If you are concerned about your newly born child entitlements as a parent, claim child benefit before he turns three months old. This will bring a major time boost to your family budget.

In this post, we will cover a complete guide to supporting you in case you are new to parenting or a parent-to-be. This includes the following:

- What is Child Benefit?

- How to Claim for Child Benefit?

- Child Benefit and the Extent of your Earnings

- Importance of Child Benefit

You might have this feeling that you are not entitled to any of the benefits as yet, but applying will still help you to keep a track of other entitlements and how you can process it smoothly. This will surely bring financial ease to your family budget.

Learn how advantageous is child benefit to boost your family budget with Accotax Advisory!

What Is Child Benefit?

Child benefit is a program that is being implemented in different countries with different versions. It is an allowance that comes under social security and is distributed among parents or guardians who are responsible for taking care of a child. In certain cases, adults and teenagers also get it if they are taking care of a child.

Furthermore, one person gets child benefit for one child only. The question arises here: how does it work? You can enjoy Claim Child Benefit if you are meeting the following terms in the process of bringing up a child.

- The child is under sixteen.

- The child is under twenty years of age and being educated or trained.

- Child benefit is given every four weeks.

- There is no extent to the number of children for whom you can Claim Child Benefit.

How to Claim for Child Benefit?

According to the Tax year 2021-2022, a parent or guardian can claim £21.15 every week in case of a first child. Whereas, this amount of child benefits changes in case of the second child or further children.

£14 is the amount an individual receives for second or further children. Which means the amount is more than £1500 annually for the first child and £800 for further children.

Child Benefit and Extent of your Earnings:

Child benefits get affected by the extent of parents’ earnings as well. In case the parents are making £50,000 annually, he can still claim child benefit but he is now bound to pay back in form of extra income tax. Annual earnings over £50,000 means you will pay 1% of your income for every child. And in some scenarios when income exceeds even more than this, you will pay all the amount of child benefit in form of income tax.

Most guardians still find it worthy enough to claim and pay back and it varies from person to person according to their circumstances.

Now, is the time to look into the question: how can it be claimed?

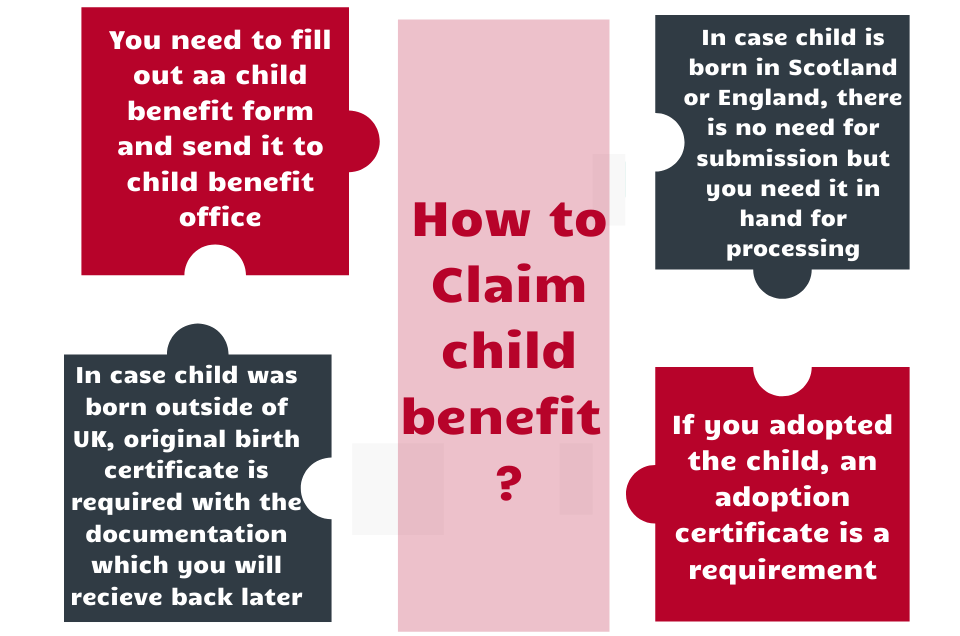

- You need to fill out a child benefit form and send it to the child benefit office.

- In case the child was born outside of the UK, the original birth certificate is required with the documentation which you will receive back later.

- If the child is born in Scotland or England, there is no need for submission but you do need it in hand for the processing.

- If you have adopted the child, an adoption certificate is a requirement.

During the exception cases like pandemic where one is unable to register the birth of a newborn due to office closures, parents can complete the process of child benefit form and write an application to explain the reason of incapability to register the birth. In case of a second or further child when you are already getting child benefit and need to claim for another child, simply call the helpline and update the recorded information. Filling the CH2 form is the requirement too here.

Still confused about what your child is entitled to according to law, do reach our Accotax for further guidance.

Importance of Child Benefit:

To claim child benefit is a great boost to your family budget as well as you are on a way of protecting your state pension. If you do not find yourself entitled for claiming, you might miss out on benefits like guardian allowance. You’re missing the opportunity for your child to get an automatic insurance number before he turns sixteen.

You feel like you don’t meet the criteria because you or your partner earn over 50,000 pounds annually which is called tax-free limit. It is still suggested to apply so that you don’t miss other benefits and national insurance credits. If you make more than 60,000 pounds a year, you can choose not to receive the payment to avoid the tax. However, you will still get the entitlement.

Conclusion:

To conclude, we may say that if parents claim child benefits, they will not only get the entitlements but enjoy the boost in the family budget with additional benefits like insurance credits as well. I hope this few minutes of reading unfolded a lot about child benefits and convinced you to opt at your earliest if you are a parent or guardian.

Have you almost approached your retirement age and intend to learn about the Pension State? Ask Us for Immediate Help!