Whether you’re putting aside your money for a financial emergency, retirement, or to make a large purchase, saving is essential to reduce your stress and to get financial freedom. If you’re worried about the possible tax implications on your savings income, don’t be, as there are many tax benefits and allowances available to cut down your taxes. Read on to find out what is saving income and how it is taxed?

Let’s kick off with the basics?

What is Savings Income?

The income you earn from savings – like interest – is known as the saving income. This income is treated the same as ordinary income and is taxable. But there are some benefits and allowances that you can use to mitigate taxes on your savings income.

So, you have got a fair idea of what is savings income. Let’s see how it is taxed!

How your Savings Income is Taxed?

A large number of people earn interest on their savings without paying any tax. In fact, you can get a tax benefit or exemption based on your personal allowance, the starting rate for savings and personal savings allowance. In addition, you need to know that these allowances are for a single tax year that starts from 6 April to 5 April of the next year.

Personal Allowance

If you haven’t used your personal allowance for wages, pension, or other income, you can use this allowance to get tax exemption on savings interest. Currently, the personal allowance threshold is £12,570. It is the amount on which you don’t need to pay tax. Here are the income tax rates as per HMRC.

| Band | Taxable income | Tax rate |

|---|---|---|

| Personal Allowance | £1 to £12,570 | 0% |

| Basic rate | £12,571 to £50,270 | 20% |

| Higher rate | £50,271 to £150,000 | 40% |

| Additional rate | over £150,000 | 45% |

Worried about tax implications on savings income/interest? Just let us know to handle everything for you!

Starting Rate for Savings

If you are earning a low income, you can benefit from starting rate for savings. In fact, you can get up to £5,000 tax-free interest in 2021/22. It means that you can get a tax exemption of £5,000 from your savings income. Remember that the more you earn from other sources, the less your starting rate will be.

You can not qualify for starting rate for savings if your other income is £17,570 or more. Conversely, if it’s less, your starting rate for savings will be up to £5,000. Remember that every £1 of other income above the Personal Allowance’s threshold brings down your starting rate for savings by £1.

Let’s take an example:

If you are earning £16,000 of wages and get £200 interest on your savings. Your personal allowance of £12,570 will be used up from your wages. And, the remaining amount will reduce your starting rate by £3,430. In this way, your remaining starting rate for saving will be £1,570 (After deducting it with £5,000). So, it means that you’re not going to pay tax on your £200 savings interest.

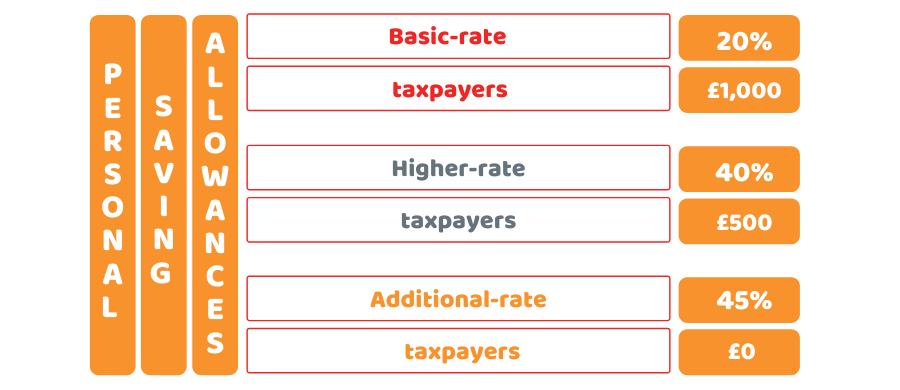

Personal Saving Allowance (PSA)

It is a tax cover that shields interest on savings. Around 95% of the people in the UK don’t pay tax on their savings interest by using their personal savings allowance, which is a tax-free allowance that allows you to earn tax-free interest up to £1,000. This allowance depends on your income tax band, as follow:

- Basic-rate (20%) taxpayers receive £1,000 in savings interest

- Higher-rate (40%) taxpayers receive £500 in savings interest

- Additional-rate (45%) taxpayers £0 – no allowance is granted to them

This allowance covers interest earned from savings accounts, banks, building societies, credit union accounts, open-ended investment companies (OEICs), corporate bonds, government bonds and gilts. Besides, it also covers interest earned from other currencies like euros, US dollar in the UK-based savings account.

In addition, if you have earned a peer-to-peer lending interest, this allowance will cover it up. However, dividend income earned from shares is not covered by this allowance.

No time to pay heed to these details? Our Accountants will manage it like no one else. Get Instant Help!

Tax on Stocks and Shares ISAs

You don’t need to pay income tax and capital gains tax (CGT) on the interest earned from stock and shares ISA. The ISA allowance for 2021/22 is £20,000.

Moreover, the dividend received from this income(stock and shares ISA) is totally tax-free. On the other hand, if you invest in shares or equity funds outside ISA, you can earn up to £2,000 (tax-free Dividend Allowance) income without paying any tax. If a dividend is above this amount, it’ll be taxed at 7.5% (basic rate taxpayers), 32.5% (higher rate taxpayers) or 38.1% (additional rate taxpayers).

Tax-efficient Investments

We can call stocks and shares ISAs tax-free investments because all interest, capital gains and dividend income is totally tax-free. However, like other investments, you have to pay investment charges on stocks and shares ISAs. Saving your money into a pension can also prove to be tax-efficient.

Quick Sum Up

To sum up, we hope you have got enough information on what is savings income and how it is taxed. In addition, you have also got a fair idea of the effect of the personal allowance, starting rate of savings and personal saving allowance on your savings interest. Also, there are multiple investment options whereby you can save a considerable amount of tax.

If you’re looking for cost-efficient, time-saving and responsive tax services to save your hard-earned money, contact our certified chartered accountants in London.

Have a query? Feel free to contact us anytime, we’d get back to you in the fastest possible time!

Disclaimer: This blog is intended for general information on the above topic.