Do you know how to work out gross profit? This article will assist you with seeing how you can deal with your net revenues and more successfully develop your business.

On the off chance that you own a business, checking your overall revenues consistently will give you the important information you need to distinguish the most worthwhile spaces of your business and scale them.

Here’s a look at how to know how to work out a gross profit.

Instructions Of How To Work Out Gross Profit:

The gross overall revenue computation estimates the cash left from the offer of your products or administrations, when the working costs used to create them are deducted. The net benefit is determined by deducting the expense of products sold from the all-out incomes. We should take a gander at every one of these in more detail.

To become familiar with net benefit and how to oversee it deliberately for business development, talk to one of our experts. Learn all You Require to Know.

Cost of Goods Sold (COGS):

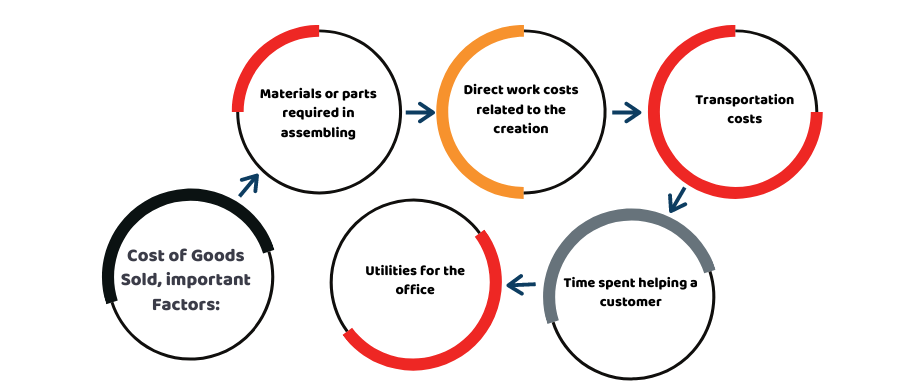

The expense of products offered alludes to every one of the immediate expenses and costs engaged with creating or conveying your labor and products. It does exclude circuitous expenses, for example, staff pay rates or deals and showcasing. The following are a few instances of COGS:

- Crude materials or parts required in assembling

- Direct work costs related to the creation

- Transportation costs

- Time spent helping a customer

- Utilities for the office

Revenue:

It is the aggregate sum of pay your organization creates from the offer of your items or administrations. It shows you unmistakably how much cash you’re getting from your all-out deals. It does exclude the expenses of maintaining your business, for example, charges, interest, and deterioration.

What is the Gross Profit Equation?

The gross benefit equation is:

Gross Profit = Revenue – Cost of Goods Sold.

What is the Gross Profit Margin – Formula?

The gross overall revenue equation, Gross Profit Margin = (Revenue – Cost of Goods Sold)/Revenue x 100, shows the rate proportion of income you save for every deal after all expenses are deducted. It is utilized to show how effective an organization is in creating income while keeping the costs low.

Gross Profit Formula And Example:

To act as an illustration of gross edge, a shoe-producer may sell a couple of shoes for £50. They cost £15 to make, returning the retailer a gross benefit of £35. This likens to an edge of 70%.

- Complete item income: £50

- Complete creation costs: £15

- Gross profit: 50-15 = £35

- Gross Profit Margin: 35/50 x 100 = 70%

Example: We should take an assistance-based business. Envision the organization is a bookkeeping firm that reviews different organizations. A solitary review sells for £500 and costs £100 to create, returning a gross benefit of £400. This is an edge of 80%.

- Total income: £500

- Total costs: £100

- Gross Profit: 500-100 = £400

- Gross Profit Margin: 400/500 x 100 = 80%

Why Calculating Gross Profit is Significant?:

To know how to work out gross profit is important because gross overall revenue fluctuates across items and areas and is regularly used to gauge the benefit of a solitary item. It shows how proficiently you are utilizing your assets to create your merchandise or convey your administrations.

A solid comprehension of your edges in business permits you to settle on fast choices to help the development and versatility of your organization. For instance, a spike may demonstrate a recent fad that warrants extra speculation, while a decrease may feature increasing costs, provoking you to examine your income and make cuts where essential.

“We see net revenues and explicit key execution markers continuously day by day and audit in more detail consistently,” says Compton. “This consistency permits the business to brave changing tides and disconnect any issues before they become a drawn-out issue.”

For instance, by examining your edges, a business will actually want to nail down related cost increments because of surprising financial interruptions.

Reach out to our Chartered Accountants to get the finest error-free calculations done today.

Showcasing Costs and the Gross Profit Formula:

The gross overall revenue equation just incorporates the variable expenses straightforwardly attached to the creation of your merchandise or administrations. More extensive organization costs, for example, paying for the corporate office, are excluded from the last measurement.

All things being equal, these costs at times show on a pay explanation as ‘Selling, General and Administrative costs. These can incorporate the wages of workers like bookkeeping, IT, and showcasing just as publicizing and special materials. It additionally incorporates any lease, utilities, or office supplies that are not straightforwardly used to make a particular item.

This implies showcasing costs are for the most part excluded from the gross profit equation.

A Good Gross Profit Margin:

An investigation of more than 13,000 retailers tracked down a normal gross net revenue in the retail of about 53%. However, this shifted broadly by item type. For auto and truck producers, the normal gross net revenue for the last quarter of 2020 was about 14%. For counseling administrations, it was a normal of 96% for a similar period.

A high gross overall revenue for the most part shows you’re bringing in cash on an item, though a low edge implies your deal cost isn’t a lot higher than the expense. In any case, recall that while these figures are a valuable reference, edges fluctuate broadly by industry and friend’s size.

Conclusion:

Realizing how to work out gross profit assists you with bettering deal with your income, guaranteeing there’s in every case sufficient cash to pay your providers and costs on schedule. We hope this article helped to develop a better understanding of gross profit and related components.

Enjoy Accotax‘s professional advice of giving you more power over your income and when to make your payments.