In this guide, we will outline the steps to authorise an accountant to access your HMRC account. Authorising an accountant or tax advisor enables them to communicate with HMRC on your behalf, streamlining discussions about your tax affairs. With a dedicated agent line to HMRC, accountants usually connect more quickly than calling HMRC directly.

Information Required:

- Your Login Details.

- Accountant’s Government Gateway Identifier: You’ll have to get this from your accountant.

Follow these steps to add or authorize an accountant:

1- Log in to Your HMRC Personal Account: Use your username and password to log in.

2- Navigate to Account Management:

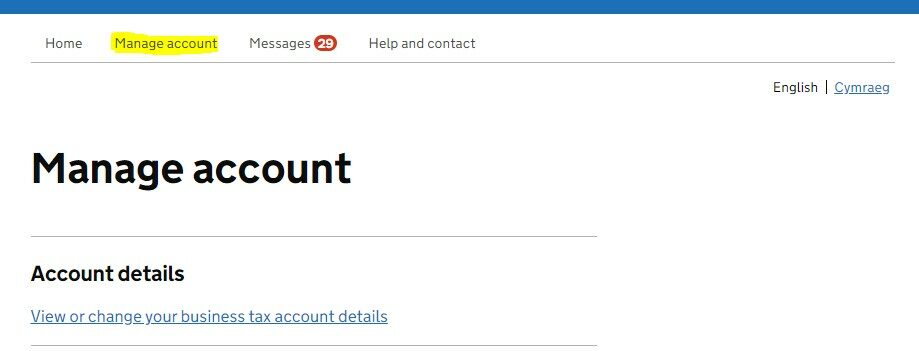

- Go to the “Manage Account” section.

- Scroll down to “Accountants & Tax Agent Access.”

- Click on “Add, View or Change Tax Agents.”

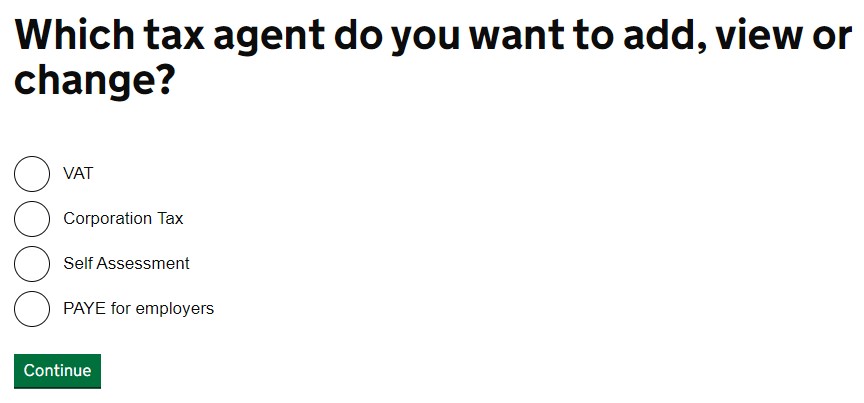

3- Add or Change Tax Agents:

- Click on “Add, View or Change Tax Agents.”

- Select the services you want to grant access to.

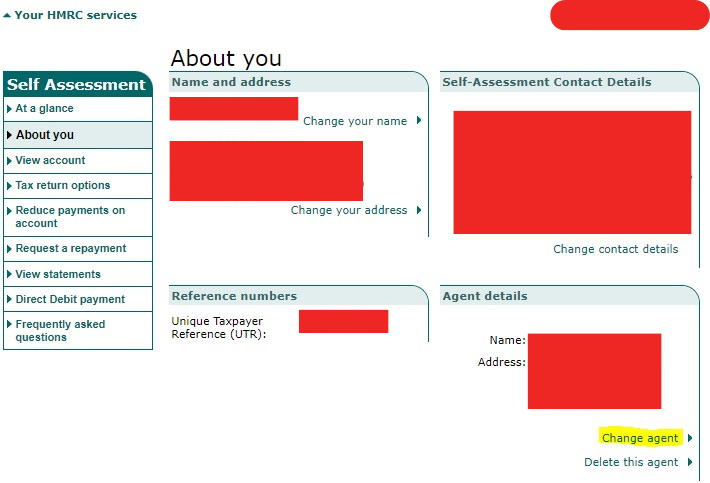

- Choose to “Change or Add An Agent.”

Change or Add An Agent.

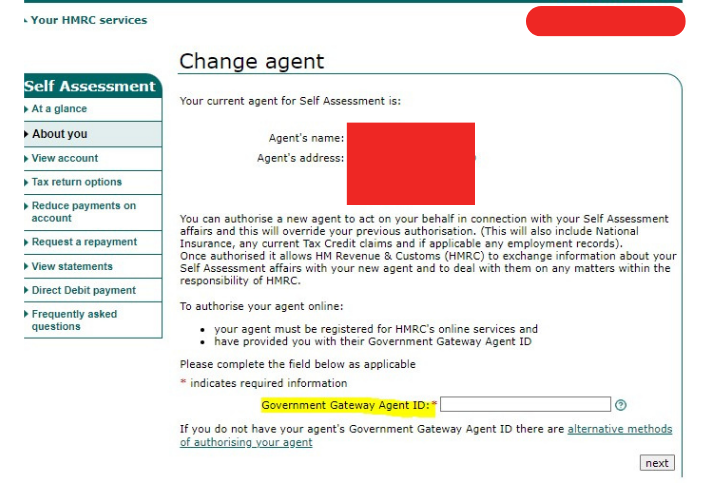

4- Enter the Gateway Agent ID:

Provide the required agent ID in the designated field, You should get this from your accountant.

Enter the Gateway Agent ID:

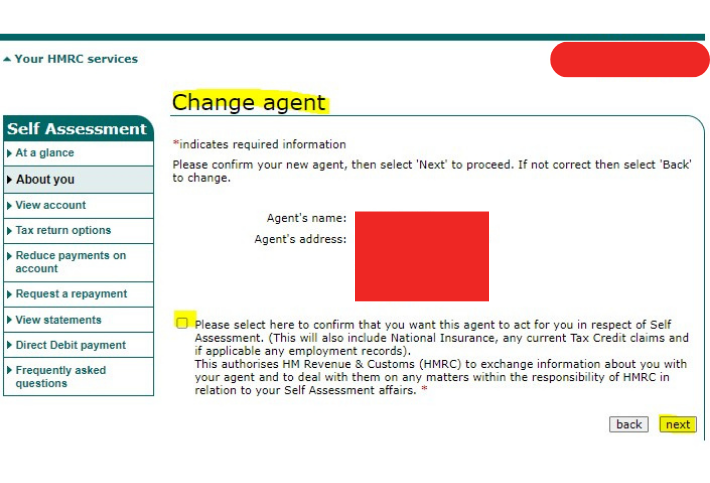

5- Send Confirmation to Accountant:

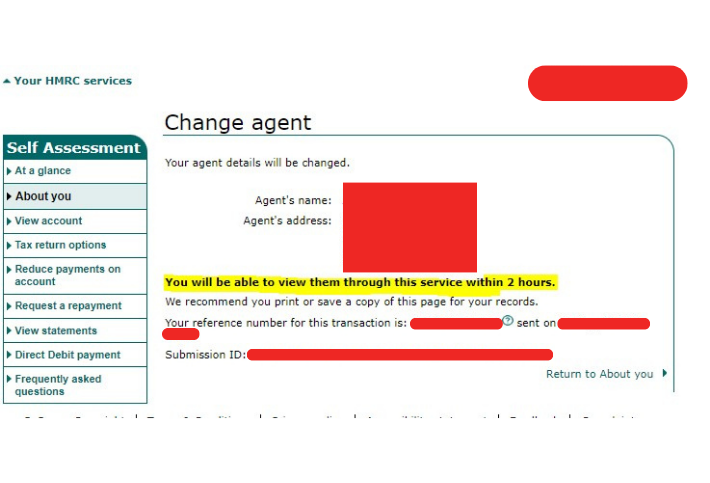

Once all details are entered, send a confirmation to the accountant, completing the authorisation process.

By following these steps, your accountant will be authorized to speak to HMRC on your behalf, potentially saving you time and effort in managing your tax affairs.