The Enterprise Management Incentive (EMI) scheme provides tax benefits for medium and small-scale businesses. It is a share option scheme for employees to acquire shares after fulfilling some conditions. This scheme attracts employees by providing them the opportunity to equally participate in the business.

Find out the tax benefits that your business needs!

Understanding Enterprise Management Incentive (EMI):

EMI scheme offers a share option; the right to get shares as per the agreement. This determines the number of shares a person can acquire, the cost of each share, and when a share is provided after the exercise of the option. Option exercise may take place after consuming a certain time in employment, upon reaching the KPIs, or upon the company’s sale.

Why you need an EMI scheme?

If you’re a startup with a tight budget, you can attract employees by offering the shares package or share option package. If an employee came to know that he’ll be getting a profitable lump sum by selling the share of the respective company, he/she would join your company even if the pay package is lower than that of other companies.

Employees’ ownership through granting them shares makes them concerned, like the employer, about the company’s interest. In this way, the staff collectively works for raising the value of the shareholder. All of them work to flourish the business, expecting to raise the value of the shares and the dividends.

Qualifying Companies:

Your company should meet the following conditions to qualify for the EMI scheme:

- Containing 249 employees

- Gross assets of £30 million or less.

- It is not majority-owned or run by another company

- Is not amongst the industries excluded by HMRC: banking, farming, shipbuilding, property development, and provision of legal services.

Eligibility for Employees:

To be eligible, an employee should fulfill the below conditions:

- Must spend 25 hours weekly, and 75% of his/her working time as a company’s employee

- Should not hold more than 30% of company’s shares

- Should not hold share options worth above £250,000 (at the time of grant).

For additional details, visit the government website or contact us.

Benefits of EMI for Employees:

- You don’t have to pay any tax on exercising EMI on the following conditions: it is of market value, work out within 10 years of the grants and there should be no disqualifying event.

- If the company’s shares prices have raised after the time it was granted. The access amount is exempted from income tax

- Capital gains tax is levied at the time of the disposal of shares.

- For assurance, you may inform your company’s valuation to HMRC and its EMI grants as per qualifying conditions.

Want to register for EMI, reach out to us anytime.

You may lose the Tax-Advantage Option If:

- Your company hasn’t registered for EMI within the terms of the legislation.

- The company is unable to inform HMRC about the grant of the EMI option within 92 days.

- In case of any disqualifying incident and option holders fails to exercise their option within 90 days.

Directors should be aware of the events that may disqualify the scheme as they’ll be able to avoid them when they are aware of them.

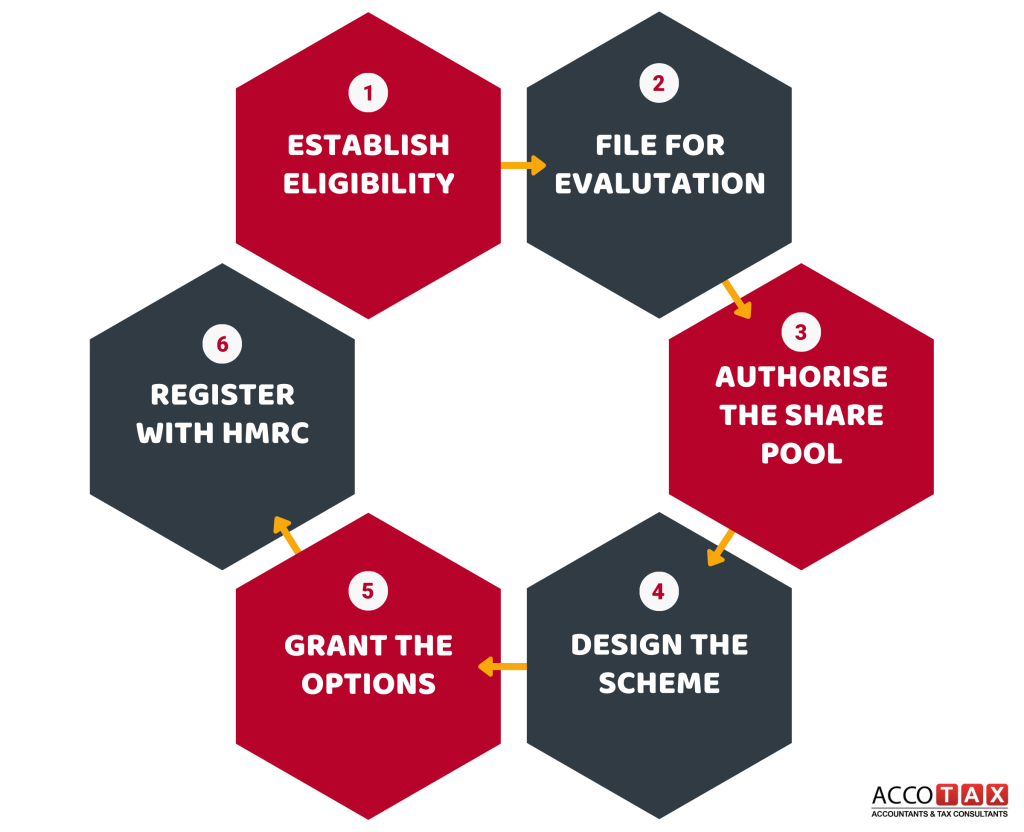

The Setup Process of EMI Scheme:

Once you’re eligible for this scheme, you (owner) should file with HMRC to get the valuation of approval. This valuation lasts for 90 days. Upon approval, You need to authorize your employee to share pool and receive approval from your shareholders and board. Register to HMRC with 92 days of its first grant.

If you’re a business owner this process would be challenging for you, as you already have a lot of other stuff to do. So, isn’t it a better idea to ask someone to do this on your behalf.

At Accotax, we have a team of EMI experts who will guide you on this scheme, help with valuation and filing it to HMRC, form the latest vesting schedules and make long-term management for your business success. We assure you that with us, you’d avoid hassle and extra cost.

How we can help?

Enterprise management incentive(EMI) options are worth considering for both companies and employees. If companies do not provide offer options, they’d be facing issues related to recruitment. So, if your company hasn’t implemented any option plan, so consider it now.

Accotax is providing a full-fledged Package on EMI including legal/ Tax and valuation requirements with expert advice and in-depth discussions.

Get in touch with us now!

Disclaimer: This blog post covers the basic information about the enterprise management incentive.