In today’s blog, we’re going to delve deep into capital gains tax, when you need to pay it, what its rates are and what are the ways for avoiding capital gains tax on property UK.

What is Capital Gains Tax (CGT)?

Capital gains tax is levied on the increased value of an asset while selling or disposing of. The CGT is only taxed on the profit and gained amount, not on the total revenue of the asset.

For example, you bought an asset worth £10,000 and sold it at £14,000, the amount of gain you receive on that asset would be £4,000. It is the profit that you received against your property. The CGT only applies to the profit or gain, which is £4,000.

Disposing of or selling an asset includes giving someone an asset a gift, selling it, transferring it, receiving compensation on it, and exchanging or trading.

You should note that the government charges CGT on those properties where gains exceed the Annual Exempt Allowance (Capital Gains Tax Allowance). Currently, the rate of this allowance is £12,300 for individuals and £6,150 for trusts. Through this threshold, you can make better decisions while selling your property. This allowance increases every year.

You can keep your profit below this rate to avoid CGT on your property.

In this short blog, we’ll try to explore the ways to avoid capital gains tax on property in the UK. You should know that if you’re making a large sale, saving CGT would be a great decision.

Save your money with Accotax!

When is CGT Payable and What are its Rates?

Most of the assets, except your main home, are liable for CGT. Though your main home will also be taxed, but not through CGT.

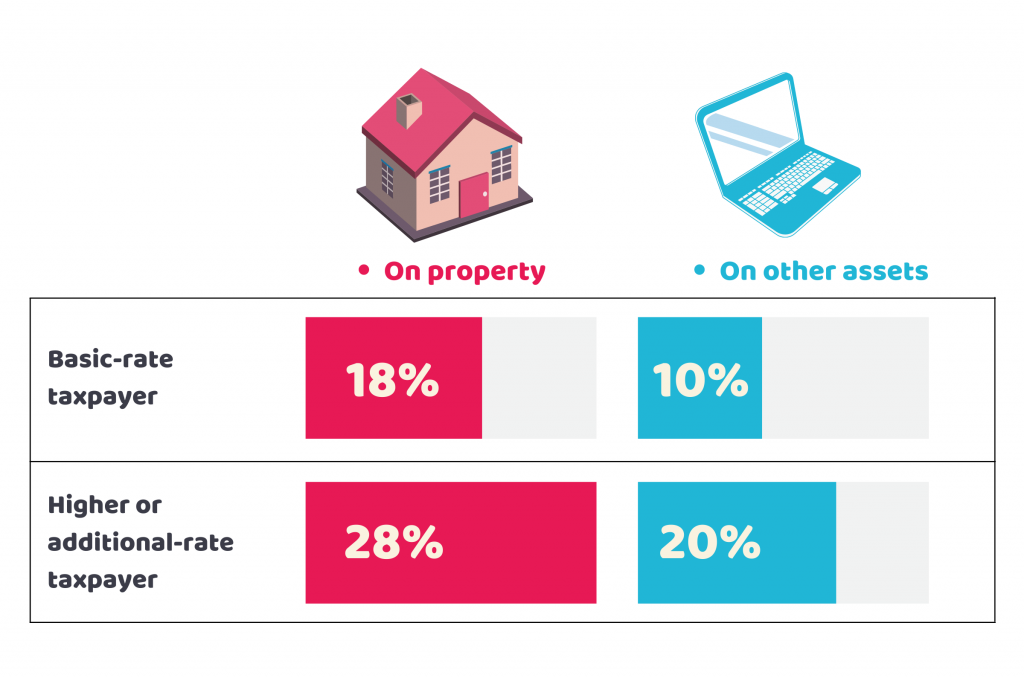

Whether you have a large house or your house is used for business or it is on rent, avoiding capital gains tax on property in the UK can be challenging. You should also note that the rates of CGT on property are more than that of normal assets.

If you’re a basic rate taxpayer, you have to pay 10% on your gains on normal assets, but you have to pay 18% on the property as CGT. The High rates and additional rates taxpayers will pay 20% CGT on chargeable assets. However, they have to pay 28% CGT on any gains in a property.

Avoiding Capital Gains Tax on Property UK:

There are some situations where you can avoid capital gains tax on the property in the UK. If you’re a resident selling your home, you should meet the criteria for avoiding CGT. Like you need to be the primary residence and it should be your only home that you own for the entire time. You haven’t let any part of the home to any other person. Additionally, you should not have used the part of the house for business purposes only.

These laws are becoming harder with each passing year. If you have used your home as a business and it is in the government records, you might be charged CGT on your property when you sell it. Additionally, to avoid CGT on a property, your property needs to be less than 5,000 square metres.

Moreover, you as a homeowner should prove that you didn’t buy the home only for the gain. This process might be difficult for you if you’re an owner of a unit of a home or you own a flip home. And if you bought the home for investment or a fixer-upper, you might pay CGT on it.

According to the UK government, owners meeting the following criteria may get a CGT tax exemption automatically under Private Residence Relief. However, if they don’t meet it, they are likely to pay the CGT.

Want to avoid CGT, let our accountant do it.

How to Avoid CGT on Inherited Property?

When you receive an inherited property, you might not need to pay CGT if you sell the property immediately after receiving it. The assets of the deceased are not subject to CGT unless they’re sold before their demise. The government considers them unrealised gains and doesn’t require inheritors to pay them. However, if the value of a property increases after the deceased death, the CGT is payable.

So if someone is an inheritor and doesn’t want to keep the inherited property, he/she should sell them at the time of probate. As selling them on probate is a great way to avoid CGT because the government considers them unrealised gains. If the property value increases during the probate, it’d be minimal.

Need further help, contact us!

How to Avoid Capital Gains Tax on Foreign Property?

If your property is your primary residence, you don’t need to worry to pay CGT on it. On declaring the foreign property as the primary residence, you can avoid capital gains tax. You should declare this within two years of buying foreign property. You might be paying CGT if you sell both your foreign property and the UK property in the same year.

Quick Wrap Up:

So, we’ve explored multiple ways for avoiding capital gains tax on property UK. The process might be daunting if you’re unaware of the tax regulations and other complexities.

With the help of skilled tax specialists, you can easily avoid Capital Gains Tax and other tax liabilities.

Accotax is here for this purpose with a team of qualified accountants and tax experts to reduce your tax burdens.

Feel free to share your financial worries with us. Contact now!

Disclaimer: This informational blog aims to provide general tips to avoid CGT.