Bankruptcy is a legal process of declaring an individual or a business entity as incapable of repaying debts. Often, it is initiated by the debtor.

Before we plunge high to study the Pros and cons of Bankruptcies UK, it is important to have a vivid understanding of bankruptcy. The question that arises here is what do you lose when you file for bankruptcy? Often people assume that the state of being declared bankrupt makes you lose all of your property. Whereas, the bankruptcy law gives you an option of “exempt” or takes out of bankruptcy.

Now, this means that you are maintaining a house, a job, and an inexpensive car. By using Bankruptcy Exemptions, one is able to protect the property and basics of household furnishing, etc. luxury items are often taken as non exempt-property.

Our expert accountants have been pulling out business entities from the worst bankruptcy cases, protect yourself and reach out to immediate help!

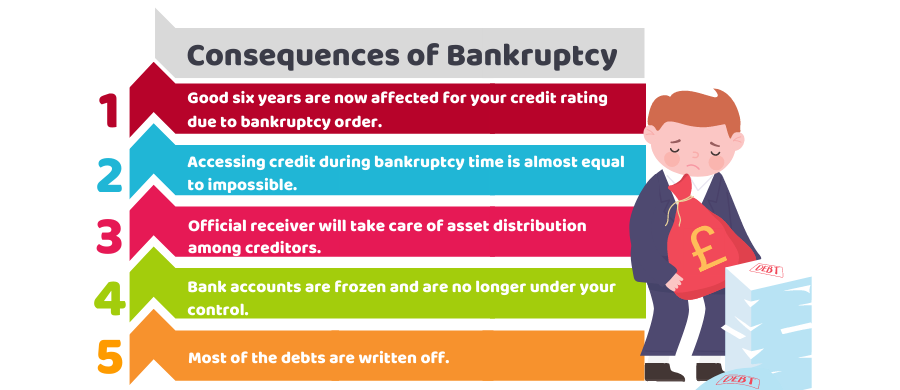

Consequences of Bankruptcy

Often debtors file for bankruptcy. However, before you decide to apply, this important read will be helpful for you to know more about the consequences you might face. Many of the debts can be written off but still the bankrupt individuals experience trouble while dealing with financial institutions and getting any kind of credit.

The common consequences faced by the bankrupt individuals after the practical implication are listed below:

- Good six years are now affected for your credit rating due to bankruptcy order.

- Accessing credit during bankruptcy time is almost equal to impossible.

- Official receiver will take care of asset distribution among creditors.

- Bank accounts are frozen and are no longer under your control.

- Most of the debts are written off.

Advantages of Bankruptcy

The only way to write off debts if an individual is unable to repay is to file for bankruptcy. In case the amount of debt is more than the value of personal assets of the debtor and that might take several years to repay, bankruptcy is the only solution to write off the rest of the amount.

Under the law of bankruptcy, it is allowed for debtors to keep assets partially. This includes the followings:

- Basic house furnishing including furniture, clothing and bedding.

- Tools and vehicles that are needed to maintain a job, this ensures to be inexpensive and not come under luxury items.

- The amount of money that can be used for immediate needs like food.

- Joint accounts of debtors are safe and the amount is returned to the other partner.

- Amount kept for pension purposes.

- House that is used for residing by the debtor or his spouse will be sold within three years, if not then it will be returned to the bankrupt.

Disadvantages of Bankruptcy:

It is important for a person who intends to file for bankruptcy to know the details about Pros and Cons of Bankruptcies UK. Other than losing the house, access to credit and personal assets, there are other restrictions as well. This makes the time period of bankruptcy very harsh. Moreover, here is a list of disadvantages and restrictions that make the debtor not to:

- Practice and work with insolvency.

- Start business or work as a partner until the other party is informed clearly about the bankruptcy.

- Establish or promote any kind of business entity without court orders.

- Work with companies as their director without court orders.

- Borrow money unless the lenders are informed about bankruptcy.

- If the money is borrowed without informing the lender about bankruptcy status, the debtor will be punished for breaking the law.

Get rid of these troubles, contact Accotax now!

In addition to Pros and Cons of bankruptcies UK, for a certain time period, most of the amount of the debtor is written off. However, an income payment agreement is also made which ensures monthly payments. This can be made for three years.

Self Assurance to opt Bankruptcy:

Any individual who is considering bankruptcy must weigh up Pros and Cons of Bankruptcies UK before investing energies and efforts. This is a preferable option only when there is no alternative to repay the debts or it might take years to make it. After all the alternative ways are considered carefully and analyzing the consequences practically, one may file the only option to deal with debts.

Moreover, there are some professions like accountants and solicitors who restrict bankruptcy upon membership, this should be considered before filing as well.

Learn alternative ways to deal with debts with our advisory at Accotax!

Conclusion

After reading about Pros and Cons of Bankruptcies UK, it can be said that when there is no way out left for a debtor to protect his basic personal assets, filing for bankruptcy is the preferable solution. This may come with a harsh time period and struggle but protects the personal assets partially. Also, offers to keep some of it to maintain the job and basic life.