Not sure how your business is utilizing its overhead costs? With activity based costing, you can get a deep insight of your business expenses, especially the overhead costs. This method best suits product-focused businesses.

By using this method, you can figure out the factors that are driving your overhead cost, which will help you to better allocate them for the future. Besides, it will help you to make productive business decisions by changing business operations to reduce your cost. As a whole, you can analyze your spending accurately and price your products through ABC.

Activity based costing can be challenging for you if you’re unaware of its nitty-gritty details. So let’s have a look at what is it, how to find it and how it can be beneficial for your business.

Looking for a professional to do it! Get in touch with us!

What is Activity Based Costing?

It is a process to calculate the production cost of your products and services. In managerial accounting, it is used for assigning costs to different items. This system divides the production cost of production-related activities. For instance, the cost related to the testing of a product.

Businesses involved in manufacturing activities with large overhead cost use Activity-based Costing (ABC) to get a clear idea of where their money is used. In addition, ABC lets you know which products are profitable for your business.

With ABC you can get:

- The direct and overhead cost used for producing a product

- To know that different products require different indirect expense

- Information to set accurate prices for different products

- Estimates to reduce your overhead cost

Importance of Activity-Based Costing:

ABC has got great popularity due to the rapid expansion of manufacturing industries in the last few decades. With the increase in manufacturing activities, businesses are toiling to cut down their manufacturing cost. That’s where the ABC method applies. Businesses can minimize their cost by analysing what they do and how they do. To find out their cost, they need to implement ABC for getting productive results.

If you’re looking for a person to cut down your liabilities, don’t hesitate to contact us.

Pros and Cons of ABC:

Despite providing accurate details of production cost, ABC can be difficult to process. For this reason, you should know its pros and cons to find out whether it can be beneficial for your business or not:

Pros:

ABC can be used for:

1) Budgeting

2) Improving production

3) Accurate pricing of the products

4) Taking overhead decisions

Cons:

Before implementing ABC, you should also consider its cons:

1) It’s complex

2) This method is not 100% accurate

How to Find Activity Based Costing?

Curious to know the calculation of ABC? To implement this costing system, you need to know how to assign costs to different items.

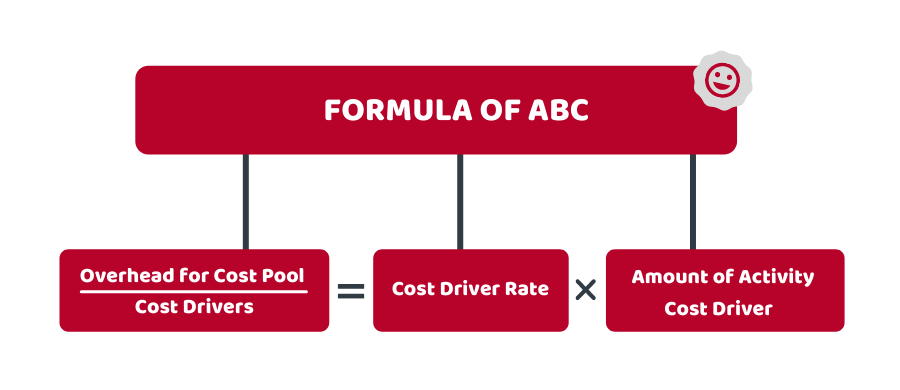

Here is the basic formula of ABC:

(Overhead for Cost Pool / Cost Drivers) = Cost Driver Rate X Amount of Activity Cost Driver

Here, the cost pool means the combination of total costs incurred on each activity. To find out the cost pool, you just need to find out activities that are associated with the production. After grouping the costs to pool, it’d be easier to find the overhead cost.

A cost driver controls and maintains the change in any activity. It includes unit, labour, machine hour etc. You can have more than one cost driver in a cost pool.

Step by Step Guide for Activity-Based Costing:

Here are some steps for implementing AOA:

- First, you need to identify all activities that are involved in the production (those where you spend money)

- Part each activity into groups

- Calculate the full overhead of each cost pool

- Assign activity cost driver (hours, units, parts) to each group

- Divide total overhead in each group by total activity cost drivers to find out the cost driver rate

- Multiply the cost driver rate by the cost of the activity (cost drivers)

Suppose, you have allocated £30,000 for setting up 2000 machines (cost driver). You will get the cost driver rate by dividing the overhead of cost pool £30,000 by the cost driver, 2000 machines and you’ll get £15 (£30,000/2000).

Now you need to calculate how much you have spent on each product XYZ. Let’s say there are 300 products that you’ve produced. You will get the overhead cost of XYZ by multiplying the cost driver rate by the total no of products, you’ll get £4500 (£15 X 300).

Quick Wrap Up:

You need to know that ABC accounting or Activity based costing is not a child’s play, especially if you have just stepped into the manufacturing business and want to implement this method. Though accounting software can provide you with the necessary information to find ABC, but they don’t offer the capability to calculate the cost of the product by applying ABC.

Therefore, we highly recommend you to consult a professional accountant or a CPA. Luckily, you don’t need to search around to find a professional accountant! Accotax is equipped with a team of certified chartered accountants in London for your assistance.

Feel free to reach out!

Disclaimer: This blog is just for general information on ABC.