If you are looking for a significant source of finance to establish a profitable business, you need retained profit. Without it, you might have to borrow a large sum of money from banks and struggle to get a loan in the market. It evinces the long-term financial stability of a business. If you have just started your business venture and want to know what is retained profit, read on this blog till the end to explore all.

We offer a wide range of Accounting Services, Get in touch to Meet Your Business Needs Beyond Numbers!

What is Retained Profit?

As the name suggests, retained profit is the reserved net income that is retained by a business rather than paid as dividends.

Normally, this profit can be kept in the bank; can be used for working capital or the purchase of fixed assets; can be reinvested in more inventories and allotted to pay off debt obligations.

The total amount of retained profit may appear in the equity section of the balance sheet and it may also be seen on the profit and loss account.

Retained Profit Brought Forward

Retained profit brought forward is the accumulation of the retained profit from every accounting period since the beginning of a business. For instance, if a business is in its fourth year and has a retained profit of £10,000 in each of the first three years, then the amount of retained profit brought forward would be £30,000.

Looking for an accountant to work out your retained profit? Look no further other than Accotax for affordable services! Contact Today!

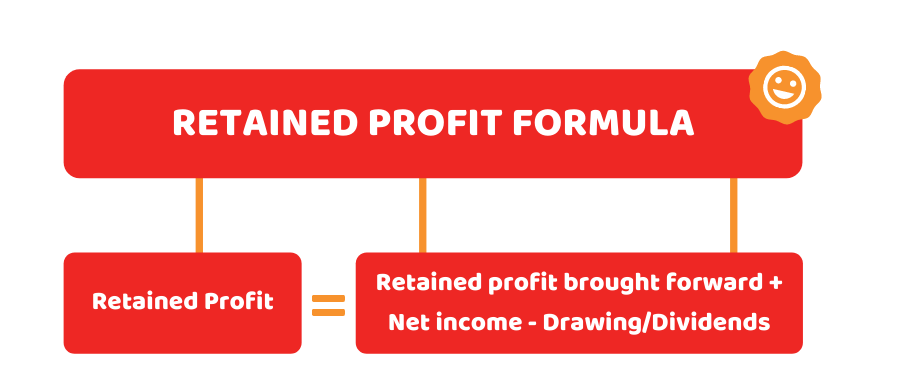

Retained Profit – Formula

Retained profit is calculated at the end of every accounting period. This calculation can either be on a monthly, quarterly or annual basis. Here is the simple formula to work out retained profit:

Retained Profit= Retained profit brought forward + Net income – Drawing/Dividends

Importance of Retained Profit

Retained profit connects income statement and balance sheet, as both are recorded under shareholder’s equity. There can be many reasons for retaining these earning. It can be done for buying new equipment and machinery, spending money on research and development, and undertaking other activities that generate profit.

If retained earnings are used for reinvestment, it can pave the way to earn more in the future. If a company can’t earn a sufficient return, then it can distribute those to shareholders as dividends.

Advantages

Following are some advantages of retained profit:

- They are inexpensive/cheap (not free): The cost of capital of retained profits is the opportunity cost for the shareholders to leave profits in the business (like they could get a return by leaving it in the business).

- Increase stock value: They are added to the corporate balance sheet that increases stockholder equity. As a result, they increase the stock value.

- Assure corporate stability: It boosts stock price momentum, attracts investors, and drives high stock prices.

- They are flexible: The management has complete control over how they can be reinvested/utilised and what portion should be saved rather than paid as a dividend.

- Provide funds: It provides funds for research and expansion without having any corporate debts.

- They don’t affect the ownership of a company.

Disadvantages

There are some downsides to using retained profit as a finance source. These include:

- Chances of hoarding cash: Directors of the company may restrict the value of dividends and can hoard too a large amount of cash in the business.

- Shareholders may ask for dividends: If retained profit don’t generate high profit, shareholders may ask for dividends.

- Higher gearing: High profit and cash flows suggest that a business is having a larger portion of debt than equity.

Quick Sum Up

To sum up, you are now well aware of what is retained profit, how it is calculated, and what are its advantages and disadvantages. It indicates the financial stability of a business in a certain period. You can find it on the equity section of the balance sheet and it can be advantageous in many ways whether it is related to increasing the stock value or the provision of funds. However, it contains few drawbacks as there’re chances of hoarding and high gearing.

We are a Young, Creative, Forward-Thinking, and Tech-Driven Firm of Chartered Accountants In London. Connect with our Experts to get your business issues settled in a split second.

Disclaimer: This blog is written for general information on retained profit.