We commit mistakes. In fact, everyone does. But the important thing after making a mistake is to owe up and take responsibility. That’s what you need to do if you realise that you have committed mistakes and didn’t pay the correct tax in the past. As the computerised system of HMRC automatically identifies mistakes and knows everything about your tax status. So whether you have made a mistake in your tax return and haven’t paid the right tax you owe, you need to do a voluntary disclosure to HMRC. Let’s find out more!

Want to make a disclosure! Give us a call on 02034411258 or request a callback to get in touch with our professionals to entertain your queries instantly!

What is Voluntary Disclosure?

HMRC gets a lot of your information from various sources, like banks, tax returns, Land Registry, eBay, Companies House and so on. Though HMRC contains and processes a bulk of information, it doesn’t mean that it knows everything. For this reason, HMRC encourages all taxpayers to inform the tax authority (HMRC) when they find that they didn’t pay the tax accurately in the past.

The process of informing a mistake, omission or non-compliance to HMRC without being prompted is known as voluntary disclosure. This allows taxpayers to settle their tax affairs and underpayments with HMRC. By doing it, taxpayers can significantly reduce their penalties.

Why Should I Make a Disclosure to HMRC?

It is necessary to disclose past mistakes or omissions voluntarily to avoid server penalties and legal proceedings. If you don’t do it, HMRC will consider your non-disclosure deceit, fraud or an attempt of tax avoidance. HMRC will investigate these matters seriously, so you need to come forward as soon as you can.

By making a voluntary disclosure to HMRC beforehand, your mistake or error will not be considered deceit or attempt to hide illegal activities, which in most instances will reduce the severity of penalties and legal proceedings.

Ways and Process to Make Voluntary Disclosure

There are many ways to make a disclosure. HMRC uses a Digital Disclosure Service (DDS) to access disclosures facilities to know that where you’ve not shown the accurate amount of one or more of the following:

- Income Tax

- Capital Gains Tax

- National Insurance contributions

- Corporation Tax

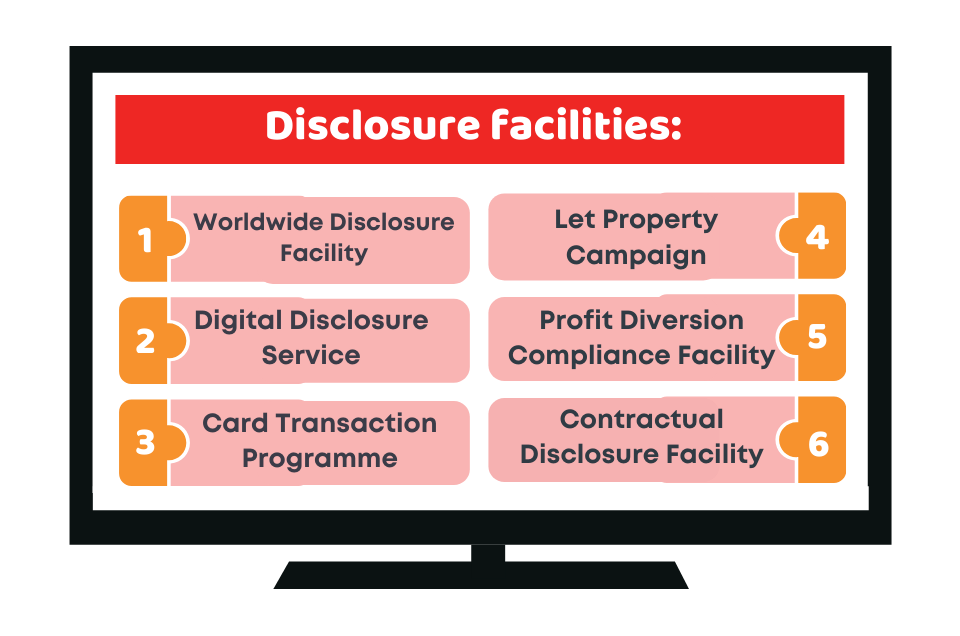

HMRC accepts a range of disclosure facilities to accommodate taxpayers who wish to correct their mistakes:

- Worldwide Disclosure Facility

- Digital Disclosure Service

- Profit Diversion Compliance Facility

- Card Transaction Programme

- Let Property Campaign

- Contractual Disclosure Facility

These facilities allow you to let HMRC know about the mistakes or omissions in your past tax affairs.

To make a disclosure, you need to:

- notify HMRC via a website that you want to disclose your information

- receive disclosure reference and payment reference number (PRN) from HMRC

- inform HMRC how and why the mistakes were made

- calculate the due tax, interest and penalties

- let HMRC check the disclosure

- reach a formal agreement with them

You need to note that if you intentionally failed to pay the correct taxes in the past, then you need to ask for a Contractual Disclosure Facility (CDF). Doing this will provide you legal protection from criminal investigations for possible prosecution and your details will be kept hidden on the Government Website for a year.

Remember that you need to do the disclosure and pay the due amount within 90 days, after getting the acknowledgment from HMRC against your notification.

Looking for all-inclusive monthly packages? Let us take care of your affairs so that you can focus on your business!

Preparation of your Disclosure

After calculating the income you need to declare, you need to determine the tax you owe on that income. Bear in mind that you are not required to disclose the income that is already declared as you had already paid tax on that. The number of years that needs disclosure depends on how the mistakes took place and when you should have informed HMRC about that income.

For the disclosure, you need to make an offer to pay the unpaid liabilities. With HMRC’s acceptance letter and the offer, you will be in a legally binding contract with the HMRC.

How to Pay HMRC?

The payments need to be made at the time when you send your disclosure. Here, you need the Payment Reference Number (PRN) to complete the transaction. HMRC should receive your payments within the 90-day deadline as per your notification acknowledgment letter.

What are the Penalties?

You may be charged penalties if the error or omission is done due to careless or deliberate behaviour. If your tax issues are of the UK, you need to pay up to 100% of the tax or 200% for the offshore-related income. If the case is serious, there might be a criminal investigation.

Quick Sum Up

A voluntary disclosure will keep you in a good position with HMRC. As a disclosure will not be investigated that much as the case itself. It can save you from heavy penalties and legal proceedings. As a result, it will give you peace of mind. You can apply for this disclosure voluntarily, however, it is preferable to take professional help as calculating taxes, the number of years, and the penalties is not that easy. So taking professional is advisable to reach a formal with HMRC.

At Accotax we take the burden off your shoulders and work for the robust growth of your business. Whether you’re concerned about the accounts, taxes, tax return, payroll, or need financial advice, we cover it all. Have a query? Reach out today!

Get an instant quote for a customized offer!

Disclaimer: This blog is intended to provide general information about the topic.