I have staff off due to coronavirus (COVID-19), what should I pay and what can I reclaim? We are receiving an extremely high number of calls in regards to paying employees statutory sick pay if they are off work due to coronavirus. We have put together a summary of information based on the most common questions asked over the last few days.

The guidance is changing on a daily basis and we will update our guidance published to remain in line with new Government guidance.

For the most up to date information and guidance from the Government, please regularly review the Government response page https://www.gov.uk/government/topical-events/coronavirus-covid-19-uk-government-response

Who is entitled to receive SSP?

Employees will be entitled to receive statutory sick pay (SSP) if they need to self-isolate due to:

- Having coronavirus

- Having symptoms of coronavirus

- Someone in their household having coronavirus

- Being advised to self-isolate by a medical professional

If someone is experiencing symptoms, all members of their household must self-isolate for 14 days. Individuals who live alone must self-isolate for 7 days.

How much SSP do I need to pay?

The normal qualifying rules for SSP will apply. An employee will be entitled to SSP if they:

- Have done some work under their contract

- Have average weekly earnings of £118 per week (19/20 tax year), increasing to £120 per week from 6 April 2020

SSP will be paid from the first day of absence for anyone self-isolating due to coronavirus from 13 March 2020. SSP rates are as follows:

- £94.25 per week for 19/20 tax year

- £95.85 per week for 20/21 tax year

Please remember that the weekly rate of SSP applies regardless of the number of days an eligible employee works (working days are known as qualifying days). Please review the below to obtain the daily rates of SSP for reference:

| Unrounded daily rates | Number of qualifying days in a week | 1 day to pay | 2 days to pay | 3 days to pay | 4 days to pay | 5 days to pay | 6 days to pay | 7 days to pay |

| 13.6928 | 7 | 13.70 | 27.39 | 41.08 | 54.78 | 68.47 | 82.16 | 95.85 |

| 15.9750 | 6 | 15.98 | 31.95 | 47.93 | 63.90 | 79.88 | 95.85 | |

| 19.1700 | 5 | 19.17 | 38.34 | 57.51 | 76.68 | 95.85 | ||

| 23.9625 | 4 | 23.97 | 47.93 | 71.89 | 95.85 | |||

| 31.9500 | 3 | 31.95 | 63.90 | 95.85 | ||||

| 47.9250 | 2 | 47.93 | 95.85 | |||||

| 95.85 | 1 | 95.85 |

What medical evidence do I need to obtain from my employee?

The Government has confirmed that employees will not need to provide a fit note in order to receive SSP when self-isolating due to coronavirus.

Reclaiming SSP

The Government is allowing small and medium-sized employers to reclaim SSP paid for sickness due to coronavirus.

- Employers can reclaim 2 weeks of SSP per employee who has been absent due to coronavirus

- Employers with 250 employees or less will be able to reclaim SSP – the size of an employer will be determined by the number of people they employed as of 28 February 2020

There has been no guidance published in regards to whether employers in a group of companies can reclaim their SSP, or if this is based on a PAYE reference basis. We are advising our clients that it will be in line with small employers’ relief for advanced funding of SMP, and therefore we are advising that this is based on a PAYE reference basis, not on the size of a group of companies.

You will not reclaim SSP through your RTI submissions when processing payroll. The government will work with employers over the coming months to set up the repayment mechanism for employers as soon as possible.

Please see the full eligibility criteria as published by GOV.UK here https://www.gov.uk/government/publications/guidance-to-employers-and-businesses-about-covid-19/covid-19-support-for-businesses

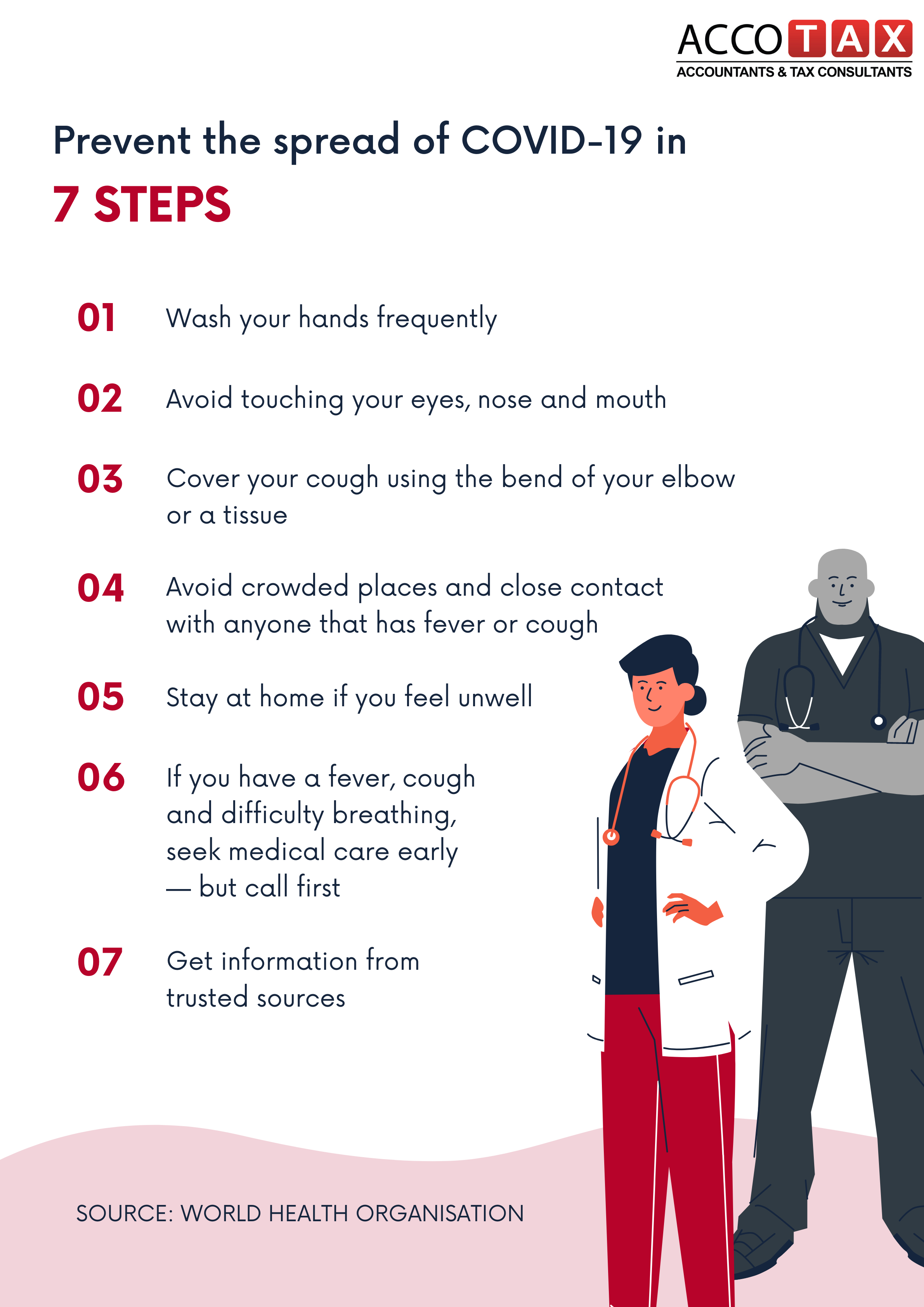

How can you Prevent The spreads of Covid-19?