Whether you’re a sole trader or a small business owner, you need to keep track of the deadline and dates of your taxes throughout the year. It will keep you safe from extra charges and penalties that occur due to the late submission of the dues. The UK tax year dates may vary with the passage of time as per the government laws. In case if the deadline falls within the weekends, you need to pay it before the last working day.

Let’s find out the UK tax year dates and deadlines.

Want to get rid of taxation troubles, contact Accotax!

UK Tax Year Dates and Deadlines:

Here are the important dates and deadlines you have to remember for self-assessment, corporation tax, VAT, PAYE and NICs.

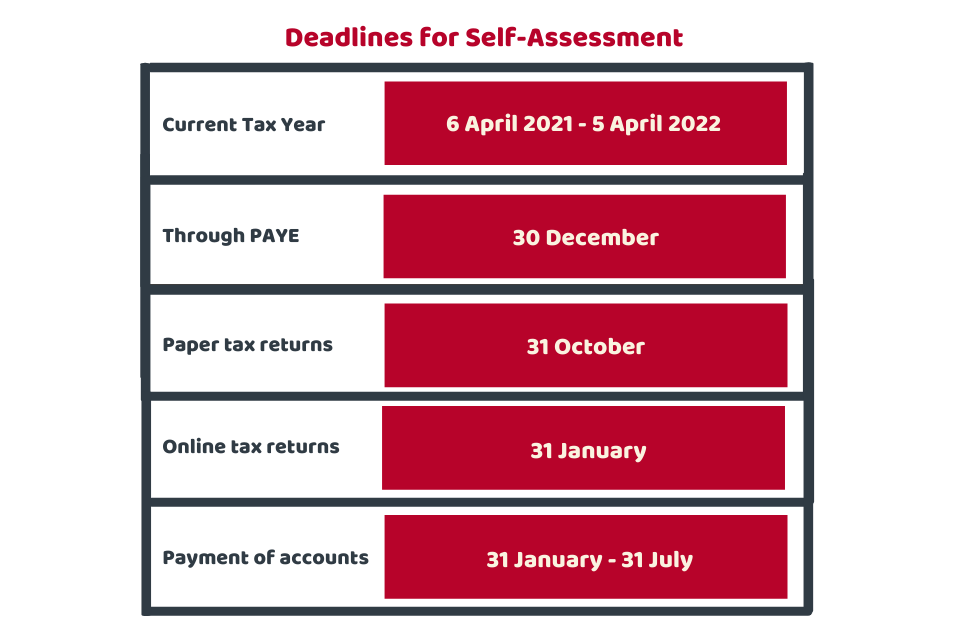

Deadlines for Self-Assessment:

The deadline for filing paper tax returns is 31 October 2021. Though, there are exceptional cases like receiving notice to file after 31 July and those taxpayers whom HMRC has directed not to file online.

If you’re an employee or run a side business, you can pay your tax bill before 30 December. If you owe your tax bill below £3,000, HMRC will automatically collect your tax bill from your wages or pension through PAYE.

You can pay online tax returns by midnight on 31 January. For this, you need to have the login and password of the government website that will normally take 10 days to receive.

You are required to pay the payment of accounts (first-one) on 31 January. It is equal to 50% of the tax liability of the last tax year. You will pay in advance for next year’s tax bill. 31 July is the date to do the second payment on account.

The current tax year has started on 6 April 2021 and it is going to end on 5 April 2022.

If you miss any of the above deadlines, you might be charged a penalty due to late payment of dues by HMRC.

Save your time, money, and energy with our self-assessment accountant to file your tax returns.

Deadlines for Corporation Tax:

After setting up a company, you need to tell HMRC about the active status of your company within three months. You will do it after filling up the CT41G and sending it to HMRC. HMRC will send this form after the registration of your company. If you have kept your company dormant, you need to inform HMRC about its dormancy.

If you are earning a profit up to £1.5 million or less that is taxable, you are obliged to pay the tax bill within 9 months and 1 day after the end of the accounting period of corporation tax. You should note that it is the normal due date.

If your taxable profit is more than £1.5 million, you can pay your corporation tax by dividing it into four installments. Contact HMRC for details.

As a company, you need to file the tax return of your company within 1 year after the end of the accounting period. You can also call it a statutory filing date. You should note that paying corporation tax is imperative before filing your return. It is contrary to the self-assessment where you have to file the return on the same day of the payment.

Reduce your tax liabilities with Accotax.

Deadlines for VAT:

Nowadays, most businesses prefer to pay VAT returns online instead of on paper. If your business is subject to insolvency procedures as you object to use computers for religious purposes or you are unable to file online due to multiple reasons, you have the choice to file VAT returns on paper.

For filing the VAT return online, you are given a period of one month and seven days after the end of the accounting period of VAT. There are several exemptions in this regard.

You need to pay your VAT bill within the due date. You should pay electronically if you file it online.

Businesses that use VAT annual accounting schemes need to submit one return on annual basis, two months after the end of the accounting period. They can pay their bills in installments. A balancing payment will be due along with your returns.

These days businesses use software to record VAT digitally and to submit VAT returns as this process is fast and convenient.

Reach out to our VAT accountants here!

PAYE and NICs:

Those people who pay PAYE and Class 1 NICs need to provide the payments to HMRC by the 22nd of each month. For quarterly payments, it should be done by the 22nd after the end of that quarter. People who use cheques must pay HMRC by the 19th of every month.

If you’re paying less than £1,500 a month, you are able to pay quarterly. You can contact HMRC to find out your eligibility.

In the case of paying Class 1A NICs electronically, payment should reach HMRC by the 22nd of July. For the payment by post, you need to pay HMRC by 19 July.

Quick Sum Up:

We have discussed UK tax year dates and deadlines for self-assessment, corporation tax, VAT, PAYE, and NICs. You should remember that the above-mentioned dates may be subject to change with time.

Got a specific case! Feel free to share with us. Our qualified chartered accountants in London would love to help you to manage your finances.

Get in touch with us now!

Disclaimer: This blog provides general information on the tax dates and deadlines.