Setup a Limited Company in No Time!

Tech Savvy Accountants for Limited Companies.

How To Setup A Limited Company In No Time?

Are you struggling with setting up a new limited company? Our Limited company Accountant will pull you out of the puddle 0f receipts and tax fines. Let’s take a look at different types of limited companies in the UK. Here’s how we segregate them. They’re limited by shares, limited by guarantee, private unlimited companies, and public limited companies. If you are looking for accountants for a limited company our chartered accountants in London will be more than happy to assist you!

Let Our Accountants For Limited Company File Your Taxes!

Our pro-Limited Company Accountant at Accotax know where to squeeze out the cash from. Whether it’s saving up on your taxes for a limited company, working on your tax dividends, or working on the allowances for your assets. Once you have us on board, expect us to do all the paperwork for you. Accotax accountants for limited company have great knowledge and they will do everything possible in their hands to help you gain profit and decrease your taxes as much as possible. We have our experts working for you.

Here’s How The Process Works

We offer inclusive accounting packages for your Limited Company, but we’d love to do it tailored to your need if you are looking for customized services. Our Limited Company Accounting services include:

- File Company’s Annual Return to Companies house every year. ( To be filed every year, within 28 days from the anniversary date of the company).

- File Abbreviated Set of accounts to the company’s house every year. ( Within 9 months after the year end date)

- Pay any Corporation Tax due, within 9 months and one day after the year-end date.

- File full set of Accounts to HMRC every year. ( To be filed within 12 months after the year end date)

- File Company Corporation tax return to HMRC- CT600 ( to be filed within 12 months after the year end date).

- Register your Business for VAT if turnover is above the VAT threshold or you can register on a voluntary basis.

- File VAT returns usually quarterly – only if you are VAT registered.

- If you have employees, you should set up a PAYE system to collect income tax and National Insurance contributions.

- File monthly payroll under real-time information. Only when you have a PAYE scheme in place.

- File Self-assessment tax return every year – Being a director of the company. ( Only when you take a salary or dividends from the company)

- Other Requirements, depends on individual circumstances such as filing P11D, etc.

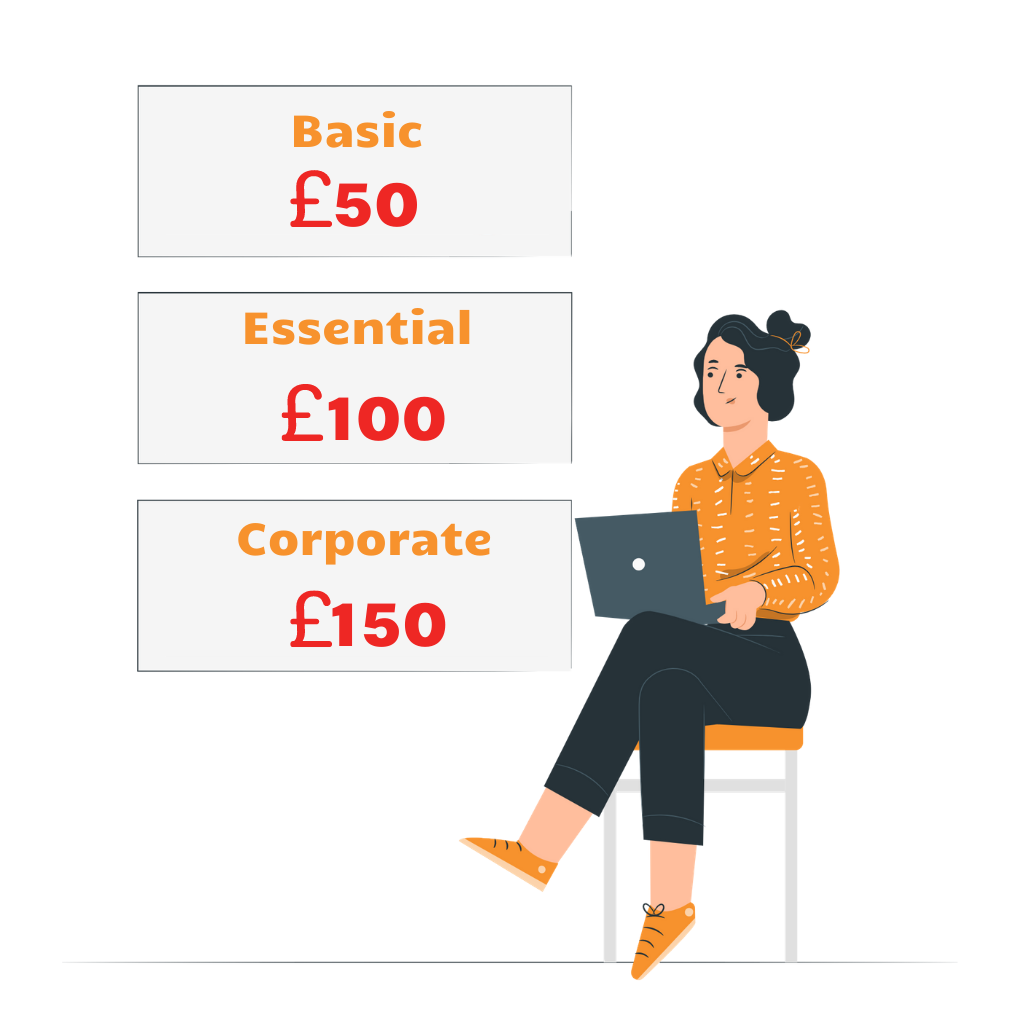

What Is Included In Our Fee Usually Or What Do We Offer?

We offer inclusive accounting packages for your Limited Company, but if you are looking for what do we offer?. It includes:-

- Unlimited face to face meetings

- Incorporation of a limited company*

- Help you to open a business bank account – where needed

- Preparation & filing of abbreviated accounts to Companies house

- Preparation and filing of a full set of accounts to HM Revenue & Customs – IXBRL format.

- Preparation & Filing of Company tax return(CT600) to HM Revenue & Customs

- Guide you how the tax system works in UK- Tax, N.I rates, etc.

- Guide you how to keep good records

- Guide you if your business needs to be registered for VAT. Explain to you the available VAT schemes

- Provide your list of possible allowable expenses

- Advise you about the tax liability & dates

- Act as an agent on your behalf and deal with HM Revenue & Customs

- Unlimited – Email and telephone support throughout the year

- ACCOTAX – Bookkeeping software

- Tax planning

Maintain Your Records

- Keep records of all Sale invoices

- Keep records of all Purchase invoices Expenses – if you are our client, you can request us a list of possible allowable expenses. This will give you an idea of what you can and can’t claim.

- Keep records of business bank statements

- Keep Record of VAT – if registered

- Keep records of all the employees & casual labor

- Keep records of business credit card statements if any.

- Keep records of any other information which you believe is relevant

Small Limited Business

Our small limited Company accountant can look at your business and support not only your administrative documenting but survey your business structure and give the understanding to augment incomes, limit squander

and convey your item to your customers in the most effective way.