In the event that you have arrived at the phase of expecting to arrange a payroll site and running PAYE fills you with fear. Then again in case you are concerned that you simply don’t realize enough to get things right. A basic check rundown will assist you with understanding it’s not as overwhelming as you might suspect.

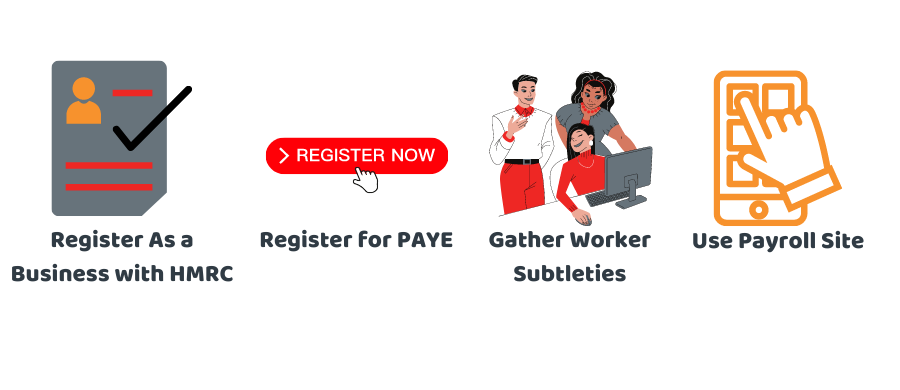

This article is based on the basic steps to get the payroll site done successfully. This includes the following:

- Register As a Business with HMRC

- Register for PAYE

- Gather Worker Subtleties

- Use Payroll Site

1. Register As a Business with HMRC:

In the first place, affirm whether you need to enroll as a business. Normally you should do as such in case you are going to recruit your first worker or use subcontractors for development work. You will likewise have to enroll as a business in the event that you’ve set up a restricted organization and plan to pay yourself compensation as a director.

At the point when you become a business interestingly, you will likewise have to get what your lawful commitments are to your workers. As a business, the assessment and work liabilities you have for your staff will rely upon the kind of agreement you give them and their work status.

HMRC has created an agenda for first-time managers which we enthusiastically suggest that you read. It incorporates things like buying bosses’ risk protection and checking whether you need to naturally enlist your staff into a work environment benefits plot.

On the off chance that you need assistance with business contracts, completing lawful right to work checks, or understanding your obligations as a business, then, at that point, our agreeable experts’ group is close by to help. Get in touch with us now!

2. Register for PAYE:

Whenever you have enrolled with HMRC as a business and you have accepted your letter from HMRC affirming your enlistment, you’ll need to enlist online to cover expenses and public protection. This is called PAYE or Pay As You Earn.

Now you can likewise decide to get cautions from HMRC – this is a truly convenient instrument and we enthusiastically suggest it! The alarms will reveal to you when cutoff times are coming up, remind you when to send installments and reports, and give you notice of new duty codes for your workers.

3. Gather Worker Subtleties:

Set aside an effort to guarantee you get every one of the right subtleties from your new worker. You will require: start date, complete name, public protection number, date of birth, personal residence, and affirmation of whether they have different positions or an understudy loan.

HMRC has made gathering this data truly simple as you can simply request that your new representative fills in the online HMRC new starter structure. The representative finishes it on the web, prints it out, and afterward signs it prior to offering it to you with all the data you need.

You ought to likewise know about your legitimate commitments when gathering and preparing individual information. Under the Data Protection Act (DPA) people and associations that cycle individual data need to enlist with the Information Commissioner’s Office (ICO), except if they are excluded. To see if you need to enroll you can finish the ICO’s enlistment self-evaluation.

To discover more about the DPA, talk to our professionals and get what you need to know.

Whenever you have gathered the necessary data, you then, at that point need to keep and keep up with precise records of what you pay your representatives (counting pay, rewards, costs, allowances, and so forth) The HMRC site subtleties what records you need to keep and for how long (a long time from the finish of the duty year to which they relate).

4. Use Payroll Site:

A cloud-based payroll site will mechanize the entire interaction for you, saving you significant time and forestalling stress by dealing with things like NI and expense estimations. Your business stipend (in case you are qualified for one), naturally making month-to-month RTI (Real Time Information) reports submitting to HMRC, creating payslips for workers, staying aware of enactment, and giving data to end of year assessment forms.

MTD is the public authority’s vision for making all expenses answering to HMRC computerised and more incessant (counting VAT and Corporation Tax returns). Sage, QuickBooks, and Xero are now arranging and fostering their frameworks to guarantee their clients’ progress to the new advanced expense framework is a smooth one.

Conclusion:

Sage, QuickBooks, and Xero all offer cloud-based bookkeeping programming bundles that incorporate coordinated payroll sites with help. In the event that you utilize one of these frameworks, it will make it simpler for you when Making Tax Digital becomes effective.

In case that, having perused the above-mentioned, handling everything without help from anyone else is still excessively overwhelming – don’t be put off. Here at Accotax, our payroll service removes the cerebral pain from being a business owner.