In the business world, you might return or refund the defective products to your seller. Likewise, providing a price cut on your damaged items to your customers is a normal practice. Also, you may offer discounts on intervals for getting a larger customer base. These transactions are recorded in the accounts as contra revenue account.

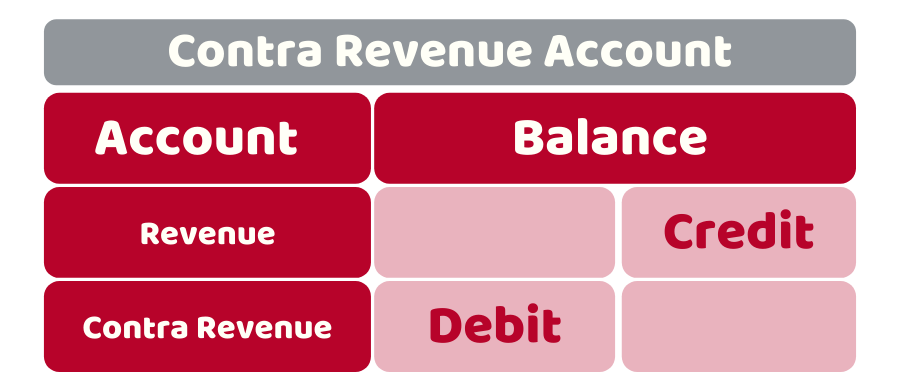

Contra is a Latin word that means against or the opposite. A Contra account is a revenue account that is offset against a normal revenue account for ascertaining the net profit. This account is used for understanding the difference between gross revenue and net revenue and to find out the reasons behind the difference. The transactions of contra revenue account are mostly recorded in one or more accounts. The balance of this account is usually debit. On contrary, the balance of a normal sales account is usually a credit.

This account prevents your business from unpredictable losses and keeps your bookkeeping records accurate. It is also important for business transparency. It also allows you to gauge the impact of your business activities on the net revenue and total profit.

Or accountants at Accotax can help you to understand how contra accounts can improve your financial accuracy and it allows you to easily generate comprehensive reports through your accounting software. Reach out to us today!

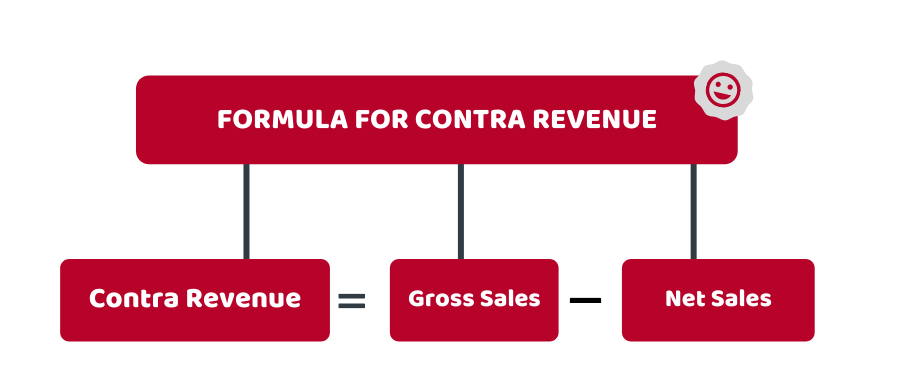

Formula:

To find contra revenue, you just need to minus your gross sales to the net sales.

Contra Revenue = Gross Sales – Net Sales

Common Types:

The three commonly used types of this account are:

- Sales allowances

- Sales return

- Sales discount

Sales Allowance:

This account is used for the defective or damaged items that are sold to the customers with a price cut. Similar to the sales return, the sales allowance contra revenue account provides information about the manufacturing, storage and packaging of the products.

Sales Return:

Sales return contra revenue account is used for showing the impact of returns and refunds on the business’s net revenue. This may occur in the retail sector, where a buyer may not like the product. Along with financial data, it also provides details of the business processes.

Sale Discount:

This account records the cash, trade, early payments or any other discounts provided to the customers that aim to sell the stock in bulk.

These three common types of contra account provide useful information to the business owner, lenders, and investors about the business objectives and its internal operations. Instead of recording the transactions on the debit balance, you record the transactions in a credit balance in this account that provides you valuable information about net revenue, sales percentage of the products and effects of discounts on the total sales.

For recording and maintaining your business transactions, you need a bookkeeper. Contact us for affordable bookkeeping service!

These were the common types of contra accounts. However, your business can also have other forms of this account which include:

- Contra asset account

- Contra liability account

- Contra expense account

- Contra equity account

Is the expected/unearned revenue a Contra Account?

The revenue that your business is expecting and is not earned would not be considered a contra account. For instance, if your business has taken an annual membership fee in advance from its customers for the first month but the remaining revenue of the eleven months is not earned. This type of revenue would be classified as a current liability and need to be recorded on the credit side of the balance sheet.

Quick Sum Up:

So you have got the idea of contra revenue accounts and their utility. But as a business owner, you might be unable to provide enough time to the financial matters of your business as it would be a daunting task. We recommended you to use automated accounting software if you’re currently relying on the manual bookkeeping system.

Save your money, time, and energy with our professional accountants and bookkeepers at Accotax!

Make a custom offer and get an instant quote right away!

Disclaimer: This blog contains general information about contra accounts.