Wondering what is capital expenditures? Capital expenditures or capital expense or CAPEX is the money that your company spends to generate profit in the future. It stands in contrast to operating expenses (OPEX) that deals with the day-to-day costs of the company. Capital expenditure is the money or expenses used by a company to purchase, upgrade/ repair, improve and maintain physical assets like property, buildings, technology, equipment, etc.

Most often, businesses used CAPEX for investing in new projects. The practical examples of using capital expenditures on fixed assets include renovating a roof, purchasing new equipment or machinery, or making a new factory. Capital expenditure is one-time spending on long-term assets to enhance the scope of business operations.

After knowing what is capital expenditures. Let’s explore:

- Importance of CAPEX

- Examples of CAPEX

- Types of CAPEX

- Traits of CAPEX

- Formula of CAPEX

- Analysis of CAPEX Investment

- Quick Sum Up

If you’re looking for accounting and bookkeeping services for recording, calculating, and budgeting capital expenditures, feel free to get in touch with Accotax!

Importance of Capital Expenditures

Deciding how much to spend on capital expenditures can be critical and crucial due to the following reasons:

- Long-term Effects

- Irreversibility

- Depreciation

- High Initial Cost

Examples of Capital Expenditures

CAPEX is an expenditure type that include:

- Acquiring fixed tangible assets (e.g. equipment, building etc.)

- Buying or purchasing an intangible asset ( e.g. patent or license etc.)

- Improving or upgrading an existing asset for the expansion of its capacity or power (e.g computer network or some major equipment)

- Renovating or repairing a non-functioning asset for its usage

- Adapting an asset for using it for a new purpose/function where it has not been used before

- Staring a new business

Need someone to keep track of your business transaction. Get in touch with our bookkeepers!

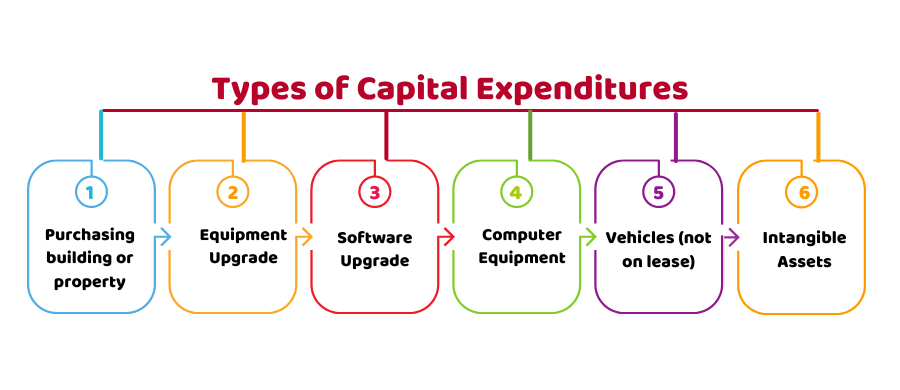

Types of Capital Expenditures

Here is the list of some common types of CAPEX which might vary as per the industry you deal with.

- Purchasing building or property

- Equipment Upgrade

- Software Upgrade

- Computer Equipment

- Vehicles (not on lease)

- Intangible Assets

Traits of Capital Expenditures

These are some common traits of CAPEX:

- They’re Infrequent

- Contain a significant value for your company

- The money is taken from sources other than the operating budget

- Need special approval by shareholders and directors

- Need time for preparation and implementation

Formula of Capital Expenditures

You need to apply the following formula to calculate CAPEX:

CAPEX = PP&E (current period) – PP&E (prior period) + Depreciation (current period)

Here:

CAPEX= Capital Expenditures

PP &E= Change in property, plant and equipment

You can get the components of this formula from the balance sheet and income statement. The balance sheet contains current and previous property, plant or machinery (PP&E), while depreciation can be taken from the income statement.

Reach out to our accountants to work out your CAPEX!

Analysis of Capital Expenditure Investment

The aim of analysing capital expenditure investment is to know whether the investment or upgrade is beneficial for your return on investment (ROI) or not. So before investing, you need to remember the following points:

- How much money you are going to invest in maintaining the assets?

- What qualitative change it’ll bring than other options?

- What will be the resale value of it in the future?

- Whether this investment is needed at a specific time?

- What risks you’re going to face?

Quick Sum Up

To sum up, after giving this blog a read you have explored what is capital expenditure, what are its types, examples and traits. In addition, you have also got to know the CAPEX formula and the analysis of capital expenditure investment. Making a final decision to invest in CAPEX can be critical. Therefore, you need to plan your budget for capital expenditure with careful planning and consideration to get the maximum benefit out of it.

Accotax has a team of certified chartered accountants in London for the smooth and effective management of your finances – all at reasonable rates. Feel free to contact us today!

Get an instant quote for customized services as per your business needs!

Disclaimer: This blog is intended for providing general information on CAPEX.