To monitor and maintain the financial health of your business, accurate reporting of financial statements regularly is crucial. Though income and cash flow statements play a vital role, yet you can’t overlook others. Equity (found in the balance sheet) is one of the common pieces of data to analyse the financial status of the company. For this reason, the statement of changes in equity is also essential but often ignored by many businesses. It can be a significant tool for shareholders to measure and realise the equity movement within your business. This helps them to make smart and better decisions for investments.

Before we delve deep into the details, let’s kick off with what is equity?

What is Equity?

Equity shows the owners’ interest in a business and how much a business is worth. In simple words, it represents what is remaining in the business when it stops trading (after selling all the assets and paying off all its liabilities). Equity is distributed or returned to ordinary shareholders (equity holders).

Learn more: What Is Equity? Definition, Types

Find out: What is Private Equity and how does it work?

You might be interested in: What is Negative Equity?

What is the Statement of Changes in Equity?

The Statement of Changes in Equity (SOCE) is one of the primary financial statements that show how equity moves or changes in a reporting period (one year) of a business. These changes in equity arise due to the fluctuations in dividends, profit or loss, rectifying errors or alteration in accounting policies.

The statement starts with the opening equity balance. Then, it further adds and deducts things over time, like profits and dividend payments, to reach the end balance. You can add it with other types of financial statements and it can be used on its own. It assists shareholders in making informed decisions for their investment strategy. Additionally, with it you can:

- Work out the par value of common or treasury stocks

- Boost the trust of investors in your company

- Clarify retained earning

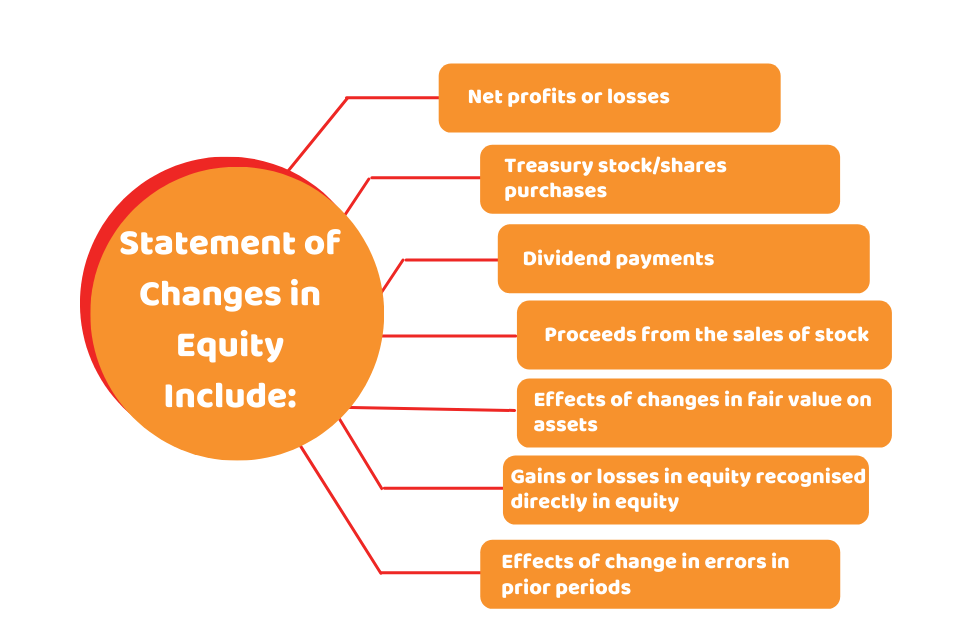

The dealings that typically appear on SOCE are:

- Net profits or losses

- Treasury stock/shares purchases

- Dividend payments

- Proceeds from the sales of stock

- Gains or losses in equity recognised directly in equity

- Effects of change in errors in prior periods

-

Effects of changes in fair value for certain assets

Need someone to assist you with SOCE? Contact our qualified accountants at Accotax! We are a dedicated firm based in Morden, UK. Call us at 020 3441 1258 or send us an email at [email protected]

What Changes in Equity Take Place?

The SOCE represents all the equity movements and changes, including:

- The results of changes in the correction of errors and accounting policies

- Inclusive profit/income for the period (showing the division between owners of the parent and non-controlling interest)

- Reconciliation between the carrying amount at the beginning and end of the period of each component of equity for each period presented, separately disclosing changes resulting from profit or loss and other inclusive income

In addition, an item-by-item analysis of other comprehensive income is required, either on the face of the statement of changes in equity or in the notes.

How to Prepare and Calculate SOCE?

Here is the step by step guide to preparing the SOCE:

- Create separate accounts in the general ledger for each equity.

- Record every business deal amount on the account and transfer every transaction of every equity account to a spreadsheet.

- Collect the transactions within the spreadsheet into similar types, and transfer them to separate line items in the statement of changes in equity.

- Finalise the statement, and ensure that its beginning and ending balances match the general ledger and that the total line items within it add up to the ending balances for all columns.

Looking for all-inclusive monthly packages? Let us take care of your affairs so that you can focus on your business!

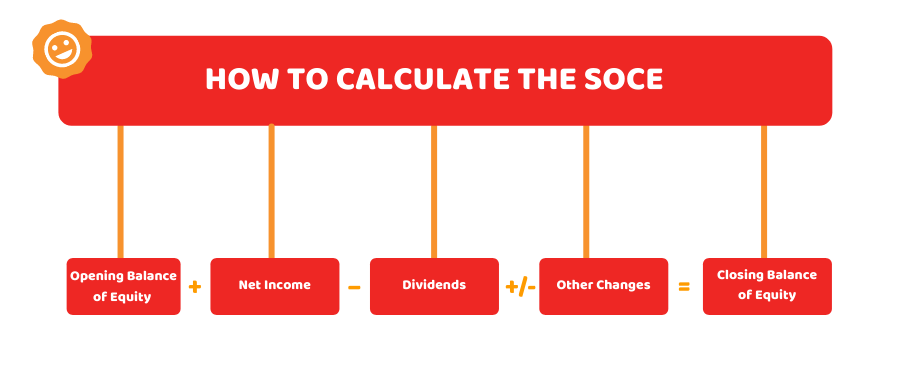

Here is the formula to calculate SOCE:

Opening Balance of Equity + Net Income – Dividends +/- Other Changes = Closing Balance of Equity

Allow us to calculate your SOCE!

What Should Accountants and Companies Need to Consider?

Accountants need to have deep insight into the changes in primary statements introduced by Financial Reporting Standard (FRS 102). They need to prepare financial statements as per the rules and regulations of FRS 102 and help clients identify the differences.

On the other hand, companies need to know that changes of main statements are given by FRS 102 for the preparation of financial statements as per the compliance of FRS 102.

Quick Wrap Up

To sum up the discussion, you are now well aware of what is Statement of Changes in Equity, what changes take place, how to prepare and calculate SOCE, and what should companies and accountants need to consider? SOCE shows how equity moves or changes in a reporting period (one year) of a business. It is one of the essential components of your annual reporting helping shareholders to ascertain the financial health of your business.

Have a Query? Reach out Or Get an instant quote now!

Disclaimer: This blog is intended for general information on SOCE.