With the whopping rise in the prices of the houses during Covid, lenders are now offering mortgages to the borrowers allowing them a 5% deposit under the new 95% mortgage scheme, a guarantee scheme by the UK government.

This scheme has recently launched on 19 April 2021, providing you the opportunity to buy a property with a small deposit. It was announced in the recent budget of 2021. This scheme was aimed at restarting the mortgage market and the overall economy, which had fallen due to the coronavirus pandemic.

In this short blog, we’ll discuss:

- What is the new 95% mortgage scheme?

- How does it work?

- Who’s eligible?

- Lenders that are offering this scheme.

- What are the pros and cons of this scheme?

If you are searching for the best investment options as per your needs, feel free to contact us.

What is a 95% Mortgage Scheme?

Under this scheme, the government is providing you a mortgage guarantee of 15% to compensate lenders if borrowers default on payment. This scheme helps first-time buyers and existing homeowners to buy a home costing up to £600,000 unless they are buy-to-let or second homes.

How Does it Work?

It works, similarly, like a traditional mortgage where you have to go straight to the lender (bank) or a mortgage broker to help you find the best deal. The borrower is not directly involved in this scheme, as this scheme works between the bank and the government. The guarantee provided in this scheme is not actually for the borrower or the person who’s buying a home, rather it is for the lender.

It is actually the security for the mortgage company if the borrower or the home buyer default the payment. In this scheme, the government will cover some of the losses that the lender incurred. This scheme provides confidence to the lenders for providing high land value mortgages.

Manage your finances with Accotax.

The Deadline of This Scheme:

This scheme is available from April 2021 to December 2022. This time period might be changed by the government.

Lenders Who are Offering this Scheme:

Most of the renowned banks are offering this scheme. Banks including Lloyds, Santander, Barclays, HSBC and NatWest have started offering this scheme. However, few lenders have said that this scheme is not for some new-build properties.

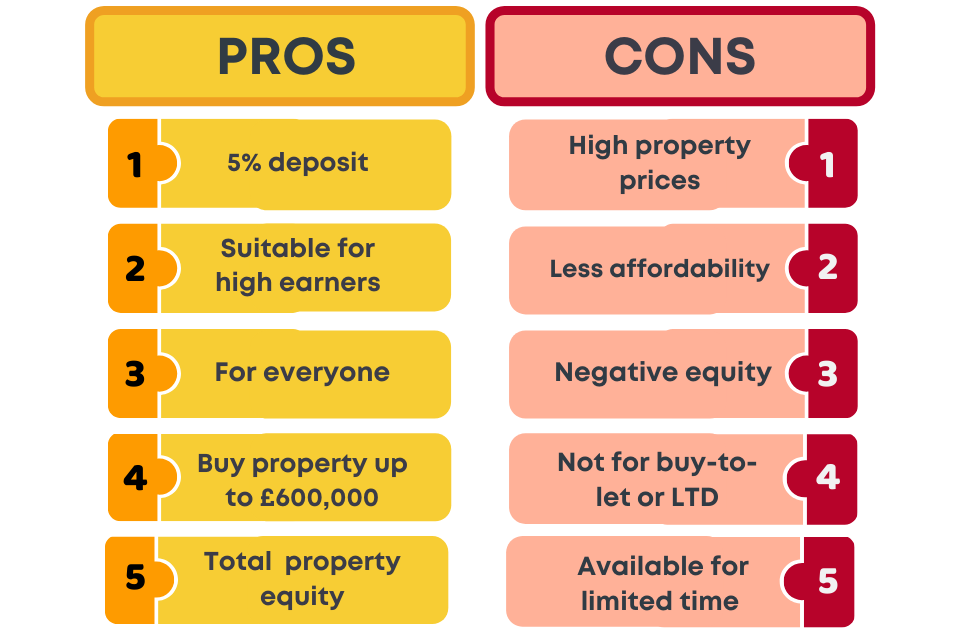

Pros:

Some of the benefits of this scheme are as under:

- This scheme allows you to put a smaller deposit of 5%

- It is suitable for those getting a high salary to meet affordability criteria

- It is available for everyone

- This scheme is not limited to some new build properties

- You can buy a property worth up to £600,000

- Helps to own whole property equity

Cons:

Here are some of the cons of this scheme:

- It raises the prices of the property due to the high demand

- It doesn’t improve your affordability for the mortgage

- There are chances for negative equity

- This scheme does not cover buy-to-let or second homes or buying property as LTD

- This scheme is available for a certain period

Quick Sum Up:

So you’ve got all the information on the new 95% mortgage scheme. The government may extend the date of this scheme based on its benefits for the new prospective homeowners after the review.

You should go for this scheme after considering all the factors mentioned above. If you’re financially well-off, this scheme will help you to buy your new home.

Still confused and need more guidance, reach out to our consultants for advice.

Disclaimer: This blog is for your basic information on the 95% mortgage scheme.