If your business has deferred VAT payments of the last year, you have less than one month left to pay it in installment under the new VAT Deferral Scheme. In this blog, we will discuss the options available for businesses to avoid a 5% penalty on the deferred VAT.

The UK government has provided a tax advantage to the businesses affected by the Covid-19 by allowing them to defer VAT payments due between 20th March 2020 to 30th June 2020.

Initially, this VAT deferral option was until 31 March 2021, but the government announced a further delay on September 2020, allowing businesses to repay their VAT or make payment arrangements until 30 June 2021.

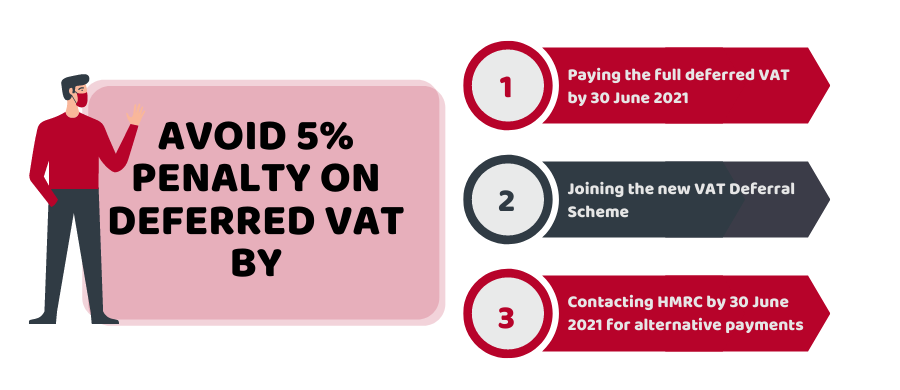

If your payments are not made until the due date, your business may be charged a 5% penalty or interest along with the outstanding deferred VAT payments.

Want to avoid penalty, follow these options:

- Pay the full deferred VAT before or by 30 June 2021

- Join the new VAT Deferral Scheme online until 21 June 2021

- Contact HMRC by 30 June 2021 for alternative payment arrangements

Avoid penalties and unwanted liabilities with Accotax. Feel free to reach out!

What if I pay the Deferred VAT in Full?

HMRC has said that if a business pays its deferred payment in full by 30 June 2021 or joins the VAT Deferral New Payment Scheme by 21 June 2021, it would not charge any interest or penalty.

The New VAT Deferral Scheme:

Businesses can join the new payment scheme by 21 June as the online portal for application will close afterward. Under this scheme you will be able to:

- Make payments of your deferred VAT in installments without any interest

- Select the number of installment from 2 to 11 based on your joining date

How to Join this Scheme?

To join the new VAT Deferral Payment Scheme, you need:

- VAT registration number

- A government gateway account

- To submit your last 4 years outstanding VAT returns

- To rectify errors on your VAT returns as early as possible

- Information of the amount that you owed, deferred and already paid

Join the scheme now!

Reach out to our VAT accountants anytime!

Eligibility for Online Services:

If you want to use the online services, you must:

- Join the scheme yourself, without the help of an agent

- Contain deferred VAT that needs to be paid

- Be up to date with the VAT Returns

- Join by 21 June 2021

- Pay your first installments right after joining

- Pay the installments by Direct Debit or call HMRC’s COVID-19 helpline 0800 024 1222

You cannot use the online services if you:

- Don’t contain a Bank Account in the UK

- Are unable to pay by Direct Debit

- Have dual signatures on your account

What to do if I Can’t Pay?

Still, if you don’t have the resources to pay through the above two options, you can contact HMRC to agree on a time for payment arrangements by 30 June 2021 to be saved from a 5% penalty. However, you will have to pay interest on it.

Quick Sum Up:

If your business is unable to use the online services of HMRC for the new VAT Deferral Scheme, you can reach out to HMRC Coronavirus helpline on 0800 024 1222 to join the scheme or to make alternative arrangements to pay.

Contact our professional VAT accountants for further support and help!

Disclaimer: This blog provides general information on the new VAT Deferral Payment Scheme.