If you have just started a business, there’s a strong possibility that you have incurred a heavy cost even before your business incorporation. These expenses can pile up and swallow your personal funds too. So, you might face difficulty claiming pre incorporation expenses, once your limited company starts working. So, in this quick guide, we’ll discuss:

- How to claim pre incorporation expenses?

- Conditions to remember

- What pre-formation expenses you can claim?

- Records to Make a Claim

Let’s dive in!

Save your time, money, and stress by allowing us to manage your accounts and taxes. Accotax has a team of accountants and tax experts to save your pennies against unwanted taxes and reclaim the most out of your expenses. Contact us right now!

Reclaiming Pre-Incorporation Expenses

Section 61 of the Corporation Tax Act states that pre-formation expenses are taken as expenses that were incurred on the first day of incorporation. Fortunately, you can make a claim for these expenses incurred over seven years before the incorporation of a company. It means that once you start operating your business, you can offset the costs against turnover for Corporation Tax in the first year.

If you need to invest in purchasing assets, like computers, and desks, you can claim the VAT for the purchase made up to four years from the day you started your business activities (for VAT-registered businesses). Additionally, you can also claim for expenses incurred on taking professional services that come under business activity within six months of the start date of the business.

Conditions to Remember

For claiming the tax, there are a few conditions that you need to remember. These are:

- You can claim for the services cost or things that are wholly and exclusively used for business purposes which have helped you to carry out your business activities from the start.

- According to HMRC manual VIT3200, you can claim VAT for the four-year limit for goods that remained in hand on the date of registration and are used for the newly incorporated business. And there is a six-month limit to reclaim the VAT paid for services.

- The cost incurred for company formation as a one-off capital cost can’t be claimed against the tax. However, you can reclaim it as a legal expense if you paid the registration fee from your personal funds.

- If you already own a registered company and incur money to form another company, you can’t reclaim these costs as the second company as the new company would be treated as a separate legal entity.

- Items bought initially for private use and afterwards used for the company don’t qualify to make a claim.

Note that there are a lot of rules on claiming back pre-formation expenses. So it is better to give us a call on 02034411258 or request a callback.

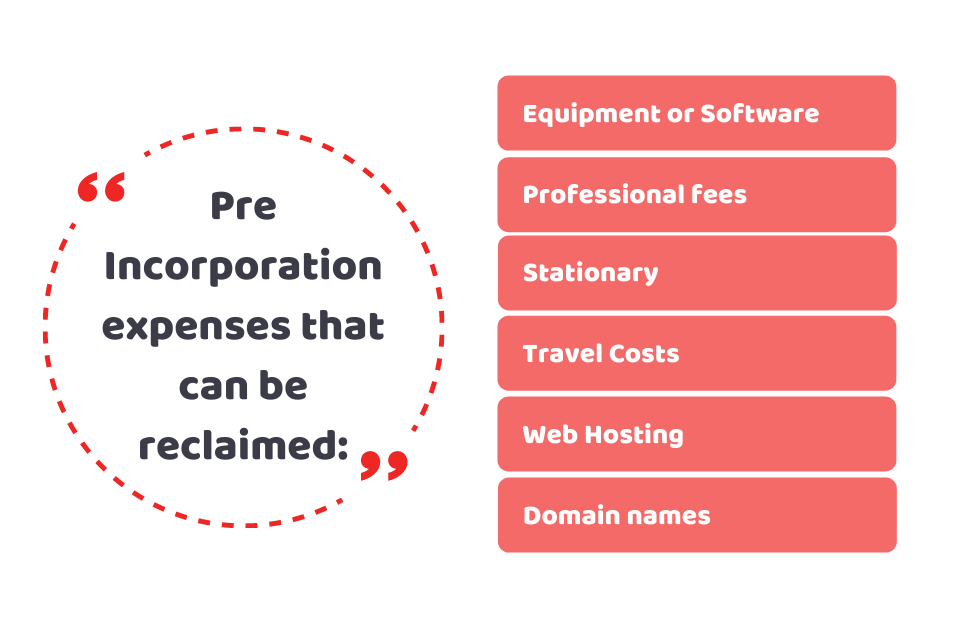

What are the Pre-Incorporation Expenses you Can Claim Back?

These are some typical expenses incurred before the incorporation of the company:

- Computer equipment and software like PCs, laptops etc (used exclusively for business)

- Professional services (accounting or legal fees)

- Travel costs related to the business

- Stationery, postage, printings etc

- Web Hosting

- Domain names

Records to Make a Claim

To make a claim, you need to ensure that you are keeping accurate and up-to-date records and receipts of the pre-formation expenses and services received. Without them, you are unable to claim the cost back or prove them as a legitimate business expense to HMRC. In addition, you also need to keep this thing in mind that you can’t purchase things and services under the name of your company until it is registered or incorporated at Companies House.

For further information see BIM46355.

Summing Up

So that’s all about claiming pre-incorporation expenses. Remember that to make a claim and to prove it as a business expense, you need to provide evidence to HMRC by maintaining accurate and up-to-date records of your per-trading expenses. Bear in mind that the one-off capital fee you paid for business formation cannot be claimed against corporation tax. However, if paid from personal expenses, it can be reimbursed. Likewise, other capital expenses can not be reclaimed before the company incorporation, like interest paid on loans, etc.

Have a query? Feel free to contact us anytime!

To find out how much our limited company accountants cost, click here!

Before you start rummaging through draws for receipts, speak to our qualified accountant! Give us a call at 02034411258 or request a callback.

Disclaimer: This post is just written for informational purposes and should not be taken as expert advice.