Welcome to our round-up of the latest business news for our clients. Please contact us if you want to talk about how these updates affect your business. We are here to support you!

Recruit an environmental management or sustainable deve

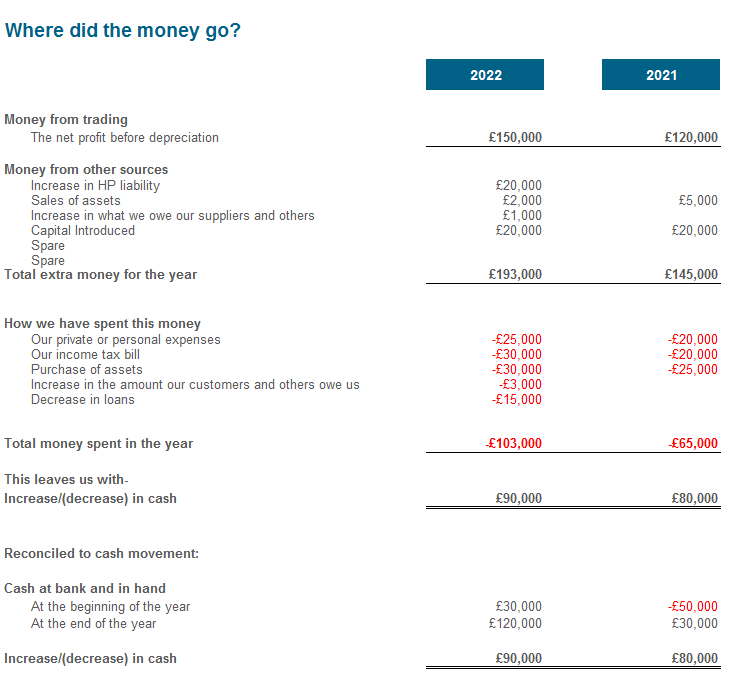

Where Does the Money Go?

With ever increasing supplier prices, managing your businesses cash and understanding the flow are now vital tools in maintaining resilience and being able to adopt flexible strategies for success.

Fund flows are a reflection of all the cash that is flowing in and out of a business. Owners can look at the direction of the cash flows for insights about the health of specific products or services and overall market patterns.

Some types of business are more likely to run into cash flow problems, while other types appear to be more resilient. If you are a business owner, you might be wondering which category your business falls into. No matter how inventive or simple your business model is, you can still have problems with cash flow. Here are our thoughts on managing the flow of cash in your business:

The first stage of understanding and predicting how funds flow is to perform a health check on your accounts. Look at your latest profit and loss statement and check that your income is sufficient to cover your expenses. If your profit is falling behind your expenses and cash flow is slowing down you might need to take action. Prepare a funds flow statement so you know where the money goes.

Next create a yearly budget and look where cash could become tight and months where you can save to cover off the quieter times. Look at those quieter months and think about flexible work scheduling, new products or services or other activities to tide you over.

Finally make sure you collect your money from those who owe you quickly. Reward customer loyalty by offering early bird discounts, set credit limits and payment terms to ensure customers follow the rules. If you take on new customers make credit checks. Penalise late payers and request up front deposits or payment.

Talk to us about preparing a funds flow statement and annual budget so that you can work on your business for maximum success!

Ransomware Attacks on Businesses Growing

UK, US and Australian cyber security authorities are warning of a growing wave of increasingly sophisticated ransomware attacks which could have significant consequences for businesses and organisations across the world.

In their joint advisory, they reveal that the tactics of ransomware groups evolved last year. Trends observed in 2021 include:

- targeting organisations on public holidays and weekends

- attacking industrial processes and the software supply chain

- targeting cloud services

- disrupting work and shutting down services

- holding organisations to ransom until demands have been paid

- increased use of cybercriminal ‘services-for-hire’

- sharing of victim information between different groups of cyber criminals

- diversifying approaches to extorting money

Businesses and organisations are encouraged to familiarise themselves with the risks and ensure their IT teams are taking the correct actions to bolster resilience.

The advisory suggests ways to mitigate risk of compromise by ransomware by implementing a requirement for multi-factor authentication, Zero Trust architecture, and a user training programme with phishing exercises.

The advisory follows the NCSC’s recently launched Ransomware Hub, which is a one-stop shop for advice on how ransomware works, on whether a ransom should be paid, and how to prevent a successful attack.

UK organisations which fall victim to a cyber-attack should report the incident to the NCSC’s 24/7 Incident Management team.

See: Joint advisory highlights increased globalised threat of… – NCSC.GOV.UK

Changes To Accounting for VAT On Imports for Users of Flat Rate Scheme

There are important changes from 1 June 2022 for small businesses using the Flat Rate Scheme who are importing goods and using postponed VAT accounting.

Those businesses using the Flat Rate Scheme must currently add the value of imported goods to the total of all their supplies before they carry out the scheme calculation.

For VAT return periods starting on or after 1 June 2022, they should no longer include import VAT accounted for using postponed VAT accounting in their flat rate turnover. The VAT due on any imports should be added to box 1 of the return after completing the Flat Rate Scheme calculation.

HMRC have issued the following updated guidance:

Complete your VAT Return to account for import VAT – GOV.UK (www.gov.uk)

Importers Not Using the VAT Flat Rate Scheme

HMRC have also updated their guidance for VAT registered importers not using the Flat Rate Scheme:-

Complete your VAT Return to account for import VAT – GOV.UK (www.gov.uk)

These traders must account for postponed import VAT on their VAT returns for the accounting period which covers the date they imported the goods. The normal rules apply for what VAT can be reclaimed as input tax and the trader’s monthly statement will contain the information to support their claim.

HMRC is aware of the problems some importers are having when trying to access their monthly VAT statements. If you cannot access your statement or you’re having problems when viewing your statement, you should follow the guidance on how to complete a VAT Return if you’re having problems with your monthly statements.

As long as you take reasonable care to follow the guidance, there will be no penalty for errors.

Payrolling Benefits in Kind

HMRC are encouraging more employers to payroll employee benefits in kind rather than declaring benefits on the end of year P11D. They have included guidance on registering to use the scheme in their latest employer bulletin.

If employers haven’t already done so they should register online now or before 5 April 2022 to payroll employee benefits for the 2022/23 tax year.

The advantages of payrolling benefits in kind are:

- employers no longer need to submit P11D and P46(Car) forms to HMRC

- simpler PAYE codes mean HR teams receive fewer queries from employees regarding tax

- tax deductions in monthly payroll will be more accurate

- tax codes for individuals should change less frequently

- fewer forms for employers to complete at year-end

If you are not yet in a position to move to payrolling you can still move away from legacy paper P11D forms by submitting them online. You can submit them in one click without worrying about posting them to HMRC. It is also a useful first step towards payrolling of benefits in kind and bringing your payrolling processes into the digital age.

Upcoming HMRC Webinars

Plastic Packaging Tax – admin and technical aspects – 22 February

In this webinar you’ll find more detail about the administrative and technical aspects of the new Plastic Packaging Tax.

See: Registration (gotowebinar.com)

Making Tax Digital for VAT – 22 February

This webinar will provide some of the basics of Making Tax Digital for VAT. This will include what’s changing, using software and keeping digital records, plus an introduction to penalty reform.

From April 2022, these requirements will apply to all VAT-registered businesses, to include those that have a turnover below the VAT threshold.

See: Registration (gotowebinar.com)

Introduction to Plastic Packaging Tax – 25 February

Find out about the new Plastic Packaging Tax being introduced in April 2022 and what you need to do now if you produce or import plastic packaging.

See: Registration (gotowebinar.com)

Employers – what’s new for 2022 to 2023 – 14 March

Join this live webinar for an overview of the new rates for:

- National Insurance

- National Living Wage/National Minimum Wage

- Statutory Payments

HMRC will discuss any changes to expenses and benefits, Student Loan deductions, freeports, employer National Insurance contributions relief, and the new Health and Social Care Levy.

See: Registration (gotowebinar.com)

Fairtrade Fortnight 2022 – Choose the World You Want!

In 2022, the online Choose the World you Want Festival will return from 21 February to 6 March. Last year’s festival saw campaigners, shoppers, students and businesses come together in a show of support for the farmers behind our food on the front line of the climate crisis. From online panels to bake-offs and coffee mornings over 50 virtual events took place as part of a virtual festival, with supporters sharing the power of Fairtrade and what needs to happen next to ensure farmers and workers are put front and centre of conversations on how to tackle the climate crisis. The COVID-19 pandemic has shown us more than ever how interconnected we are globally. This interconnection is at the very heart of the Fairtrade message and is where your role begins. You are part of the Fairtrade movement, and you have the power to drive long-term change, not only with your shopping choices but with your support in spreading the message.

See: Online Festival: Choose The World You Want festival 2022 – Fairtrade Foundation

Food Waste Action Week 2022

Around a third of the food produced globally is lost or wasted and it’s having a real impact on climate change, contributing 8–10% of total man-made greenhouse gas (GHG) emissions.

That is why Love Food Hate Waste dedicate a whole week of action to raising awareness of the environmental consequences of wasting food and promoting activities that help to reduce the amount of food we waste.

The aim of Food Waste Action Week is to create lasting change that helps to deliver the UN Sustainable Development Goal of halving global food waste by 2030.

After an incredible response to the first-ever Week in 2021, plans are already taking shape for Food Waste Action Week 2022 (7-13 March 2022) and this time we will be taking it global.

See: Food Waste Action Week 2022 | WRAP

Digital Security by Design: Technology Access Programme

Applications remain open until 6 March 2022.

Digital Security by Design (DSbD) challenge and Digital Catapult have launched a new programme for developers and organisations to experiment with DSbD technologies.

The Technology Access Programme has been developed to build a pipeline and community of developers and technology companies to trial and experiment with the new DSbD technologies, to addresses the cyber security challenges faced by embedded product and software companies.

What is available?

To support a six-month experimentation period with the DSbD technologies within their own organisations, programme participants will have access to:

- the Morello Board and CHERI prototype architecture and hardware

- technical guidance

- £15,000 in funding

- collaboration and mentoring opportunities

- industry and technical advisors

Businesses will also get an opportunity to access Digital Catapult’s Future Networks Lab with state-of-the art IoT and 5G networks testing facilities, allowing them to test the impact of DSbD technologies on other areas of their products and services.

There will be four open call opportunities during the overall timeframe of the Technology Access Programme for organisations to apply.

See: Technology Access Programme – Digital Security by Design (dsbd.tech)

The COVID-19 Childcare Temporary Closure Support Fund Has Been Extended for The Period January to March 2022

The COVID-19 Childcare Temporary Closure Support Fund will provide continued support for childcare providers who have had to close temporarily due to a COVID-19 related incident within their provision. Those eligible to apply include registered childminders, day-care providers, school age childcare providers, crèches and playgroups who are registered and have been operational during the period 1 January to 31 March 2022. The deadline for applications is 4pm on Friday 15 April 2022.

Webinar: Spotlight on Germany

Learn about the current opportunities and challenges for Northern Ireland businesses in the German market.

As one of the largest industrial and export economies in Europe, Germany provides many business opportunities for Northern Ireland companies across a variety of sectors.

Invest NI is organising a “Spotlight on Germany” webinar which will highlight the current opportunities and challenges for Northern Ireland businesses in the market, while providing delegates with a sound foundation for choosing Germany to become part of their export portfolio.

The webinar will showcase the latest in-market macroeconomic and technological trends, the influence of the new German government programmes and the potential impact on businesses.

It will also provide insight into a select number of sectors and demonstrate success factors, challenges and potential obstacles for entering the market.

The webinar will conclude with a Q&A session

See: Webinar: Spotlight on Germany (nibusinessinfo.co.uk)

Coronavirus: Online Isolation Notes – Providing Proof of Absence from Work

People unable to work because of coronavirus (COVID-19) can obtain an isolation note through NHS online service.

Isolation notes are for employees who:

- have symptoms of coronavirus or have tested positive

- live with someone who has symptoms or has tested positive, and the employee is not fully vaccinated

- have been told to self-isolate by a test and trace service or the NHS COVID-19 app

For the first seven days off work, employees can self-certify so they don’t need any evidence for their employer. After that, employers may ask for evidence of sickness absence.

Employees can use the NHS online service to get an isolation note if:

- they have symptoms of coronavirus or have tested positive

- they live with someone who has symptoms or has tested positive, and they’re not fully vaccinated

- they’ve been told to self-isolate by a test and trace service or the NHS COVID-19 app

If an employee is aged under 18 and 6 months they only need to self-isolate if they have symptoms or have tested positive. They do not need to self-isolate if they live with someone who has symptoms or has tested positive.

Get an isolation note here: Get an isolation note – NHS (111.nhs.uk)

If staff have to isolate but feel well enough to work, you could facilitate them working from home. If they can work from home, they will not need an isolation note.

Employers should use their discretion around the need for medical evidence if an employee has been told to self-isolate because of coronavirus.

If you need evidence that an employee cannot work because of coronavirus, ask them to get an isolation note. Employers can check an isolation note is valid here: Check an isolation note – NHS (111.nhs.uk)

See: Coronavirus (COVID-19): self-isolating and close contacts | nidirect

Recruit An Environmental Management or Sustainable Development Placement Student

Improve your business’ environmental management with a Queen’s University Belfast placement student.

Queen’s University Belfast (QUB) have students with skills to support your business’ environmental management. You can improve your sustainability through a QUB placement programme.

Undergraduate placements last for up to 46 weeks, commencing from June each year. Postgraduate placements last either eight or 12 weeks, commencing from January each year.

Students are available to work in the following areas:

- Environment Management – Waste and resource management, industry maintenance and monitoring of environmental regulations, environmental managements systems include ISO14001, energy efficiency and renewable energy projects

- Consultancy and Monitoring – Environmental impact surveys, GIS, planning and site surveys – air, land and water, emissions and climate change

- Conservation – conservation and environmental protection, ecological and biodiversity management, advocacy, policy, communication and education

The benefits to employers are that taking on a placement student can help your business in the following ways:

- students will support your Environmental teams on-site and help identify opportunities for environmental and sustainable development improvements

- opportunity to assess a student’s potential for future employment – the opportunity to give a potential recruit a trial without obligation

- breakthrough thinking

- international student population who can bring a wide range of skills, knowledge and experience from across the world

For more information about environmental management or sustainable development placements, contact Dionne Alexander on Email: [email protected] or Telephone: 028 9097 5301.

See: Recruit an environmental management or sustainable development placement student (nibusinessinfo.co.uk)