What are the Pros and Cons of Being a Sole Trader

Sole Proprietorship is the simplest and most popular business structure. According to research in 2019, there were almost 3.5 million sole traders in the UK. The ease of setting up and multiple advantages are the intriguing points to make Sole trading popular in the UK. Freelancers mostly opt for this kind of business structure. If you are seeking a guide to setting up a business plan, sole trader pros and cons could be an important read and help to build a success story for you. However, this important read about the sole trader advantages and disadvantages will help to decide the best structure for you.

Features of Sole Proprietorship:

Being the natural person, but not the legal entity, a sole proprietorship is called to be a one-man business organization. The features belonging to sole traders include the following:

- The oldest and most commonly used form of business structure is a sole trader.

- It has no different existence other than the owner.

- It is known to be the oldest yet the simplest form of the structure under which one can operate a business.

- Income and losses are directly related to the owner’s personal income.

Basic Guide and Needs to Start Sole Proprietorship:

- Choose a business name if you don’t intend to choose your own name.

- Market yourself on social media and have a happening website, portfolio, and business page.

- Have your detailed search based on sole trader pros and cons and get yourself assured of your decision.

- Saving account and business checking.

- Attract customers.

- Obtain the right license and register the business.

Contact Us to register as a Sole Trader

Sole Trader Pros and Cons:

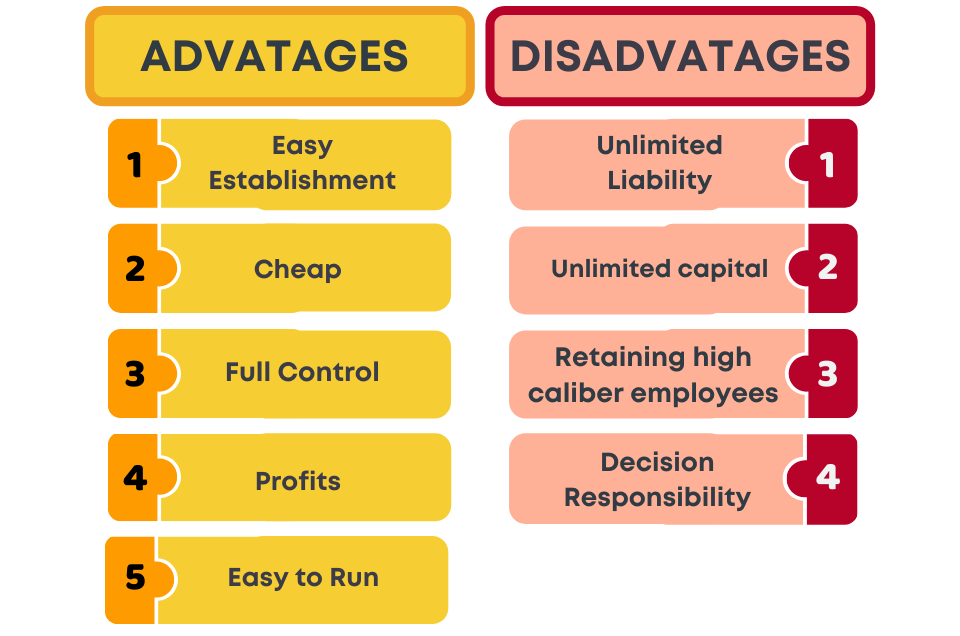

Information gathered here on sole trader pros and cons will be helpful in making the right decision with vivid understanding. Here is a list of basic advantages and disadvantages.

Advantages of Being a Sole Trader:

With the simplest structure, there are some amusing advantages which include:

Easy to Establish:

To operate and set up as a sole trader is easier and simpler than setting up a limited company. The owner can set up immediately and there are only a few forms to fill in for the process.

Low Cost:

Unlike limited company setups that require a lot to invest and pay for companies’ houses, Sole Trader registration with HMRC is free. So, if you opt for a sole trader, your startup will be cheap comparatively, depending on the type of business you set up.

Full Control and Ownership:

The most prominent feature is that no one is there to dictate the direction of the business. You may have workers and helpers like a news agency is a very practical example of it. This gives you freedom of decision making which most likely is the reason why people leave jobs and get inclined towards setting up their own small business.

Profits:

The main attraction to incline towards setting up sole trading is that there are no partners, shareholders, or investors that are there to share the profits like limited companies.

Easy to Run:

The flexibility factor of structure where you may start from a small plan and later intend to expand, you are free to make decisions of your choice which makes it easy to run in terms of decision-making and flexibility.

Disadvantages of setting up the business as a Sole Trader:

Of course with advantages, there are some major sole trader disadvantages as well. Let’s have a look at the disadvantages of being a sole which includes the following.

Unlimited Liability:

Since there is no legal difference between private and business assets, you have unlimited liability for debts which increases the risk and chances of trouble in case the business faces the loss.

Limited Capital:

Another main feature that makes sole trading less popular is that being the only owner means the capital to invest becomes limited. On one side of the picture, you enjoy the profits and freedom fully, the other way of investing capital on your own gives limited opportunities to grow.

Retaining High Caliber Employees:

It becomes very difficult and challenging for a developing business name to retain and maintain attractive offers for high-calibre employees due to limited amounts of capital. This results in high rates of employee turnover which is hard to deal with.

Solo Power to Decision Making:

Although you can hire workers to maintain day-to-day records and divide duties, still there are limited chances for the business life to grow as much as they are in a limited company. The total responsibility of decision-making is yours being the only owner.

Wrapping it Up!

To Conclude, we may say sole trader pros and cons come with the fun factors of being the boss and enjoying your own way of decision-making with no one around to share your profits. However, the facts based on the famous saying “Two heads are better than one” cannot be denied because they are unlikely to go wrong in the same direction.

If you are new to Sole Proprietorship and seeking answers to your questions, learn more here.