A cash flow forecast is an important business planning tool to manage your business finance. Along with providing you with an estimate of the current financial status, it also lets you know the future cash flow of your business. Whether you’re a small business or an established company, a forecast of your cash flow will help you to effectively plan for the future and to deal with an emergency.

Read on to learn all about the cash flow forecast!

Understanding Cash Flow Forecast:

Before learning how to create a cash flow forecast, you should first know what is a cash flow?

Cashflow is the amount of money that your business receives and pays. The incoming cash of your business is generally the money that you receive from sales. But, it might be from other sources like from sale of assets, debt repayments, rebates, and grants. The cash that goes out of your business is due to bills, wages, payment to supplier, maintenance cost, and other expenses.

An effective cash flow can lead your business to success, but a poor cash flow can take it to doom.

To forecast the cash flow, you need a cash flow statement. This statement records the amount of money that your business receives and spends. It is an estimate that lets you know how your company generates cash to spend on operating expenses and liabilities.

Typically, most businesses create it for a year, but it can be weekly, monthly, semi-annual or quarterly.

Reach out to create a forecast for your business!

Advantages of Cash flow forecast:

This forecast plays a key role in your business success. Its worth is beyond the profit and loss statement or balance sheet. If you keep it up to date, relevant and simple, you’d reap the following benefits:

- You can predict the business shortages and excess of money

- You can compare your business income and expenses

- You can predict the effects of business changes

- It is evidence of your income for investors and financial bodies

- It helps to manage the cash needs of your business

- It helps tackle emergency

- It incorporates with your business goals

You should remember that this forecast is never perfect. However, if accurately made, you can uplift your business based on its results.

You need to be well versed in recording and analyzing the incoming and outgoings cash of your business for an accurate forecast. As it can be time-consuming and costly if done improperly. Therefore, we suggest you hire an expert for it.

For professional service, get in touch with our accountants for help!

What to Include in a Cash flow forecast?

You should have the following details to forecast the cash flow:

- Estimate of sales numbers

- Estimate of inventory costs

- Estimate of overhead cost

- Estimate of gross margins

- The average duration of your payment on sales

- The average duration of your purchases to be paid

- The expected date for the payments of tax

- The arrangements of your fundings

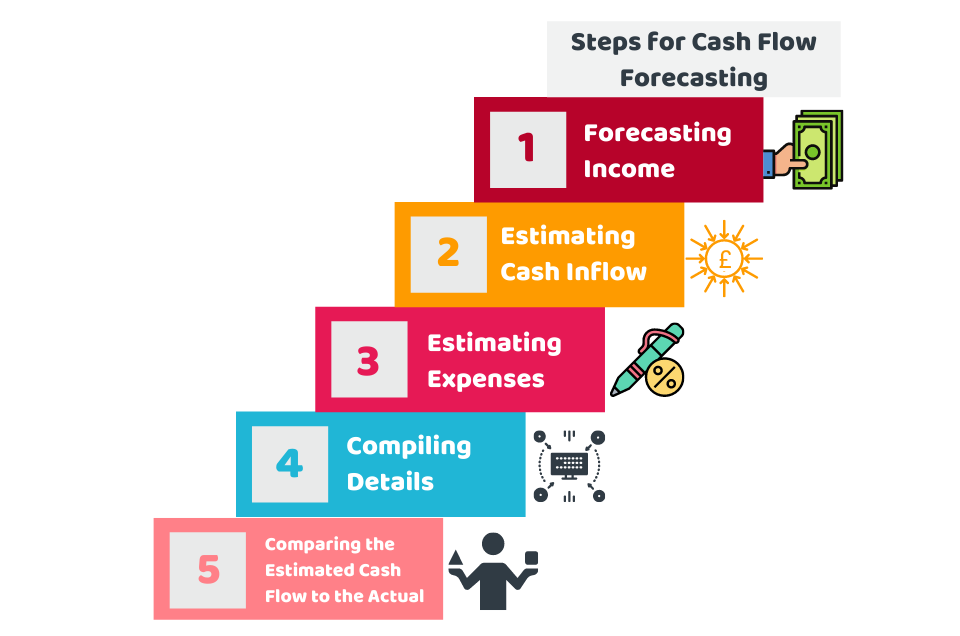

How to do Cash Flow Forecasting?

This forecast is an estimate of your future income and expenses. It provides you with information about your budget to run or expand the business. It will let you know when your business has more spendings than its income. Here are a few points to follow for forecasting the cash flow of your business:

1) Forecasting Income:

You need to forecast your income and sales through last year’s income. You can make adjustments based on whether your income has increased, decreased, or remained the same in a certain period. If you’re a startup, you can do it based on the money that goes out of your business. In this way, you can guess how much money you need to cover your expenses. These figures may change based on various factors.

2) Estimating Cash Inflow:

After forecasting your income, you need to estimate the cash inflow that is coming from various sources other than sales. It may be from sales of assets, paid back loans, refunds, rebates, royalties, grants, and through adding extra equity.

3) Estimating Expenses:

Afterward, you should estimate all the expenses and liabilities your business has to pay. It includes the purchase of new assets, loan repayments, investing in surplus funds, bills, and other expenses.

4) Compiling Details:

You can deduct the expected incoming cash from the outgoing cash for a certain period to get the forecast.

5) Comparing the Estimated Cash Flow to the Actual:

After doing the forecast, review it with the estimated cash flow for that period. It is crucial as it will let you know the difference between the estimated forecast of cash flow and the actual. If it meets the results, that’s great. If not, you can analyze the factors, that are hurdles, for not meeting your actual cash flow from the expected.

Confused! Don’t worry, contact Accotax for professional support.

Quick Wrap Up:

If you don’t have time to create a cash flow forecast, consider providing the updates to our bookkeeper. For accuracy, you need to keep track of your business transaction. If you are busy, our bookkeepers are here to record your income and expenses to maintain the financial health of your business. We’re always to discuss your needs.

Contact us today!

Disclaimer: This blog is for your general guidance on cash flow forecast.