Welcome to our round up of the latest business news for our clients. Please contact us if you want to talk about how these updates affect your business. We are here to support you!

Over ten million people have now received their COVID-19 booster jab, ensuring the protection they have secured from their first two doses is maintained over the winter months.

Recent figures follow hundreds of thousands of vaccinations over the weekend. People who are eligible are also able to get a booster at hundreds of walk-in sites across the country, as long as it’s been six months since their second dose. The third vaccine dose will be offered to 30 million people over 50, medical staff, and younger adults with some health conditions.

New Recovery Loan Fund launched

Charities and social enterprises that have been operating for a minimum of two years can now apply for loans worth up to £1.5 million from Social Investment Business (SIB).

Eligible organisations can apply for loans of £100,000 to £1.5 million with a one-to-six-year term, and no early repayment penalty. BAME-led organisations and those based in Wales or Scotland will be able to apply for loans upwards of £50,000.

The new Recovery Loan Fund is the successor of the Resilience and Recovery Loan Fund and aims to help organisations that have been affected by Covid-19. It is also open to organisations looking to refinance short-term debt – all loan purposes will be considered, including refinancing.

The deadline is Sunday, 21 November 2021 and applications will be reviewed on a first-come, first-served basis.

See: Recovery Loan Fund (sibgroup.org.uk)

Help to Grow your Business

Small business leaders can now register their interest in Help to Grow Management, a 12 week-programme delivered by leading business schools across the UK. Designed to be manageable alongside full-time work, this programme will support small business leaders to develop their strategic skills with key modules covering financial management, innovation and digital adoption.

Who is it for?

UK businesses from any sector that have been operating for more than 1 year, with between 5 to 249 employees are eligible.

The participant should be a decision maker or member of the senior management team within the business e.g. Chief Executive, Finance Director etc. Charities are not eligible.

See: Help to Grow – Take your business to the next level (campaign.gov.uk)

Intellectual Property and your Work

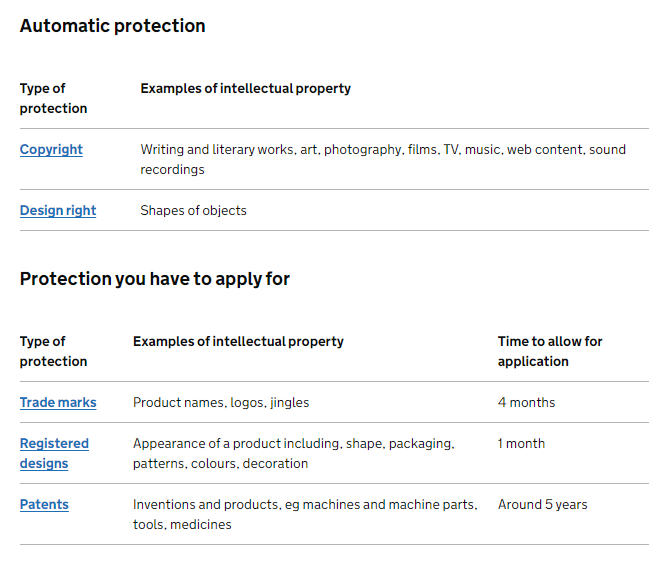

Protecting your intellectual property makes it easier to take legal action against anyone who steals or copies it. The type of protection you can get depends on what you have created. You get some types of protection automatically, others you have to apply for.

For more guidance see: Intellectual property and your work: Protect your intellectual property – GOV.UK (www.gov.uk)

Return to your Claim for the Self-Employment Income Support Scheme

A Section has been added with links to guidance for the fifth grant and previous grants. A link to guidance on how to pay back a grant has also been added.

You can use the online service to check the status of your payment, update your details, see how much you were paid or if you think the grant amount is too low.

If you have made a claim, HMRC will check your details and pay your grant into your bank account in the next 6 working days. They will send an email when your payment is on its way.

Contact HMRC if you haven’t heard from them after 10 working days since you made your claim and you’ve not received your payment in that time.

If you’ve received a letter from HMRC stating you need to pay back some or all of the grant then see a new section which been added to the guidance called ‘Check how to tell HMRC and pay money back’. You can use the service to check whether you need to tell HMRC and pay back a grant.

See: Return to your claim for the Self-Employment Income Support Scheme – GOV.UK (www.gov.uk)

Foreign Travel Insurance

The guidance has been updated on using an EHIC or GHIC to access healthcare in Switzerland.

Before travelling, government advice is you should check the travel advice for your destination. If you travel internationally during the COVID-19 pandemic, make sure you have appropriate travel insurance.

If you already have a travel insurance policy, you should check what cover it provides for coronavirus-related events, including medical cover and travel disruption. If you are choosing a new policy, make sure you check how it covers these issues.

If you do not have appropriate insurance before you travel, you could be liable for emergency costs including medical treatment. We recommend you buy your travel insurance as soon as possible after booking your trip.

See: Foreign travel insurance – GOV.UK (www.gov.uk)

Coronavirus (COVID-19): Advice for Pregnant Employees

The government advice is for you if you are pregnant and working as an employee. This includes pregnant healthcare professionals. It will help you discuss with your line manager and occupational health team how best to ensure health and safety in the workplace.

The advice has been updated to reflect changes surrounding shielding requirements and to provide more information on vaccines.

See: Coronavirus (COVID-19): advice for pregnant employees – GOV.UK (www.gov.uk)

Finding and Choosing a Private Coronavirus (COVID-19) Test Provider

The lists of and information about private test providers, to help you get the private COVID-19 tests you need,have been updated.

See: Finding and choosing a private coronavirus (COVID-19) test provider – GOV.UK (www.gov.uk)

Applying for Advance Assurance Before Raising Venture Capital

HMRC have updated their guidance to companies applying for Advance Assurance that the company seeking finance qualifies for one of the generous venture capital tax reliefs that are currently available.

Individual investors may obtain an income tax deduction of 50% if the company qualifies for Seed Enterprise Investment Scheme (SEIS) or 30% income tax relief where the company qualifies for EIS relief. In addition there is potentially a CGT exemption when the shares are sold and also deferral or relief from CGT on other disposals. Although not mandatory, Advance Assurance that the company and trade qualifies for tax relief may encourage more external investors to invest in the company.

There are numerous detailed conditions that need to be satisfied for the company to qualify and lots of details such as business plans need to be supplied to obtain Advance Assurance. HMRC will not comment on whether a particular investor would qualify for relief, however the company will normally be required to give details of potential investors for HMRC to consider the application. Note that the generous tax reliefs are not normally available to an investor who is connected to the company, typically an existing employee or someone who will own more than 30% of the company’s capital.

The HMRC guidance also covers Advance Assurance that the company qualifies under the Social Investment Tax Relief and Venture Capital Trust rules.

Applications for Advance Assurance may be emailed to: [email protected].

Or alternatively posted to the HMRC Venture Capital Reliefs Team.

For updated guidance see: Apply for advance assurance on a venture capital scheme – GOV.UK (www.gov.uk)

Innovate UK Smart Grants: Autumn 2021

Smart is Innovate UK’s ‘open grant funding’ programme. It provides an opportunity for UK registered organisations to apply for a share of up to £25 million to deliver disruptive research and development (R&D) innovations that can significantly impact the UK economy.

All proposals must be business-focused. Applications can come from any area of technology and be applied to any part of the economy, such as, but not exclusively:

- the arts, design and media

- creative industries

- science or engineering

Innovate UK welcomes projects that overlap with the Industrial Strategy grand challenge areas, but this is not a requirement.

See: Competition overview – Innovate UK Smart Grants: October 2021 – Innovation Funding Service (apply-for-innovation-funding.service.gov.uk)

Biomedical Catalyst 2021: Round 2 Competition

Innovate UK, part of UK Research and Innovation, will invest up to £12 million for businesses to develop innovative healthcare products, technologies and processes.

This competition combines two strands of the Biomedical Catalyst:

- Feasibility Award – this award is designed for projects that have developed an innovative concept or carried out experimental proof of concept but have not validated the technology.

- Primer Award – this award is for conducting a technical evaluation of an idea through to proof of concept in a model system.

Your project must focus on the development of a product or process that is an innovative solution to a health and care challenge. Your project can focus on:

- disease prevention and proactive management of health and chronic conditions

- earlier and better detection and diagnosis of disease, leading to better patient outcomes

- tailored treatments that either change the underlying disease or offer potential cures

See: Competition overview – Biomedical Catalyst 2021 Round 2: Feasibility & Primer Awards – Innovation Funding Service (apply-for-innovation-funding.service.gov.uk)

EUREKA GlobalStars Taiwan: Digital Industrial Collaborations

Innovate UK, part of UK Research and Innovation, is investing up to £865,000 to fund collaborative research and development (R&D) projects focused on industrial research.

The funding will be awarded through a EUREKA Globalstars competition to facilitate collaboration between UK and Taiwanese businesses and encourage innovation and deployment of novel digital technologies for manufacturing.

See: Competition overview – EUREKA GlobalStars Taiwan digital industrial collaborations – Innovation Funding Service (apply-for-innovation-funding.service.gov.uk)

Good Ventilation can Help Reduce the Spread of COVID-19 in the Workplace

HSE is continuing to update its ventilation guidance encouraging all workplaces to continue to work safely. As more people have returned to the workplace, using good ventilation can help to reduce how much virus is in the air. This helps reduce the risk from aerosol transmission and the spread of COVID-19 in the workplace.

See: Work equipment and ventilation during the coronavirus (COVID-19) pandemic – HSE

TORCH

TORCH is a business advisory service designed to speed up data-driven innovation and change, whilst encouraging collaborations between businesses. It enables clients who have developed a data strategy to overcome the challenges of starting new data projects.

This service allows businesses to trial and become successful with data technologies through engagement with The Data Lab experts and qualified supplier organisations.

TORCH addresses the following topics:

- understanding how your business objective could be achieved

- what efforts would be required

- choosing appropriate tools and skills

- finding suitable vendors

Every business gathers data in some form, and this can be gathered on a daily basis. A data strategy can be used to gather insights and help develop your business. Think of your data strategy as a road map, highlighting the direction you must travel to achieve your goals – whatever they may be.

See: TORCH (findbusinesssupport.gov.scot)

Scotland’s Covid Certificates Accepted by the EU

Scotland and the rest of the UK have been formally adopted into the European Union’s Digital Covid Certificate (EU DCC) scheme; the European Commission has confirmed.

All Covid status certificates were recognised across Europe on Monday November 1st as the UK joins the EU scheme which provides the means for QR codes to be scanned and verified as being officially issued.

The change opens up ease of access for travellers to more than 40 countries covered by the certification scheme. It covers travel to Europe and those countries which, like the UK, are affiliated with the EU DCC.

It will also enable better access to facilities like bars and other venues where this is required in those countries which have chosen to use the EU DCC domestically.

Users of the NHS Covid Status app will have their vaccination status automatically updated when they login. Scots travelling to the EU and countries covered by the scheme who have downloaded a PDF version with QR codes on their mobile device, or anyone who has a printed letter with their Covid status dated before October 7th will need to either download the app or request a new letter.

See: Scotland’s Covid Certificates Accepted by the EU – gov.scot (www.gov.scot)

The Future for Rural Scotland

Farmers and crofters are to be supported to play their part in Scotland becoming a global leader in sustainable and regenerative agriculture.

A National Test Programme will begin next spring, with up to £51 million of investment over the following three years.

The Programme will support and encourage farmers and crofters to learn about how their work impacts on climate and nature, including offering financial support to carry out carbon audits and nutrient management plans. This will establish a clear baseline and options for action for all who participate.

Through work with a focus group of farmers and crofters, the Programme will also help understanding of how sustainable farming can be supported and rewarded in future. This will ensure the right tools and support are in place when, from 2025, the climate and biodiversity performance of businesses will determine the level of agricultural support payments.

In addition, the Programme will put in place livestock data and performance systems for businesses in the beef sector with the aim of improving both business and emissions performance.

See: Ambitious future for rural Scotland – gov.scot (www.gov.scot)

Creative Scotland – Radical Care

Many people who wish to work or progress in the arts, screen and creative industries have experienced barriers due to their caring responsibilities. Radical Care is an action research project for organisations in these industries to help them try out new approaches to support those with caring responsibilities.

Through this fund, Creative Scotland can help offset the risk of initial investment in your project, to encourage you to test theoretical ideas and share best practice, as well as any common pitfalls, to help others avoid similar challenges in the future. The aim is to learn from the actual impacts and challenges involved in practical solutions.

See: Creative Scotland – Radical Care (findbusinesssupport.gov.scot)