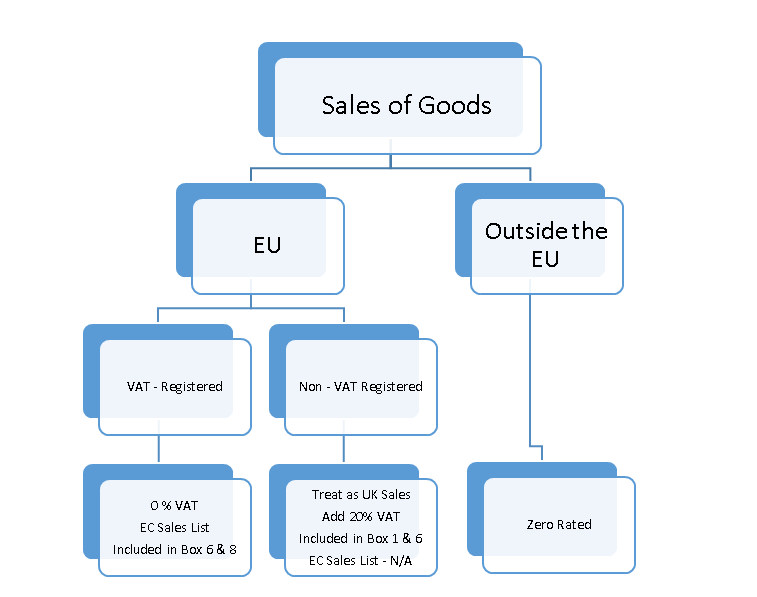

Please see below the Summary When you are SELLING GOODS:

Sales inside EU: Treat as mentioned above.

Sales outside EU: They will be treated as EXPORTS. Hence will be Zero-rated.

VAT on exports to non-EU countries

VAT is a tax on goods used in the EU, so if the goods are exported outside the EU, VAT isn’t charged. You can zero-rate the sale, provided you get and keep evidence of the export, and comply with all other laws. You must also make sure the goods are exported, and you must get the evidence, within three months from the time of sale. This can be longer for goods that need processing before export and for thoroughbred racehorses. The time of sale is the earlier of:

• the day you send the goods to your customer

• the day you receive full payment for them

You mustn’t zero-rate sales if your customer asks for them to be delivered to a UK address. If the customer arranges to collect them from you, an indirect export, you may be able to zero-rate the sale as long as certain zero-rating conditions are met.

Ref: https://www.gov.uk/guidance/vat-exports-dispatches-and-supplying-goods-abroad