Welcome to our round up of the latest business and Covid-19 news for our clients. Please contact us if you want to talk about how these updates affect your business. We are here to support you!

Covid-19 Update

Restrictions are to ease but the wearing face masks remains as Scotland moves to level 0 today. First Minister Nicola Sturgeon said the planned easing had to be modified due to the spread of the Delta variant. The government is asking people to adhere to protective measures and sensible precautions to suppress coronavirus to help create conditions that allow Scotland to move beyond Level 0 on 9 August.

From today physical distancing in Level 0 will reduce to 1 metre in all indoor public settings and outdoors. Additionally, informal social gatherings of up to 15 people from 15 households will be permitted outdoors without physical distancing. Gatherings of up to 10 people from four households will be permitted in all indoor public settings with 1 metre physical distancing.

Other easings to Level 0 taking effect today include:

- under-12s will no longer count towards the number of households that can gather indoors in public spaces and homes

- hospitality settings can open till midnight, if their current licence permits that, and customers will no longer be required to pre-book a two-hour slot to go to a pub or restaurant but will still be required to provide contact details to assist Test & Protect

- up to 200 people will be able to gather at weddings and funerals

- travellers who are fully vaccinated through a UK vaccination programme and children arriving into Scotland from Amber List countries will no longer be required to self-isolate and take a day eight test, but adults and children over 12 will still take tests before travelling and on day two after arrival. Anyone testing positive for or experiencing symptoms of COVID-19 will still be required to isolate for 10 days.

- employers are asked to continue to support home working where possible until Scotland moves beyond Level 0.

A survey is being launched for those at highest risk from COVID-19 to gather views on what additional support might be needed as restrictions ease. The Chief Medical Officer has written to this group with advice on what moving to Level 0 will mean for them.

See: Coronavirus (COVID-19) update: First Minister’s statement – 13 July 2021 – gov.scot (www.gov.scot)

Funding for Fishing Sector Training and Equipment

Fishing crews will benefit from 100 new on-board defibrillators and a range of life-saving training opportunities. The investment through Marine Fund Scotland (MFS), is aimed at improving safety and wellbeing in one of Scotland’s iconic industries, including £140,000 for industry body Seafish to deliver free safety training for fishing vessel crews. This will be match funded by the Maritime and Coastguard Agency, to realise total funding of £280,000 through to March 2022.

In addition, the Scottish White Fish Producers Association (SWFPA) will receive £80,000 through MFS to provide around 100 defibrillators to its members.

The awards, announced during Maritime Safety Week, are some of the first to be made through MFS, a one-year fund aimed at investing in marine industries, seafood sector and the marine environment.

See: Funding for fishing sector training and equipment – gov.scot (www.gov.scot)

UK Trade Tariff: Duty Suspensions and Tariff Quotas

Duty suspensions are designed to help UK and Crown Dependency businesses remain competitive in the global marketplace. They do this by suspending import duties on certain goods, normally those used in domestic production.

These suspensions do not apply to other duties that may be chargeable like VAT or the anti-dumping duty. Duty suspensions allow unlimited quantities to be imported into the UK at a reduced tariff rate. Autonomous Tariff Quotas (ATQs) allow limited quantities to be imported at a reduced rate.

Duty suspensions and ATQs are temporary and can be used by any UK business while in force. They are applied on a ‘Most Favoured Nation’ (‘MFN’) basis. This means that goods subject to these suspensions or quotas can be imported into the UK from any country or territory at the specified reduced tariff rate. Find the current duty suspensions and quotas using the Trade Tariff Lookup Tool.

The 2021 window to apply for a duty suspension will close on 31 July 2021.

For further information see: UK Trade Tariff: duty suspensions and tariff quotas – GOV.UK (www.gov.uk)

Delaying Declarations for EU Goods Brought into Great Britain

Businesses can delay sending HMRC full information about goods by up to 175 days before the deadline of 31 December 2021. After that full customs declarations must be made at the point of import for all goods.

For goods brought into Great Britain (England, Wales and Scotland) from the EU, you (or someone who deals with customs for you) may be able to delay sending HMRC the full information about your goods by up to 175 days after import.

However, you cannot delay declarations and must follow the normal rules for making an import declaration if either:

- your goods are controlled

- HMRC has told you to because you have a poor compliance record

You can delay declarations if you import goods into free circulation in Great Britain from EU free circulation between 1 January and 31 December 2021, your goods are not controlled and HMRC has not told you that you cannot delay declarations.

See: Delaying declarations for EU goods brought into Great Britain – GOV.UK (www.gov.uk)

Making a Full Customs Declaration

From 1 January 2022 your business will need to do a full customs declaration at the point of import for all goods.

Also, if you are moving goods into Great Britain, into Northern Ireland from Great Britain, or into Northern Ireland from outside the EU, you will need to make an entry summary declaration.

See: Making an entry summary declaration – GOV.UK (www.gov.uk)

VAT Postponement

Businesses are still able to use postponed VAT accounting (PVA) to account for import VAT on their VAT returns.

Accounting for import VAT on your VAT Return means you will declare and recover import VAT on the same VAT Return, rather than having to pay it upfront and recover it later.

You will need to get your monthly postponed import VAT statement to do this.

The normal rules about what VAT can be reclaimed as input tax will apply.

See: Check when you can account for import VAT on your VAT Return – GOV.UK (www.gov.uk)

Intellectual Property Office Launches Digital IP Renewal Service

Following a successful trial period, the Intellectual Property Office (IPO) has officially launched their new digital renewals service.

The online service offers IPO’s customers a way to renew up to 1,500 intellectual property (IP) rights in a single digital transaction. These rights include combinations of patents, trademarks and designs.

The service offers several benefits to the IPO’s customers. It:

- streamlines the bulk renewals process

- provides instant validation of renewal applications

- eliminates errors resulting from a manual process

Customers also benefit from automated electronic delivery of correspondence and receipts, certificates, and ability to complete transactions at the time and place that suits them.

The renewals service offers a taster of what you can expect from the IPO in future. As part of their One IPO Transformation Programme, work is underway to develop a single, integrated system for all registered IP rights. The new, paper-free system would allow IP owners to access all IPO’s services through one digital account, and easily manage all of their IP rights in one place.

For updates about the IPO’s transformation programme, you can email [email protected].

Off-Payroll Working – Will HMRC Accept CEST Result?

Since 6 April 2021 large and medium-sized organisations, based on the Companies Act criteria, have had to determine whether or not a worker supplying his services via their own personal service company would be treated as an employee if directly engaged. This replaced the IR35 rules for these larger organisations.

HMRC suggest organisations use their Check Employment Status for Tax (CEST) tool on their website to check the worker’s status, although that is not obligatory. The tool is an interactive database of questions and will normally provide a ruling after 15 to 20 questions depending on the answers given about the contractual relationship.

See: Check employment status for tax – GOV.UK (www.gov.uk)

HMRC have recently confirmed that they will be bound by the result of the software provided the information is accurate and it is used in accordance with their guidance.

See: ESM11010 – Employment Status Manual – HMRC internal manual – GOV.UK (www.gov.uk)

HMRC have also stated that they will not stand by results achieved through contrived arrangements that have been deliberately created or designed to get a particular outcome. They would see that as deliberate non-compliance, and potentially levy financial penalties.

Note that the end-user organisation is required to issue a Status Determination Statement to the worker with a copy to any agency to be passed to any fee payer in the labour supply chain making payments to the personal service company.

Balearic Islands Removed from Travel Green List

The decision was taken on a four nations basis and will also see the British Virgin Islands removed from the green list. Both islands will become amber, and travellers must follow isolation and testing rules that apply.

An improved position in Bulgaria, Croatia, Hong Kong and Taiwan mean they are all added to the green list.

Four countries will be added to the red list, with arrivals required to enter quarantine hotels for 10 days. These are Cuba, Indonesia, Myanmar and Sierra Leone.

The previously announced change for UK residents who have been fully vaccinated by the NHS returning from amber list countries will also come into force today, with the exception of France.

Self-isolation for all Travellers Returning from France

Fully vaccinated travellers returning to Scotland from France will still be required to self-isolate from today.

The decision follows concerns about the persistence of Beta variant cases in France, given this variant may evade vaccine protection. It means that anyone who has been in France in the previous 10 days will need to quarantine on arrival to Scotland in their own accommodation and will need a day two and day eight coronavirus (COVID-19) test, regardless of their vaccination status.

See: Self-isolation for all travellers returning from France – gov.scot (www.gov.scot)

COVID-19 Government Support News

Below is our weekly roundup of changes to government support information generally and for businesses, employers and the self-employed.

Coronavirus Job Retention Scheme (CJRS) – Update

The CJRS has been extended until 30 September 2021. From 1 July 2021, the government will pay 70% of wages up to a maximum cap of £2,187.50 for the hours the employee is on furlough.

Employers will top up employees’ wages to make sure they receive 80% of wages (up to £2,500) in total for the hours the employee is on furlough. The caps are proportional to the hours not worked.

From 1 August 2021, the government will pay 60% of wages for furlough employees up to £1,875. From 1 July 2021, employers will top up employees’ wages to make sure they receive 80% of wages (up to £2,500).

Download a template if you’re claiming for 16 or more employees through the Coronavirus Job Retention Scheme

Complete a template with the details of the employees you’re claiming for and upload this when you claim (for claims on or after 1 July 2020). These templates have been updated.

Self-Employment Income Support Scheme (SEISS) – Get Ready to Claim the Fifth Grant

HMRC have provided a new video about the SEISS fifth grant.

See: Help and support if your business is affected by coronavirus (COVID-19) – GOV.UK (www.gov.uk)

Work out your turnover so you can claim the fifth SEISS grant

The introduction to the guidance has been edited to explain that you would need to tell HMRC about your turnover if you traded in 2019 to 2020 as well as any of the other tax years listed. The section ‘How to work out your April 2020 to April 2021 turnover’ has been updated with examples of start dates you can use.

See: Work out your turnover so you can claim the fifth SEISS grant – GOV.UK (www.gov.uk)

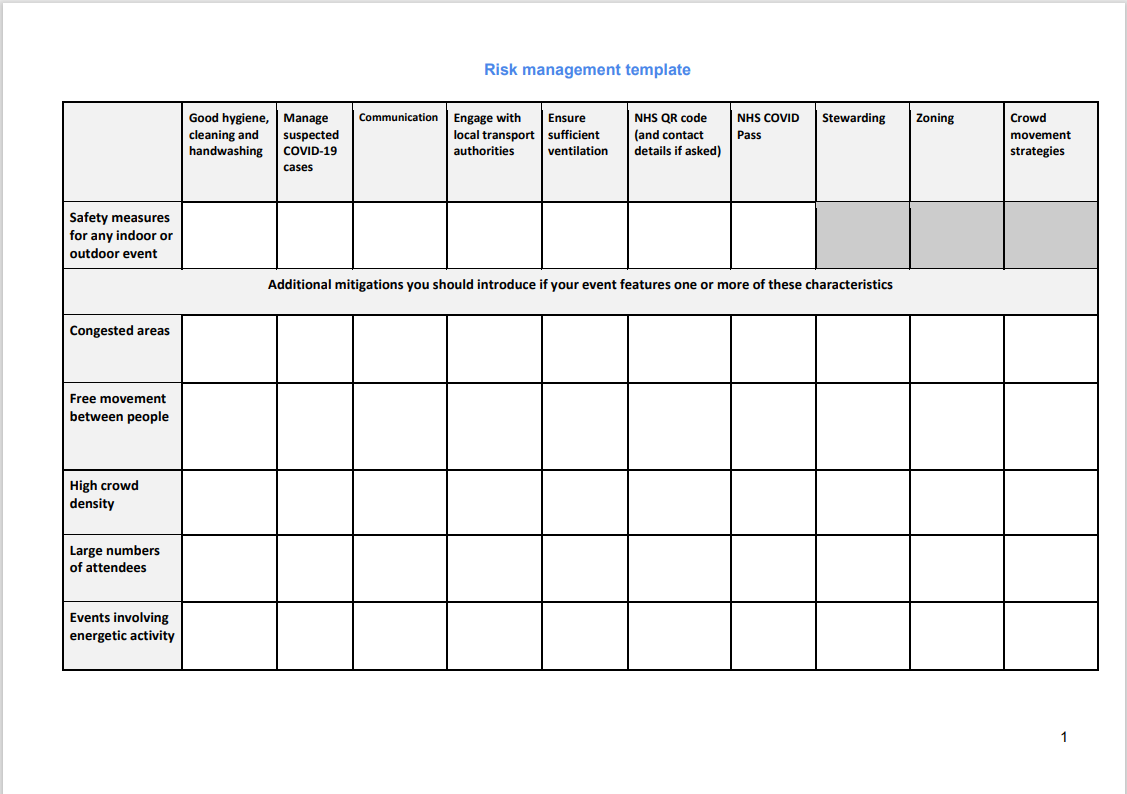

Risk Management Template for Event Organisers

The Department for Digital, Culture, Media & Sport has provided a resource to help event organisers to reduce the risk of COVID-19 transmission in event settings. This resource sets out examples of the types of risk mitigation measures event organisers can put in place to reduce the risk of COVID-19 transmission at events.

This should be used in conjunction with the events and attractions guidance, which explains the types of events which may need to take additional measures and how these measures can help to reduce risk. It also includes more detail on how you can put these measures in place in different settings.

See: Risk management template for event organisers – GOV.UK (www.gov.uk)

Smart Scotland Grant

This grant is for Small and medium enterprises (SMEs) based in Scotland undertaking research and development projects with a commercial endpoint.

Grants can support up to 70% of the eligible costs for a small enterprise and up to 60% of the eligible costs for a medium enterprise. The initial deadline for applications has been extended to 11:59am on 31 August 2021.

See: SMART SCOTLAND grant (findbusinesssupport.gov.scot)

Funding for the Advanced Innovation Voucher

This funding programme is designed to enable companies to work collaboratively with a Scottish University or further education college. The purpose of an Advanced Innovation Voucher is to help build sustained relationships between small and medium sized companies (SMEs) and universities or Further Education colleges in Scotland who may have previously collaborated together or for those companies who are beginning their collaborative journey.

The value of an Advanced Innovation Voucher is up to £20,000 of grant funding. The company match is a mix of in-kind and cash contributions.

Applications can be made from all industry sectors and the proposed collaborative project should lead to new products, services and processes that will benefit the company, the university or college and the Scottish economy.

Interface provides support with finding a suitable academic partner who has the right specialist expertise to progress your Research and Development project.

See: Funding for the Advanced Innovation Voucher (findbusinesssupport.gov.scot)