Launched in the spring budget on 6 April 2021, the Covid-19 Recovery Loan Scheme aims at providing financial support for the revival and growth of UK businesses that have suffered in the wake of the coronavirus pandemic.

So, if your business has gone through a disruption following the Covid-19 pandemic apply for this scheme, without any delay, before 31 December 2021 (subject to review).

In this blog, we’ll discuss:

- Covid-19 Recovery loan Scheme

- Eligibility

- Ineligibility

- What you’ll get?

- Loan term

- How to apply for RLS

- Required Documents

- Sum Up

Let’s kick off with the details of the Covid-19 Recovery Loan Scheme (RLS) scheme!

Covid-19 Recovery Loan Scheme (RLS)

RLS is a government-backed recovery loan scheme supporting businesses affected by the coronavirus pandemic. If you are running a business in the UK, you can avail up to £10 million for a single business. The terms and loan amount would be decided as per the decisions of your lender.

The Government has encouraged lenders by providing them with an 80% financial guarantee in case of losses that may arise by lending the loan amount. Lenders can still provide the RLS facility even if they don’t want to comply with the terms of RLS as per the government or they like to offer it at a higher rate. In such a case, they can’t claim the benefit of guarantee from the government.

You should note that borrowers are liable to pay 100% of their debt.

Looking for tailored accounting services? Contact us!

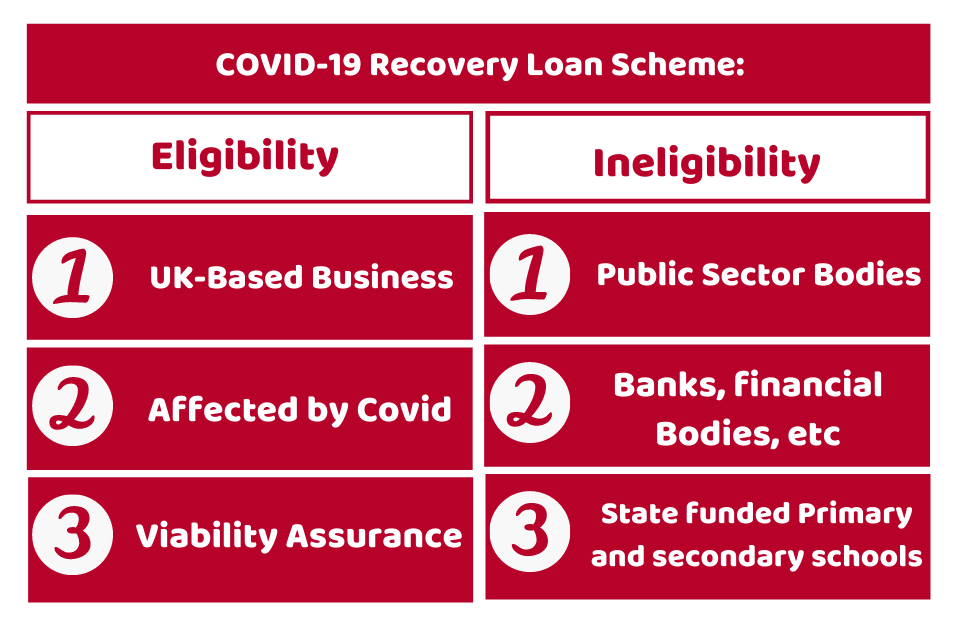

Eligibility

A Business can apply for this scheme if:

- It’s based in the UK and doing its trading there

- It is adversely affected by the Covid-19 – you need to ensure it to your lender

- It is well off to withstand the uncertainties or impact of the Covid-19 pandemic

Ineligibility

Businesses of any sizes and sectors can apply except:

- Public Sector Bodies

- Banks, financial Bodies, building societies insurers and reinsurers (not insurance brokers)

- Primary and secondary school funded by the state

What you’ll Get?

You’ll be getting:

- loans or overdraft from £25,001 to £10 million per business

- invoice or asset finance of between £1,000 and £10 million per business

The best part of it is you don’t need to have a personal guarantee if your loan amount is up to £250,000 and the principal private residence of the borrower cannot be taken as security.

Loan Term

The length of the loan depends upon the type of loan you’re applying for, but normally, it will be:

- 3 years for getting the finance facility of overdrafts and invoice

- 6 years for getting finance facilities of loans and asset

Need expert financial advice. Talk to our chartered accountants right away!

How to Apply for RLS?

Many of the lenders, authorized by British Business Bank, are providing the facility of the Recovery loan Scheme (RLS). This scheme aims to improve the terms of loans that you’ll get. However, if a lender provides you with a commercial loan on better terms, without receiving the government guarantee on RLS, it can do so.

Follow the steps below to apply for RLS:

1) Find a Lender:

The first step is to find an accredited lender of the RLS. You can get the list of accredited lenders here.

2) Contact a Lender:

You should contact a lender yourself through its website. Note that not every lender will provide all types of finances available under RLS and the lending amount also varies from lender to lender. Visit the lender’s website to find out their terms and the amount they can offer.

3) The Lender will make the Final Decision:

Remember that RLS loan is provided at the discretion of the lender. You are not required to provide a guarantee to the lender if you’re availing an amount of £250,000 or less. If you take above £250,000, the lender has the authority to decide whether your personal guarantee is needed or not. However, you should note that:

- The total amount covered under RLS is capped at 20% of the unpaid balance of the RLS facility after the proceeds of all other available collateral have been applied

- You cannot hold a personal guarantee over Principal Private Residence

Required Documents

To apply for RLS, the following documents should be provided to ensure your lender that you’ll repay the RLS amount within the time limit. These documents include:

- Asset details

- Business plan

- Management accounts

- Historic accounts

British Business Bank’s accredited lenders have the authority to decide whether a business is eligible for RLS or not.

Quick Wrap Up

To conclude, Covid-19 Recovery Loan Scheme can be beneficial to you to revive your business that has suffered financial crises due to the coronavirus pandemic. Lenders will require security for this scheme, but if you’re taking finances less than £250,000, you don’t need it. Moreover, the sole authority for taking a guarantee is up to the discretion of the lender.

So, if your business is affected by the Covid-19 pandemic, apply for Recovery Loan Scheme before it’s too late.

You might be looking for a person to manage the finances of your business. Accotax is here for your help. Reach out to us anytime!

Disclaimer: This blog is just for general information about the RLS.