Mistakes are a part of life. But sometimes a tiny mistake in the professional world can cost you a hefty sum. And to be protected, you need professional indemnity insurance.

Read on to find out:

- What is professional indemnity insurance?

- Who needs it and Why?

- What to look for while choosing a PI insurance provider?

What is Professional Indemnity Insurance?

It is one of the important types of business insurance, especially for service-based businesses that provide advice and consultation. Business owners, freelancers or self-employed who provide services to customers should have this insurance to be protected against claims of negligence, mistake or breach of duty by a client. This insurance covers the amount of legal and other expenses and compensation to rectify your mistake.

Managing the finances of your business can be a daunting task, allow us to handle it for you. Contact now!

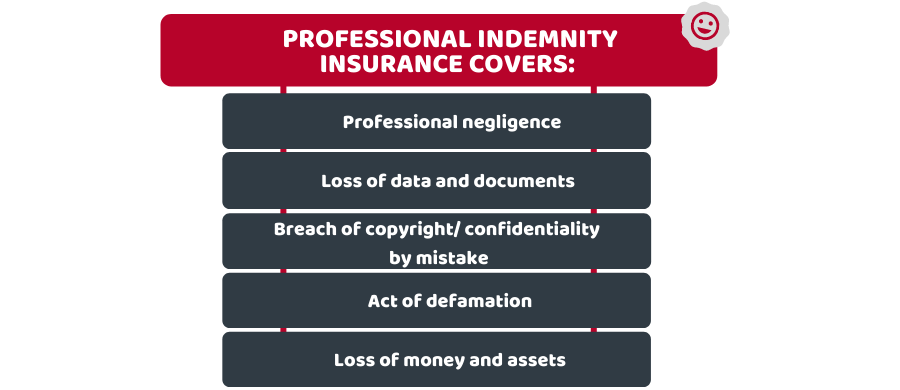

This insurance is also known as professional liability insurance. It provides indemnity on:

- Professional negligence

- Loss of data and documents

- Breach of copyright/confidentiality by mistake

- Unintentional act of defamation

- Loss of money and assets

Who Needs this Insurance and Why?

If you provide advice and other services, you should consider having professional indemnity insurance. Though you might have good relations with your client, but a mistake in a project can ruin your long-term relationship. And if your client faces a large amount of financial loss by negligence from your side, he/she may sue you for the recovery. Hence, this insurance is a viable source to provide you and your customer peace of mind against any financial loss.

The professionals that typically need this insurance include:

- Advisors and consultants

- Accountants

- Private Tutors

- IT professionals

- Architects

- Doctors/ Medical Practitioners

- Designers

- Consultants (e.g. financial consultants and accountants)

- HR professionals

Looking for affordable accounting and bookkeeping services. Reach out to us!

What to look for while choosing PI insurance provider?

Market is filled with dozens of PI insurance provider but you must choose the one that is suitable for your profession, business size, etc. Here are some important points to remember before choosing a PI insurance provider:

- Does the insurance policy suit your business needs?

- Does the PI insurance provider know your business?

- Is there any option to pay in monthly instalments?

- Are you choosing a reputable insurance provider?

Usually, this policy is claim-based means your insurer will only cover you for the claim if the policy is active and continuous. You need to maintain cover as a claim can occur many years after the completion of the task. Therefore, it is advisable to keep track of insurance renewal dates and be up to date with the terms of the policy to be protected against liability claims.

Quick Wrap Up

You might wonder what is the cost of professional indemnity insurance. There is no standard cost for it as it depends on your insurance type and the level of cover you need. Besides, the cost of your PI insurance also depends on the nature of your business, its turnover, size, and the sector it deals with.

It’s always better to get the help of a financial professional for tailored financial services. Accotax provides inclusive accounting and tax services for sole traders, freelancers, and self-employed at reasonable rates.

Get an instant quote for a customized package!

Disclaimer: This blog aims at providing general information on the topic.