Welcome to our round up of the latest business news for our clients. Please contact us if you want to talk about how these updates affect your business. We are here to support you!

We Stand with Ukraine!

The days since the invasion of Ukraine by the Russian State have been terrifying for all those people under fire in the country. For the rest of us, the shock at such reckless action has been profound. We condemn the violence replacing the diplomatic dialogue that should be ongoing between all the parties involved in the conflict.

While Britain has very limited direct trade links with Russia, the conflict will inevitably have a wide, indirect economic impact.

The main economic linkage would be higher natural gas prices. We think a conflict would keep inflation higher for longer and potentially bring forward some rate rises and with faster interest rate increases would quicken the housing market slowdown that many analysts have forecast this year as mortgage costs would increase.

If you are a UK business selling goods or services to Ukraine or Russia, you can contact the Export Support Team (ESS) by phone or online. ESS is the first point of contact for business and trade enquiries relating to Ukraine or Russia and continues to provide support to businesses exporting to Europe. It gives access to cross-government information and support in one place. All UK businesses can use this free service, no matter the size of your business or which part of the UK you are based.

The Department for International Trade (DIT) will continue to work with businesses and business representative groups from all sectors, in all parts of the UK, to help make the service as useful as possible for businesses.

You can access the Export Support Service online or by calling 0300 303 8955 where you will be put in touch with a member of the export support team.

Do you Want to Grow your Business?

Then ask us for a copy of our guide called “57 Ways to Grow Your Business”!

Our publication is packed full of bright ideas for the Serious Entrepreneur and starts with the four basics of growth.

All the ideas in this guide ultimately revolve around four basic insights about growing a business. You can:

- Increase the number of customers

- Increase the number of times each one does business with you

- Increase the average value of each transaction

- Increase your own effectiveness and efficiency

Here are some other business principles that we explore in the guide:

- What you can measure you can manage

- Build in unique core differentiators and focus on them constantly

- It’s more important to be different than it is to be better

- Cutting the price is always an option but there is usually a better way – increasing value

- Break compromises and lower the barriers to people doing business with you

- Systemise every aspect of your business

- Empower your team to make it right for every customer

- Create a clear and detailed action plan

Ask us for a copy – you never know there may be a gem or two in there for you to help you grow faster!

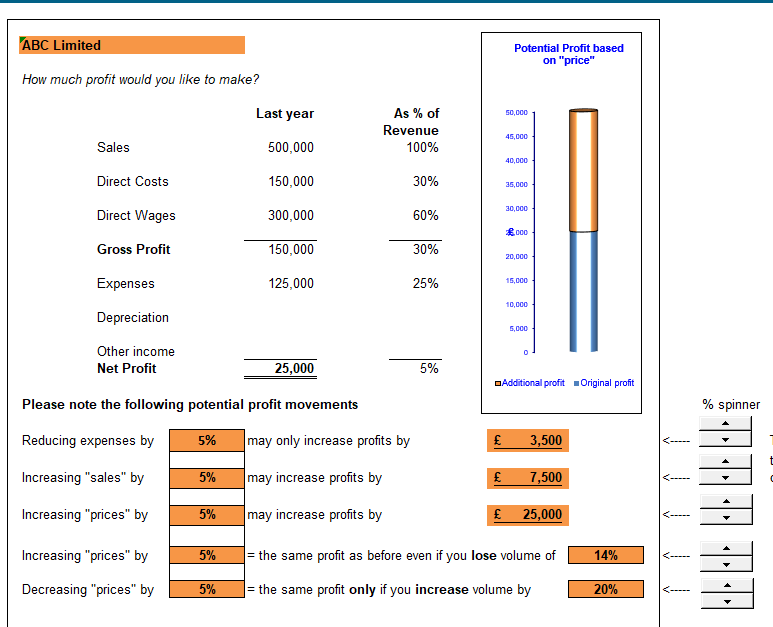

What If you Put up your Prices?

Or maybe increased the number of customers, reduced expenses or even decreased prices. Do you know the effect of these changes to your bottom line?

Successful businesses right now have one thing in common – they are prepared to make fast changes to their plans!

With Brexit, Covid-19 and supply chain problems, flexibility is the key attribute needed to survive and prosper in an uncertain economy.

Just suppose we could show you movements on profit when flexing key variables with a simple but effective tool called “Business Analyst”.

Together we could enter your current figures such as turnover, direct costs such as material and labour and expenses and analyse the effect of rising National Insurance Costs, inflation and work out how these could impact your business. We could then examine key performance indicators and look at all the options such as the impact of a price rise or reduction, increasing sales or reducing expenses to help you maximise your profit and set targets of where you want your business to be in twelve months. We can look at “What if Scenarios” and set a strategy for success. Talk to us about how we can work together on your business and stay ahead of the curve!

What is Business Asset Finance?

Business Asset Finance is an agreement that enables businesses to obtain the assets needed to manage and/or expand effectively and spread the cost/outlay.

Regardless of the size of business, the decision to invest in assets is always difficult but take a look at some of the benefits:

- A great alternative to a traditional bank loan

- Increased tax benefits

- Payments can be budgeted according to cash flow

- Lenders secure against the asset.

Our experts can advise on:

- Hire Purchase – allows you to buy an asset and pay for it over a period of time, spreading the cost via an agreement with a finance company. An initial deposit is payable; and

- Finance Lease – a rental agreement through which an asset can be obtained for a fixed term. At the end of the initial term, the agreement can be extended, or sold with a rebate of the sale proceeds to the client.

You will need to ensure your management accounts are up to date, you have current detailed lists of debtors and creditors and all assets, and you might need up to date projections before a lender will consider your application. Please talk to us about finance, our finance experts have many years of experience and success in advising business across a wide range of sectors in obtaining working capital finance solutions.

New ICO Video Surveillance Guidance

The Information Commissioner’s Office (ICO) has published new guidance on processing of personal data captured by video surveillance systems

The guidance provides organisations in the public and private sectors with:

- information on new applications of video surveillance technologies

- guidance on using these technologies in accordance with the data protection laws

Technologies covered in the guidance include:

- traditional closed circuit television (CCTV)

- automatic number plate recognition

- body worn video

- facial recognition technology

- drones

- technologies such as smart doorbells and dash cams

Organisations using surveillance systems that process the personal data of identifiable individuals need to comply with the UK General Data Protection Regulation and the Data Protection Act 2018.

If you operate video surveillance systems that view or record individuals, or capture information on individuals through other types of surveillance technologies, this guidance will be a vital resource for your business.

Construction Business Cyber Security Guidance

New guidance published for the construction sector to improve the security and resilience of their business against cyber threats

The National Cyber Security Centre (NCSC) has partnered with the Chartered Institute of Building (CIOB) to produce guidance to help small-to-medium sized construction businesses protect themselves from cyber-attacks.

Recent high profile cyber-attacks against the construction industry illustrate how businesses of all sizes are being targeted by criminals. As the industry continues to embrace and adopt new digital ways of working, it is more important than ever to understand how you might be vulnerable to cyber-attacks, and what you can do to protect your business.

The guidance is aimed at small-to-medium sized businesses working in the construction industry and the wider supply chain – including the manufacture of building supplies, surveying, and the sale of buildings.

While you cannot guarantee protection against all the cyber threats you face, by implementing the steps described, you’ll be protected from most common cyber-attacks. And should the worst happen, you’ll able to quickly recover.

See: Construction_Guidance_English_Web_Version.pdf (ncsc.gov.uk)

HMRC Customers have One Month Left to Switch their Post Office Card Account

HM Revenue and Customs (HMRC) is reminding about 7,500 tax credits, Child Benefit and Guardian’s Allowance customers they have just one month left to switch their Post Office card account.

HMRC will stop making payments to Post Office card accounts after 5 April 2022 so customers must notify HMRC of their new account details, so they don’t miss out on vital payments.

In November 2021, HMRC extended the deadline to the end of the financial year. The one-off extension to the contract meant customers could temporarily continue to receive their payments into their Post Office account, giving them extra time to set up new accounts and notify the department.

Nearly 138,800 customers have already switched their accounts and provided HMRC with updated bank account details. Time is running out for the remaining 7,500.

Customers can choose to receive their benefit payments to a bank, building society or credit union account. If they already have an alternative account, they can contact HMRC now to update their details.

See: HMRC customers have one month left to switch their Post Office card account – GOV.UK (www.gov.uk)

Use the Correct National Insurance Letter to Pay the Correct Amount

With the 1.25% increase in National Insurance Contributions (NICs) from 6 April 2022 to help fund health and social care it is important that employers use the letter that is appropriate for that employee.

This is particularly important where you employ apprentices under the age 25 (H) and other employees under the age of 21 (M) as there are no employer contributions where the employee is paid no more than £50,270 a year. Although the employee pays 13.25% on earnings above the 15.05% employer contributions are not payable. This is clearly designed to encourage employers to take on apprentices and young adults.

Five new NIC letters are being introduced from 6 April 2022 for military veterans (V) and employees working in a designated Freeport area (in most cases F). Note that the exemption from employers NIC for military veterans only operates for the first 12 months of their civilian employment and the exemption for Freeport workers applies for 36 months. In each case after that initial period the normal NIC letter should apply to that employee.

There are three further NIC letters for workers in Freeport areas with special circumstances.

Check the tables below for the correct letter!

| Category letter | Employee group |

| A | All employees apart from those in groups B, C, J, H, M and Z in this table |

| B | Married women and widows entitled to pay reduced National Insurance |

| C | Employees over the State Pension age |

| J | Employees who can defer National Insurance because they’re already paying it in another job |

| H | Apprentice under 25 |

| M | Employees under 21 |

| V | Military veterans in first 12 months of civilian employment |

| Z | Employees under 21 who can defer National Insurance because they’re already paying it in another job |

The 4 NIC letters that apply for workers within a Freeport are as follows:-

| Category letter | Employee group |

| F | Standard category letter equivalent (not within I, S, or L) |

| I | Married women and widows entitled to pay reduced National Insurance contributions |

| S | Employees over state pension age |

| L | Employees who can defer National Insurance contributions |

Mental Health Programme Time to Change Wales Extended by Three Years

The Deputy Minister for Mental Health and Wellbeing, Lynne Neagle and Minister for Economy, Vaughan Gething, confirmed on 23 February 2022, the additional funding for Time to Change Wales will see the programme extended until 2025.

Time to Change Wales’ central aim is to challenge and change negative attitudes and behaviours towards mental ill health. The programme concentrates on four key areas: partnerships; employers and the workplace; health and social care; and social marketing. The campaign is delivered by a partnership of two leading Welsh charities; Mind Cymru and Adferiad Recovery.

The new phase of work will have particular focus on working with Black, Asian and Minority Ethnic communities and employers in areas of poverty and deprivation. In previous years the programme has focused on increasing engagement with men through the Talking Is A Lifeline campaign and increasing the number of Welsh speakers involved.

One key part of Time to Change Wales is working with employers to create more open cultures around discussing mental health at work and provide employers with practical resources including an Employer Toolkit and training.

See: Mental health programme Time to Change Wales extended by three years | Business Wales (gov.wales)

Long-term Plan to Live with Coronavirus Safely

First Minister Mark Drakeford has published Wales’ longer-term plan to live safely with coronavirus.

Together for a Safer Future will mark the start of Wales’ transition beyond the emergency response to the pandemic – emergency measures have been in place for 2 years.

It sets out how Wales can live safely with coronavirus – just as we live with many other infectious diseases – and what that will mean for public health services and protections put in place to respond to the pandemic, including testing services.

Wales will remain at alert level 0 for the next 3 weeks with the current level of protections in place. But all legal measures could be removed from 28 March 2022 if the public health situation remains stable.

The next 3-weekly review of the coronavirus regulations will be carried out by 24 March 2022, when the remaining legal measures at alert level 0 will be reviewed.

For further information visit:

- Long-term plan to live with coronavirus safely | GOV.WALES

- Written Statement: Health Protection (Coronavirus Restrictions) (No. 5) (Wales) Regulations 2020 – 3 March Review (4 March 2022) | GOV.WALES

FinTech Seminar for the Legal Sector in Wales

A virtual seminar for all of those who work in the Welsh Legal Sector, to learn about the rapid evolution of the FinTech Sector and its success in Wales.

Gain an understanding of the steps the Legal Sector in Wales needs to take now to meet the future challenges.

Speakers:

- Sarah Williams-Gardener, CEO FinTech Wales

- Nicola McNeely, Partner & Head of Technology, Harrison Clark Rickerbys

- Dr Kerry Beynon, Legal Counsel at BRUSH Switchgear

- Dr Adam Wyner, Associate Professor Computing & the Law Swansea University

The event takes place on 9 March 2022, 12:30pm to 1:30pm.

To book your complementary place please email: [email protected]

Help Build the Future of Wales!

The Organisation for Economic Co-operation and Development (OECD) invites you to complete a questionnaire about the future of regional development in Wales, and share it with your network, including family, friends, and associates. This initiative forms part of a collaboration between the OECD and the Welsh Government.

By sharing your thoughts about economic, social, environmental and community development challenges and priorities, you can help build the future of Wales and Welsh local communities!

Your responses will provide critical inputs for a vision-setting workshop on regional development with the Welsh Government and other stakeholders including local authorities, private sector, and the third sector etc, facilitated by the OECD. Your perspective will help the Welsh Government and Welsh Local Authorities improve services, enhance social and economic well-being, and increase the quality of life throughout Wales.

Please reserve about 10 minutes to complete the full questionnaire.

Please click on this link to access the questionnaire:

https://survey.oecd.org/index.php?r=survey/index&sid=741948&lang=en

The questionnaire is only available in English. Responses by 9 March 2022.

Childcare Offer Extended

The Childcare Offer will be extended to parents in education and training and parents on adoption leave, the Welsh Government has announced.

From September, parents in education and training and parents who are on adoption leave, if it is in line with the child’s Adoption Support Plan, will be eligible for up to 30 hours of government funded early education and childcare for children aged three and four.

Currently workless households are not eligible for government-funded childcare in addition to their early education entitlement.

The Welsh Government has also announced an extra £6 million per year to increase the hourly rate for childcare providers from £4.50 to £5 per hour from April. The 11% increase will help provide greater sustainability across the childcare sector in Wales.

Ministers have committed to reviewing the rate at least every three years. The maximum amount settings can charge for food will also increase from £7.50 to £9 a day, reflecting the increase in both food prices and utility and energy prices.

See: Childcare Offer extended as providers receive funding boost | GOV.WALES

New Tax Rules for Second Homes

The Welsh Government has announced an increase to the maximum level of council tax premiums for second homes, as well as new local tax rules for holiday lets.

The changes represent more steps taken to ensure people can find an affordable home in the place they have grown up.

The measures are part of a wider commitment to address the issue of second homes and unaffordable housing facing many communities in Wales, as set out in the Co-operation Agreement between the Welsh Government and Plaid Cymru.

The commitment is to take immediate and radical action using the planning, property and taxation systems.

The maximum level at which local authorities can set council tax premiums on second homes and long-term empty properties will be increased to 300%, which will be effective from April 2023.

See: New tax rules for second homes | GOV.WALES