When it comes to inheritance, succession, and wealth planning, people naturally choose trusts. Trusts might be a useful estate planning tool for many. However, the complex tax laws and reporting requirements make them a less efficient way of transferring wealth while maintaining control of assets. As a better alternative to trusts, Family Investment Company (FIC) is a great way to retain control of wealth and its management for the future generation.

We deal in Accounting and Taxation Services to maintain your wealth for your next generation, contact us for swift guidance!

What is a Family Investment Company (FIC)?

FIC is a private limited company. Typically, directors control and operate it, with family members owning the shares. Here, directors refer to the parents or guardians, whilst family members refer to the children.

The directors are responsible for regular control and investment decisions. In this way, the individuals use FIC to transfer assets/estate to family members but hold some control over the wealth gifted or transferred.

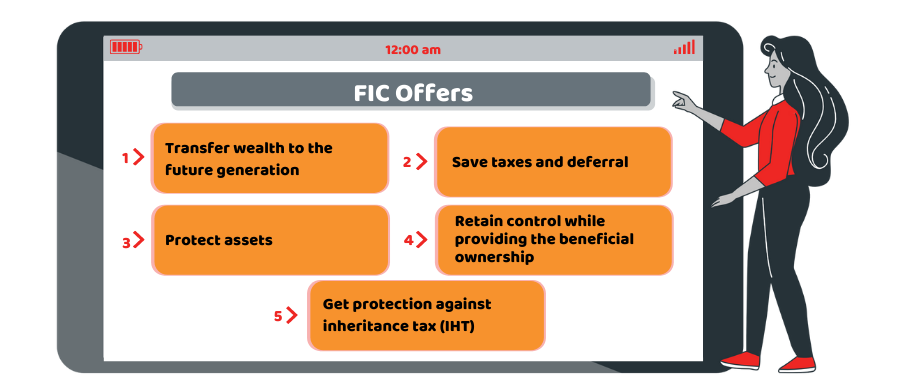

Briefly, the FIC offers:

- Transfer wealth to the future generation

- Save taxes and deferral

- Protect assets

- Retain control while providing the beneficial ownership

- Get protection against inheritance tax (IHT)

How Does FIC Work?

Evident by its name, a family investment company focuses on investing rather than trading. Typically, these investments are equity portfolios or properties.

It is a way to transfer assets and cash, usually by the way of a loan. The profit earned from these investments is taxed at the corporation tax rates rather than capital gains or income. As a result, it can save your taxes up to 25% if you’re an additional rate taxpayer.

According to the governing articles and provisions, FIC works on the bespoke needs of individuals covering aspects like:

- Profit distribution

- Capital return (ROC)

- Directors’ appointment

- Transfer of shares

Most often, parents form and control FIC by subscribing for shares with voting rights. They own a single ‘A’ share each. And each ‘A’ shareholders have the authority to select one director and have the voting power at general meetings. However, they are not entitled to dividends or any return on capital.

The children contain a ‘B’ share each. They do not have voting or the right to control but they are entitled to return on capital and dividends (but it must be approved by the parents).

Under the parents’ control, the company obtains assets like property, vehicles, trading companies, art etc, that generate a return. The income earned is reinvested within the company or is used to pay back the parent’s loan. If capital value increases, it goes to the children’s share.

Find the professional guide on Family investment companies contact our Accountants at Accotax, get in touch now!

Advantages of Family Investment Companies

Here are some of the major advantages of family investment companies:

- Low levels of tax.

- FIC is simpler and straightforward than a trust structure.

- Provides an environment for the children for investment planning and decision-making.

- Family and marital asset protection.

- Dividends can be given up to £14,500 to any family member, aged above 18 tax-free (subject to their wider tax profiles).

- Mitigates your taxable estate for inheritance tax, whilst holding control over the funds.

Disadvantages of Family Investment Companies

These are some of the downsides of FIC that you need to consider beforehand:

- Tax may be inefficient if the family receives all income/gains from the Company, as there would potentially be a double layer of tax.

- The tax efficiencies are based on current laws that may create inefficiencies in the future.

- An extra cost might arise while setting up and ongoing corporate compliance requirements (Companies House and HMRC).

FICs can prove to be efficient if you retain the profit for reinvestment purposes. You need to remember that you will pay an additional tax if you extract the profit from the company.

Quick Sum Up

In the rapidly changing landscape of personal taxation and compliance and every family with unique estate planning needs and objectives, there are many tools available to meet those needs. Though trust can be a useful tool for family wealth governance, however, other means like a Family Investment Company can be a better way to do it. Therefore, you need to carefully consider the best structure for estate planning before making the final decision. In this regard, getting professional advice is worthwhile.

Accotax has the solution for you! We have a number of professionals all ready to handle your accounting and tax concerns. Whether you are an individual or a limited company, be sure to get in touch with us today for a quote!

Disclaimer: This blog is intended to provide general information on FIC.