If you are thinking to earn some extra money, aside from your full-time job, you might be wondering whether you can be self-employed and employed at the same time? The short answer to this is a big yes! If you have already been operating your own business with your full-time job, you might be aware of the responsibilities that come along.

However, if you haven’t been through this situation, you need to know what are the tax implications and how you will be taxed and what are the responsibilities of being employed and self-employed at the same time. Let’s explore!

Interested in ACCOTAX – Accountants in London? Why not speak to one of our qualified accountants? Give us a call on 02034411258 or request a callback.

Can I be Employed and Self-Employed at the Same Time?

Obviously! You can be employed and self-employed at the same time. Like you work for an employer/business during the day, but you work for your own business in the evening or night.

You are considered self-employed when you operate your own business yourself and are responsible for the business success and failure. On the other hand, you are an employee or employed when you work for a company on their own payroll and you receive wages through it.

If you fall under both, you became employed and self-employed at the same time. The money that is earned through your employment will be taxed via PAYE and you need to declare the earnings you made through your own business through a Self-Assessment Tax Return.

Employed and Self Employed: Registration

Being an employee, you don’t need to register for anything as your employer is responsible to register you to PAYE. However, as a self-employed person, you need to register yourself as a sole trader for Self Assessment Tax Return. If any of these apply, you need to declare yourself as a sole trader:

- You earn over £1,000 from self-employment in a tax year.

- You need to prove yourself as self-employed to claim tax-free Childcare

- If you want to pay Class 2 National Insurance payments (voluntarily) to avail benefits like state pension etc.

Want to Register for Self-employment? Fill out this form and let us handle the rest. Get in touch for help!

Responsibilities of a Self-Employed

If you are self-employed, you need to keep track of your business incoming and outgoings. You need to send a Self-Assessment tax return every year on time otherwise, you’d be levied a penalty. In addition, you need to pay Income tax on your earnings and Class 2 & 4 National Insurance. If you earn above £6,515, you’d be classed in the Class 2 NI category. And if your profit is over £9,569 or more in a year, you’d be classed in the Class 4 category.

What is PAYE?

If you are employed, PAYE (Pay As You Earn) is the method to deduct your income tax at source from your wages. Your employer will handle it and pay your tax directly to the HMRC. It also takes away your National Insurance (NI) and Student Loan Repayments.

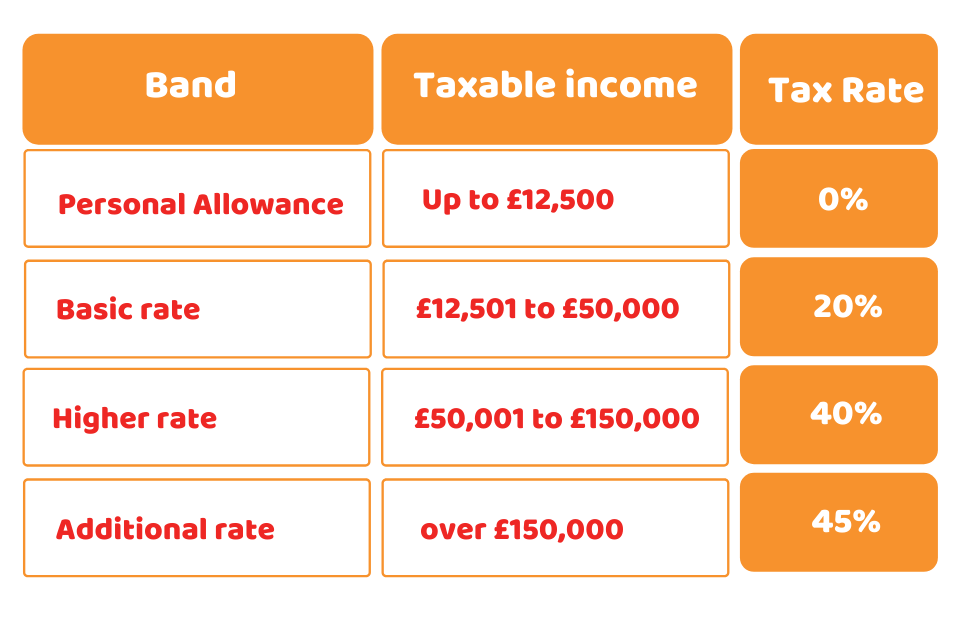

You are provided with a personal allowance that is a tax-free amount on your income which is £12,570 (2021-22). When your income goes above the personal allowance you are entitled to pay income tax at the rate of 20%, 40% and 45% depending upon the money you earn in a tax year. Here is the table to let you know how much you need to pay:

What is a Self-Assessment Tax Return?

If you are self-employed and don’t pay tax through PAYE, you need to register for Self-Assessment to pay your income tax. Self-employed businesses and persons need to report their income in a Self-Assessment tax return after the end of a tax year (5 April).

You just need to keep track of your receipts and bank statements to fill in and submit your returns. HMRC will evaluate what you need to pay based on what you’ve informed. You need to pay your Self-Assessment bill by the 31st of January. And, the tax you need to pay will depends on your Income Tax band.

You need to send a self-assessment tax return if:

- You’re self-employed with a profit of over £1,000

- You are a partner in a partnership

Remember there is a penalty of £100 for sending the tax return up to 3 months late. If it is late for more than 3 months, you need to pay more. Therefore, you need to be careful.

Quick Sum Up

To sum up the discussion, we can say that you can be self-employed and employed at the same time and it comes with a lot of advantages. However, there are tax implications that you need to be aware of. As an employee, your income tax and NI will be deducted through PAYE. But as a self-employed, you need to pay the tax and National Insurance through Self-Assessment.

If you need help with accounting, tax payroll and any other financial issue, you may reach out to our tax experts and accountants at Accotax to deal with it!

Have a Query? Reach out Or Get an instant quote now!

Disclaimer: This blog is written for general information on being employed and self-employed at the same time.