Getting started with your new business venture can be exciting and challenging at the same time. To find out your answers about business structures, you need to invest your energies in gathering information to know the types of business that will turn out to be the best for you.

Choosing the right type of business structure will specify your direction and path to work for it. Whereas, investing in the wrong direction if you happen to choose the wrong business structure can result in the worst nightmare.

Accotax will help you to choose the best type of business!

Different Types of Business in the UK:

While there are different types of business structures in the UK that operate differently and are classified due to the unique way of structure they own. What makes business structures different is all connected to the details of who owns them and what is the extent of liabilities they are responsible for.

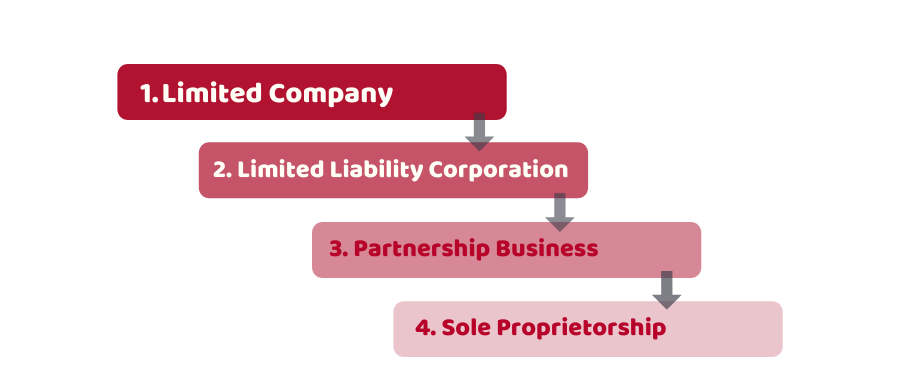

Below is a list for you to find out the most popular, 4 main types of business structures in the UK. Each of them has unique factors in terms of liability for the members, shareholders, and owners.

1- Limited Company:

A limited company is a legal business structure that offers a platform to have more than one owner. In this type of business structure, owners and the members have limited liability to an extent of the amount they have invested in the company.

Also, the company has its separate legal entity apart from its owners which means the directors are not liable for the company debts. In case the company fails and faces a loss, the personal assets of directors and shareholders are safe as the banks can’t touch them but only recover from the amount already invested in the company.

There are two types of limited companies.

- Private Limited Company

- Public Limited Company

Private Limited Companies:

Any type of business entity that comes under private ownership is called a private limited company. The examples of shops, restaurants and local retailers belong to private limited companies. They are often set up on a small scale with no minimum limit of capital invested.

The prominent features of private limited companies are listed below.

- It is the most common type of business that comes under UK incorporation.

- It is easy to set up directly with the companies house.

- The private limited company has its own independent identity apart from its owners and shareholders.

- The initial capital to invest can be as manageable as £100.

Public Limited Companies (PLC):

A public limited company is a kind of business structure that offers its share to the general public and is usually ideal for the stock exchange. Just like the private limited company it is known to have its separate legal identity separated from its shareholders and members. Also, the shareholders have limited liability in case the company faces losses.

However, some factors make a public limited company different from private limited companies. Some of the major differences are given here.

- PLC is led by the board of directors.

- Decision-making is done by the board of directors and strong shareholders which is a slow and exhausting process in this type of business.

- The death of any member or director does not affect the company and the place is filled with a new replacement.

- The capital share can be increased by adding in new members.

- The number of members that can buy the shares has no limit.

- The details of loss and profits are publicly available.

Reach out to Accotax to Learn more to set up a Limited company in no time!

2- Limited Liability Corporation (LLC):

The corporation is generally chosen by the entrepreneurs. People tend to mix limited companies with LLC. The major factors that are the same about LLC and a limited company are mutual protection in terms of being liable for company debts. Furthermore, the fact of having an independent existence apart from the owners is the same as well.

The difference to keep in mind is that a limited company is owned by one or more owners whereas the corporation is owned by its shareholders.

3- Partnership Business:

When two business parties agree to run a business based on mutual interest and share the liabilities and enjoy profits together is the case when a partnership business is formed.

In this regard, the partners can be individuals with mutual interests. Already running business parties, organizations and governments as well. Many types of partnership businesses are formed based on mutual interest where two individuals or parties are agreed to work for their interests.

In the first type of business, parties share the liabilities and profits equally, while in the others, limited liability is given. It all depends on the terms and conditions of the agreement formed to work together. Some of the most common examples of partnership business are real estate, law firms, and accounting firms.

Common types of partnership business are:

- General Partnership

- Limited Partnership

- Limited Liability Partnership

- Public-Private Partnership

Let’s explore the types of Partnership in Business with Accotax!

4- Sole Proprietorship:

Sole Proprietorship is also known as the common name Sole Traders. This business structure is owned by one individual and unlike limited companies, this type of company doesn’t have its separate existence separated from the owner.

It is the oldest and simplest kind of structure with unincorporated businesses. The single owner is liable for the debts and income tax. He has to manage all business activities. This turns out to be a very easy and doable idea for the individuals who intend to be minimal in terms of capital investment.

Moreover, being a sole trader can be advantageous as:

- Being the only boss and no one to dictate your business direction.

- Start with being minimal in terms of capital investment.

- Enjoy profits and have your maximum privacy.

- Easy to establish and operate.

- Change your structure according to circumstances with no intervention.

Just like every business comes with its pros and cons. Being a sole trader can be disadvantageous too, in several ways. Some disadvantages are listed here for you.

- Unlimited liability for the debts and losses.

- No protection is provided to the personal assets of the owners as the company doesn’t have its own identity.

- Retention of high-caliber employees is challenging.

- Responsibilities of day-to-day business activities.

- The limited life span of the business.

Now that you know the main types of business with exploring the facts about them from multiple perspectives, you are good to gear up to choose the best type of business!!

Contact Us to Register yourself as a Sole Trader now!