Welcome to our round up of the latest business news for our clients. Please contact us if you want to talk about how these updates affect your business. We are here to support you!

The Best Way to Predict the Future is to Create It!

The latest Office for National Statistics (ONS) survey to June 2021 showed that the UK gross domestic product (GDP) is estimated to have increased by 5.5% in Quarter 2 (Apr to June) 2021, revised from the first estimate of a 4.8% increase. However, the level of GDP is now 3.3% below where it was pre-pandemic at Quarter 4 (Oct to Dec) 2019, revised from the previous estimate of 4.4% below. The increase in GDP was expected as the UK moved out of lockdown, however, more worrying for businesses is the rise in inflation and therefore a possible rise in interest rates that accompanies growth in GDP.

The news is not that positive right now and the TV and the press are currently full of worrying stories about global bottlenecks and supply chain problems, energy bills rising, HGV drivers and staff shortages. We have also seen rising prices, queues at the petrol pumps and now a flatlining post Pandemic economy.

The end of the stamp duty holiday, higher VAT in the hospitality industry and less generous universal credit payments mean the most immediate task facing the government is to prevent the economy from going backwards over the coming months.

All the negativity in the press can lead to us feeling “out of control” and uncertain about in what direction we should take our business. We firmly believe in our clients and their aims, hopes and ambitions and in remaining positive, we also believe the best way to predict the future is to create it!

There is an old saying “A sailor without a destination will never get a favourable wind”.

It is easier to get to your destination with a plan. We all know this simple truth. If you are driving from A to B it helps to know where A is and the directions you need to take.

Planning ahead is the single most important exercise any business owner can do. If you have a vision of what you want your business to look like when it is “complete” then you are in a position to drive your business towards the vision and you can monitor how you are doing as you go along. If you do not have a plan then you could get blown around like “flotsam in the sea”, without any control.

If you agree it is hard to accomplish anything without a plan, let’s start thinking about how we can make it successfully through the coming winter and make our business more resilient to factors outside of our control. Here are our thoughts:

- Take time to review your personal objectives – the business is there to provide you with what you want from life, and this is the most important element of any plan.

- Look at where the business is now its strengths, weaknesses, opportunities and threats and get a clear understanding of its position in the marketplace, the competition, the systems and the way things are done and the improvements that could be made.

- Focus on what the business is to look like when it is “complete” or running profitably and successfully. Then you can determine priorities – the big issues that need to be focussed on – this is the plan!

- Write down the plan and define what it must achieve, and the actions needed. Monitor how it is doing towards the vision each month and what actions have been completed and what needs to be done to keep the business moving towards the plan.

- Allocate responsibility for taking the actions.

- Monitor, review and adjust regular activities to keep the business on track towards the plan.

It is also a good idea to look at where you are now and plan for a range of scenarios “good and bad” so that you can be flexible about the direction you should take.

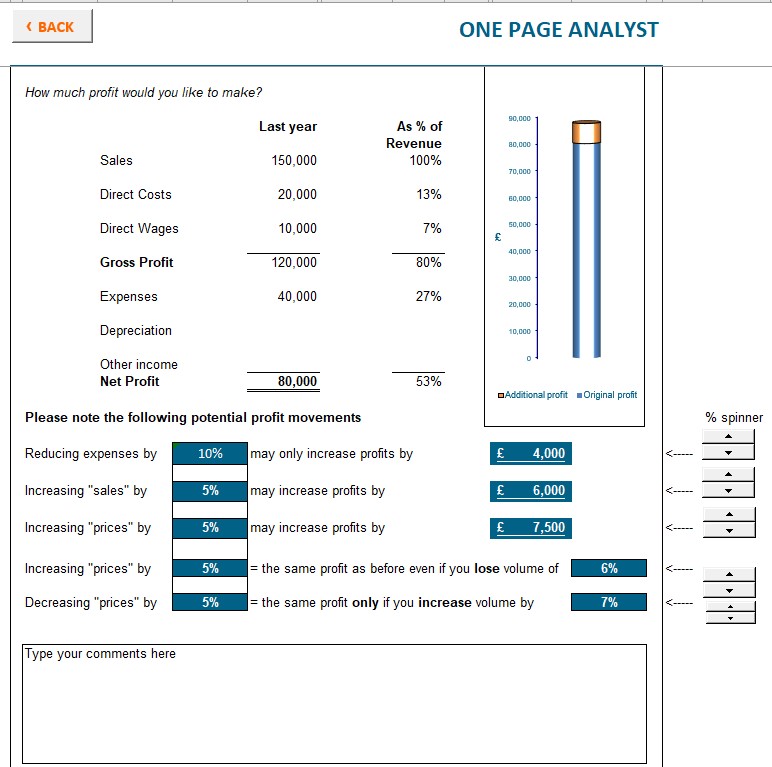

Ask us about our One Page Analyst, a “what if” scenario planner which takes your projected 2021 figures and allows you to work out the effect on profit of reducing expenses, increasing sales, increasing or decreasing prices.

Please talk to us about helping you with forecasting and planning for the next few months. We have helped many clients with “what if” scenarios and their future planning.

New Export Support Service Launched

UK businesses exporting to Europe can now access one-to-one advice via the new Export Support Service (ESS).

The Export Support Service is a new government helpline and online service where all UK businesses can get answers to practical questions about exporting to Europe.

It gives access to cross-government information and support in one place.

All UK businesses can use this free service, no matter the size of your business or in which part of the UK you are based. The Department for International Trade (DIT) will continue to work with businesses and business representative groups from all sectors, in all parts of the UK, to help make the service as useful as possible for businesses.

You can access the Export Support Service online or by calling 0300 303 8955 where you will be put in touch with a member of the export support team.

See: Ask the export support team a question – GOV.UK (www.gov.uk)

Kickstart Scheme

The Kickstart Scheme provides funding to employers to create jobs for 16 to 24 year olds on Universal Credit who are at risk of long term unemployment. Employers of all sizes can apply for funding until 17 December 2021 which covers:

- 100% of the National Minimum Wage (or the National Living Wage depending on the age of the participant) for 25 hours per week for a total of 6 months

- associated employer National Insurance contributions

- minimum automatic enrolment pension contributions

Employers can spread the job start dates up until 31 March 2022. You will get funding until 30 September 2022 if a young person starts their job on 31 March 2022.

Further funding is available for training and support so that young people on the scheme can get a job in the future.

Applications to the Kickstart Scheme are closing soon.

After 17 December 2021 you will not be able to:

- apply for a new Kickstart Scheme grant

- add more jobs to an existing grant agreement

The Department for work & pensions (DWP) will process applications submitted before this time or that are already in progress.

See: Kickstart Scheme – GOV.UK (www.gov.uk)

Check which Expenses are Taxable if your Employee Works from Home due to Coronavirus

The HMRC guidance has been recently updated to reflect the fact that employees can no longer be furloughed using the Coronavirus Job Retention Scheme. The scheme ended on 30 September 2021.

If any of your employees are working from home due to coronavirus (COVID-19), either because your workplace has closed, or they are following advice to self-isolate, then HMRC accepts there are non-taxable types of equipment, services or supply.

For example – if you provide a mobile phone and SIM card without a restriction on private use, limited to one per employee, this is non-taxable.

Broadband – if your employee already pays for broadband, then no additional expenses can be claimed. If a broadband internet connection is needed to work from home and one was not already available, then the broadband fee can be reimbursed by you and is non-taxable. In this case, the broadband is provided for business and any private use must be limited.

Laptops, tablets, computers, and office supplies – if these are mainly used for business purposes and not significant private use, these are non-taxable.

Reimbursing expenses for office equipment your employee has bought – if your employee needs to buy home office equipment to allow them to work from home, they will need to discuss this with you in advance. If you reimburse your employee the actual costs of the purchase, then this is non-taxable provided there is no significant private use.

Employers can continue to pay their employees £6 a week to cover the additional expenses of working from home and the amount would be free of tax and national insurance. This is to cover the additional costs of electricity, heating and water whilst working from home. It has been confirmed that the amount may be paid regardless of the number of days that employees work from home.

HMRC guidance can be seen here: Check which expenses are taxable if your employee works from home due to coronavirus (COVID-19) – GOV.UK (www.gov.uk)

If you need to discuss employee expenses or loans or are looking to develop a more resilient employee expense policy for the future please talk to us and we will be delighted to assist you.

Webinars Designed to Help Small and Medium-Sized Enterprises Work with the Defence Sector.

The Defence Science and Technology Laboratory (Dstl) has announced dates for a new series of webinars designed to help small and medium-sized enterprises work with the defence sector.

They are free to attend, and businesses do not need to have worked previously with Dstl or in the defence sector. Attendance is welcomed from equipment and material manufacturers, engineers, innovators, researchers, academics, and others who have a genuine interest and ability to work with Dstl.

Webinar dates and times:

- Cyber: 19 October 2021, 10am to 11:15am

- Defence S&T Futures: 19 October 2021, 1pm to 2:15pm

- Advanced energetic materials: 16 November 2021, 10am to 11:15am

- High speed and hypersonic science and technology: 14 December 2021, 10am to 11:15am

- Directed energy weapons science and technology future roadmap: 16 December 2021, 1pm to 2:15pm

- Space: 18 January 2022, 10am to 11:15am

- Artificial intelligence: 20 January 2022 1pm to 2:15pm

See: Sign up for Searchlight webinars – GOV.UK (www.gov.uk)

Consultation on the UK Marine Strategy Programme of Measures

The Department for Environment, Food & Rural Affairs (DEFRA) has opened a UK-wide public consultation has been launched on the Marine Strategy which has been developed with input from scientific experts and policy-makers across the 4 UK administrations.

The aims of the Strategy are consistent with the UK government and devolved administrations’ vision of “clean, healthy, safe, productive and biologically diverse oceans and seas”. This requirement to monitor and assess the state of the UK seas is enshrined in UK legislation and demonstrates the combined commitments of the four UK Administrations to work together to monitor and protect what are some of the most biologically diverse and productive seas in Europe. will also continue to collaborate internationally with those countries that share our seas, particularly through OSPAR, our regional seas convention, to protect and conserve the marine environment of the North-East Atlantic.

The target audiences for the consultation are groups or individuals who use the sea for whatever purpose, or have an interest in it, business users of the sea and national and local interest groups.

You can find out more and complete the survey here: UK Marine Strategy Part Three: Programme of Measures – Defra – Citizen Space

Advice for UK Visa Applicants and Temporary UK Residents

Following recent lockdown changes the guidance for visa applicants and temporary residents has been updated and applicants and temporary residents are expected to take all reasonable steps to leave the UK where it is possible to do so or apply to regularise their stay in the UK.

Applicants and temporary residents are allowed to access Visa and Immigration services as these are considered an essential public service. They must follow current COVID-19 rules for where they live, in England, Scotland, Wales and Northern Ireland.

For the full guidance see: Coronavirus (COVID-19): advice for UK visa applicants and temporary UK residents – GOV.UK (www.gov.uk)

A Fairer Future?

People who have suffered the most as a result of the pandemic will be at the heart of Scotland’s Covid recovery strategy.

For a fairer future sets out the next steps in Scotland’s recovery from the pandemic, recognising that while the pandemic has affected every area of life in Scotland, those who were already struggling have been hardest hit by its effects.

The strategy aims to address systemic inequalities made worse by Covid, improve people’s wellbeing, and remobilise public services to be more focused on people’s needs, building on lessons learned during the pandemic.

Actions to achieve this will include upskilling and retraining opportunities for workers impacted by the pandemic and the transition to net zero, help for low income families most at risk of poverty, and locally-based mental health and wellbeing support for children and young people.

While the strategy is focused over the next 18 months, it includes a series of actions over the course of this Parliament to deliver substantial improvements in child poverty, make significant progress towards net zero, and secure an economic recovery that is fair and green.

See: A fairer future – gov.scot (www.gov.scot)

New Funding Adds to Range of Salmon Conservation Measures

Funding of more than £650,000 will extend the salmon counter network as part of a package of measures to support salmon conservation. The expanded network will provide valuable information to monitor salmon populations and inform their population status. The funding is in addition to more than £550,000 announced earlier this month to support wild salmon conservation.

The move comes as the Scottish Government published its response to the Salmon Interactions Working Group (SIWG), established to provide advice on a future approach to the interactions between wild and farmed salmon.

A comprehensive range of measures has been announced, including plans to make fish farm containment measures and regulation more robust, including the introduction of financial penalties for fish farm escapes.

See: New funding adds to range of salmon conservation measures – gov.scot (www.gov.scot)

Scotland Putting Rail Decarbonisation at Heart of Net Zero Plans.

Decarbonising transport, including rail services, offers a significant opportunity to contribute to reducing the threat of climate change, First Minister Nicola Sturgeon has said.

Speaking at a formal launch of the £120m Glasgow Queen Street Station today, the First Minister applauded the substantial investment of over £9bn in rail infrastructure since 2007 that sees over 75% of all rail passenger journeys in Scotland made by electric services.

She also announced key progress in the continuation of rail decarbonisation with confirmation that the £63m Barrhead line electrification will now move to the construction phase. This is the latest milestone in the delivery of Transport Scotland’s Rail Decarbonisation Action Plan, launched last year, which will see removal of all diesel on passenger services by 2035.

See: Scotland putting rail decarbonisation at heart of net zero plans. – gov.scot (www.gov.scot)

Modernising Legal Services

A new system of regulation to promote accountability, transparency and independence is being proposed to meet the needs of the legal sector and consumers.

A consultation has been launched and will run until 24 December to seek views on options to change the way legal services are regulated and how the legal complaints system operates. The options will promote competition, innovation and the public and consumer interest in an efficient, effective and independent legal sector.

Legal services contribute to the social value of Scotland and there is significant diversity in the types of legal services people access. Many will interact with legal services when buying a home or writing a will. There are also a range of commercial matters supported by legal services, from the small business to the multi-national corporation.

The legal sector in Scotland is worth over £1.5 billion to the Scottish economy each year and is responsible for over 20,000 high value jobs. Not only an economic generator in its own right but a profession that plays a key role in the infrastructure supporting growing sectors; including Financial Services, Renewables and Bioscience.

See: Modernising legal services – gov.scot (www.gov.scot)

Scottish Companies at World Expo

Around 12 companies across Scotland are providing services worth more than £8 million to the World Expo 2020, which opened in Dubai last week.

The work ranges from branding the six month international showcase to supporting digital engagement from participants around the globe. The Scottish Government and its partners will be staging themed days and hosting a series of receptions during the Expo to promote Scottish businesses, create new international connections and engage with potential investors.

See: Scottish success at World Expo – gov.scot (www.gov.scot)

Black History Month Fund

This £10,000 fund is open to all organisations across Scotland to help them tackle inequalities and prejudice in line with the goals of Black History Month. This can include the kickstart of new events, activity or projects to tackle inequalities and prejudice or support for the continuation of activity in line with the outcomes of Black History Month. Organisations can apply for between £250 and £500. The deadline to apply is Friday 15 October 2021.

See: Black History Month fund (findbusinesssupport.gov.scot)

Coronavirus Vaccine Certification Scheme – Information for Businesses and Event Organisers

From 1 October 2021, people have had to show proof that they have been fully vaccinated (or are otherwise exempt) to get into certain events and late-night premises in Scotland. This is known as the vaccine certification (or COVID passport) scheme.

In settings where vaccine certification is required, businesses, venues and event organisers should ensure there is a reasonable and proportionate system to check and restrict entry to only those who can show proper certification (or proof they are exempt).

Businesses and event organisers need to develop a compliance plan by 18 October 2021. This should describe the system for checking and restricting entry that will operate for the premises and any other measures that are or will be in place to prevent or minimise the risk of COVID-19 being spread.

The guidance covers:

- which premises and events are included in the scheme

- how the scheme can be implemented at various venues and events

- individuals who are exempt

- what premises and event organisers need to do

- enforcement and offences

- how to check customers’ vaccine status

- support available for businesses

- businesses which choose to use the scheme voluntarily

See: Coronavirus vaccine certification scheme – information for businesses and event organisers (findbusinesssupport.gov.scot)

Grants of up to £5,000 Available to Support Women Songwriters and Composers

Grants of up to £5,000 are available to support the development of outstanding women, trans and non-binary songwriters and composers of all genres and backgrounds at different stages of their career.

The funding is available to support touring, recording, promotion and marketing, community projects involving high-quality music creators, music creator residencies and live performances featuring new UK music.

The funding is being made available through the Performing Rights Society (PRS) for Music Foundation’s Woman make Music Grants Programme and the closing date for applications is 18 October 2021.

See: Women Make Music. – PRS for Music Foundation (prsfoundation.com)

Countries Taken off the Red List

South Africa, Mexico and Thailand are among 47 countries removed from the international travel red list from today, 11 October.

The changes – agreed on a four nation basis – leave a smaller red list consisting of Peru, Ecuador, Colombia, Panama, Dominican Republic, Haiti and Venezuela in place to protect public health.

This is the first review of countries since the traffic light system ended on 4 October.

In addition, vaccine certificates from more countries will be recognised to allow quarantine-free travel to Scotland.

Certificates from a further 37 countries will be recognised, as well as those issued under the United Nations vaccination programme.

An ongoing four nations process will expand the policy to additional countries over coming weeks, where approved vaccines are administered, and certificates meet the required standards.

See: Countries taken off the red list – gov.scot (www.gov.scot)