Tax being introduced in April 2022 and what you need to do now if you produce or import plastic packaging.

See: Registration (gotowebinar.com)

Employers – what’s new for 2022 to 2023 – 14 March

Join this live webinar for an overview of the new rates for:

- National Insurance

- National Living Wage/National Minimum Wage

- Statutory Payments

HMRC will discuss any changes to expenses and benefits, Student Loan deductions, freeports, employer National Insurance contributions relief, and the new Health and Social Care Levy.

See: Registration (gotowebinar.com)

Fairtrade Fortnight 2022 – Choose the World You Want!

In 2022, the online Choose the World you Want Festival will return from 21 February to 6 March. Last year’s festival saw campaigners, shoppers, students and businesses come together in a show of support for the farmers behind our food on the front line of the climate crisis. From online panels to bake-offs and coffee mornings over 50 virtual events took place as part of a virtual festival, with supporters sharing the power of Fairtrade and what needs to happen next to ensure farmers and workers are put front and centre of conversations on how to tackle the climate crisis. The COVID-19 pandemic has shown us more than ever how interconnected we are globally. This interconnection is at the very heart of the Fairtrade message and is where your role begins. You are part of the Fairtrade movement, and you have the power to drive long-term change, not only with your shopping choices but with your support in spreading the message.

See: Online Festival: Choose The World You Want festival 2022 – Fairtrade Foundation

Food Waste Action Week 2022

Around a third of the food produced globally is lost or wasted and it’s having a real impact on climate change, contributing 8–10% of total man-made greenhouse gas (GHG) emissions.

That is why Love Food Hate Waste dedicate a whole week of action to raising awareness of the environmental consequences of wasting food and promoting activities that help to reduce the amount of food we waste.

The aim of Food Waste Action Week is to create lasting change that helps to deliver the UN Sustainable Development Goal of halving global food waste by 2030.

After an incredible response to the first-ever Week in 2021, plans are already taking shape for Food Waste Action Week 2022 (7-13 March 2022) and this time we will be taking it global.

See: Food Waste Action Week 2022 | WRAP

Digital Security by Design: Technology Access Programme

Applications remain open until 6 March 2022.

Digital Security by Design (DSbD) challenge and Digital Catapult have launched a new programme for developers and organisations to experiment with DSbD technologies.

The Technology Access Programme has been developed to build a pipeline and community of developers and technology companies to trial and experiment with the new DSbD technologies, to addresses the cyber security challenges faced by embedded product and software companies.

What is available?

To support a six-month experimentation period with the DSbD technologies within their own organisations, programme participants will have access to:

- the Morello Board and CHERI prototype architecture and hardware

- technical guidance

- £15,000 in funding

- collaboration and mentoring opportunities

- industry and technical advisors

Businesses will also get an opportunity to access Digital Catapult’s Future Networks Lab with state-of-the art IoT and 5G networks testing facilities, allowing them to test the impact of DSbD technologies on other areas of their products and services.

There will be four open call opportunities during the overall timeframe of the Technology Access Programme for organisations to apply.

See: Technology Access Programme – Digital Security by Design (dsbd.tech)

Coronavirus Guidance for Offices

The Scottish Government has published guidance to help employers and employees work safely in offices and similar indoor workspaces during the coronavirus (COVID-19) pandemic. It provides advice on measures to reduce the risk of the spread of COVID-19 and create a safe environment for customers and staff.

It explains:

- the current pandemic situation in Scotland

- employers’ legal requirements

- hybrid working arrangements – what they are and how to implement them for your workforce

- points to consider, including

-

- how to decide which staff should return to the office, and which individuals may need or prefer to continue to work from home

- how to support staff on the highest risk list

- how to manage hybrid working arrangements

- how to protect staff who return to the office through physical distancing, ventilation and other measures

- the Distance Aware scheme

- travel and commutes

- outbreak management

- related information, guidance and resources

See: Coronavirus (COVID-19): safer businesses and workplaces – gov.scot (www.gov.scot)

Glasgow City Region Low Carbon Innovation Grant

This grant is available to businesses within the wider Glasgow City Region. It aims to help companies carry out research and development and innovation activities to improve existing products or processes or develop new ones that will help the company reduce their carbon emissions.

The grant can be used for products and services which enable and accelerate the take-up of wider decarbonisation plans across their business.

This grant closes on 30 April 2022.

See: Glasgow City Region Low Carbon Innovation Grant (findbusinesssupport.gov.scot)

Angus – Shared Apprenticeship Ltd

Shared Apprenticeship Ltd gives construction businesses in Angus the chance to take on apprentices without having to commit to the whole 4 years of an apprenticeship.

Shared Apprenticeship Ltd will coordinate the apprentices with the host companies. The apprentices are required to attend college to complete their qualification while gaining on-the-job experience.

As Shared Apprentice Ltd is the main employer, construction companies can work with apprentices and benefit from:

- no National Insurance costs

- no holiday pay

- no pay while apprentices are at college

- no pension contributions costs

- no PPE costs

Other benefits include:

- short term commitment

- a flexible workforce

- basic toolkits for each MA

All paperwork, behaviour issues, wages and holidays are handled by the Shared Apprentice Ltd team.

The host company is asked to support apprentices for a minimum of 3 months at any time, although placements can last longer.

See: Shared Apprenticeship Ltd | Invest in Angus

Two Green Freeports to Be Established in Scotland

A partnership agreement to establish two Green Freeports in Scotland has been reached between Scottish and UK Ministers.

Following robust discussions in recent months, both governments have agreed:

- to establish a joint applicant prospectus, with Ministers and officials from both the Scottish and UK Government having an equal say throughout the assessment and selection process

- that applicants in Scotland are required to contribute towards a just transition to net-zero emissions by 2045, delivering net-zero benefits and creating new green jobs

- that applicants in Scotland are required to set out how they will support high-quality employment opportunities that offer good salaries and conditions, and how fair work practices will be embedded in the green freeport area

Ministers have agreed that a joint offer set out in a prospectus offers the maximum benefits for the Scottish economy as both governments will be able to deliver tax reliefs and other incentives through a combination of devolved and reserved powers.

As a result of the recent negotiations, UK Ministers are expected to provide up to £52 million in seed funding to help establish Green Freeports in Scotland which is in line with funding offered to Freeports across England.

See: Deal agreed to establish Green Freeports – gov.scot (www.gov.scot)

First Stage of Aquaculture Review Complete

The first stage of the review of how fish farms are regulated is complete and the Scottish Government has accepted all its recommendations in principle.

The independent review is part of a programme to make the Scottish aquaculture regulatory system one of the most effective and transparent in the world and benefit rural communities.

Professor Russel Griggs OBE, who led the first stage, has submitted his recommendations to Ministers after comprehensive engagement with a wide range of stakeholders.

Proposals include the introduction of a new single licencing payment based on the level of production at a site, which covers the cost of all organisations involved in the process and adds value to local communities.

The development of frameworks tailored to different aquaculture sectors including shellfish and seaweed are also recommended. Another suggestion is for the establishment of a new scientific advisory body to advise Government and commission new work.

See: First stage of aquaculture review complete – gov.scot (www.gov.scot)

Scottish Budget Bill Passed

The 2022-2023 Scottish Budget Bill has been backed by MSPs.

During the Stage 3 debate in the Scottish Parliament, Finance Secretary, Kate Forbes, announced a further £290 million in financial support to help address the rising cost of living.

Ms Forbes said that while the Scottish Government is awaiting final confirmation from the Treasury on funding allocations, the £290 million for Scotland announced by the Chancellor of the Exchequer last week is not likely to mean net additional funding. This is due to an expected reduction of a similar amount in other consequential funding previously anticipated through the forthcoming UK Government Supplementary Estimates.

Despite these budget pressures and existing support in place to help people, Scottish Ministers have honoured the commitment to allocate £290 million to help tackle the cost of living crisis and are going further to ensure those hardest hit have support. New measures announced include:

- £280 million to provide £150 to every household in receipt of Council Tax Reduction in any Band and to provide £150 to all other occupied households in Bands A to D. This means 1.85 million households, or 73% of all households, will receive financial support through their council tax bill or a direct payment

- £10 million in 2022-23 to continue the Fuel Insecurity Fund to help households from rationing their energy use

A further £39.5 million has also been allocated to businesses from the £375 million of Omicron business support funding for the current financial year. Following consultation with businesses, who asked for financial support to now focus on economic recovery, this funding will help support local economies and cities continue their economic recovery and help build a more resilient economy. Funding allocated includes:

- £16 million for culture and major events

- £7.5 million to support inbound tour operators

- £6.5 million to support the childcare sector

- £3.5 million for outbound travel agents

- £3 million for city centre recovery

- £3 million to help digitalise SMEs to increase competitiveness, productivity and drive growth