Whether you’re self-employed, a sole trader, or a limited company owner, you need to know what is a unique tax reference (UTR number UK), who needs it, how to find and get one? Read on this post till the end to find out all about the UTR number.

Let’s kick off with what is a unique taxpayer reference (UTR number UK).

What is a UTR Number UK?

A unique taxpayer reference number is a 10 digit tax code that HMRC issues for self-assessment taxpayers to keep track of their tax records. If you submit tax returns to HMRC, you’d be assigned a UTR number. Like your National Insurance number, the UTR number remains the same for all your life.

Worried about taxes! Contact our accountants at Accotax!

Who Needs a UTR Number?

You need it to submit a self-assessment tax return. If you complete a tax self-assessment, you need to have a UTR to file your tax returns. This applies if you’re self-employed, a sole trader or a limited company owner. In addition, there are many instances where you’ll need to submit a self-assessment tax return.

For more information on whether you need to submit a self-assessment tax return or not, you can visit the government website.

Why do you Need a UTR Number?

You must have a UTR number to file your tax return, sign up for the construction industry scheme (CIS) or work with your accountant. Besides, you should note that this number is not needed only for self-employed; it is equally important for the person who is paid via PAYE or who earns income from other sources like rent etc because HMRC might be expecting a Self Assessment tax return from these.

Therefore, you need to have a UTR number as per UK law. As without it, penalties or fines might be levied on you.

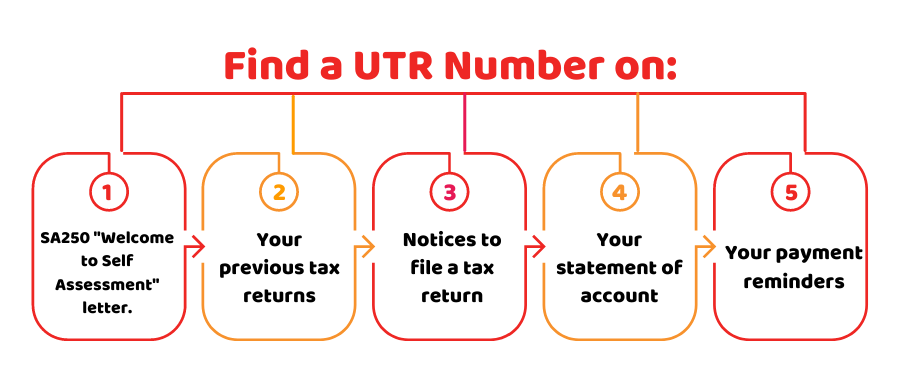

How to Find a UTR Number?

You will get a UTR number around 10 days after you apply for self-assessment or register a limited company. You can find it on the documents sent by HMRC including:

- Your SA250 “Welcome to Self Assessment” letter.

- Your previous tax return (s)

- Notices to file a tax return

- Your statement of account

- Your payment reminders

Moreover, you can also get it by logging into your self-assessment portal, where you can view and manage your tax. Here, you can also use other online services of HMRC.

How to Get a UTR Number?

Remember, you can’t get a UTR number UK automatically. To get one, you first need to register for self-assessment. Here is the simple procedure to get a UTR number:

- Register for Self-Assessment online: The first process to register for self-assessment online via the HMRC website. After registration, you’ll automatically be assigned this number which you can receive by post. If you’re not self-employed, you can use form SA1 to register.

- Apply via phone: You can contact HMRC on 0300 200 3310 to know about your UTR number. You need to provide some details in this regard. They might ask you to apply online.

- Apply via post: You can request HMRC for UTR number via post. Remember that it might take a long time as some letters are sent back due to insufficient information.

Our Chartered Accountants are here to grow your business. Reach out today!

Information Needed to Get a UTR Number

You first need to register for self-assessment to get a UTR Number. To register for self-assessment you need to provide the following details:

- You full name

- Your current address

- Date of Birth

- Phone number

- Email address

- The National Insurance number

If you’re a business owner, you need:

- The starting date of your business

- Your business type

- Business address

- Business phone number

How to Find a Lost UTR?

If you are unable to find your UTR number after checking previous correspondence from HMRC and visiting its online service portal, you can request a lost UTR. Luckily, it is a simple process. You just need to call the Self Assessment helpline on 0300 200 3310 and provide your details, along with your National Insurance number to find out the lost UTR.

Talk to Our Experts, if you’re unable to find your UTR Number, contact us now!

Quick Sum Up

That’s it – you have got all the information about the UTR number UK. After reading this post, you are now well informed about what is a UTR number, why it is needed, who needs it, how to get one and what to do if it’s lost. Remember that the UTR number that you receive will remain the same for your lifetime.

If you need help regarding accounts and taxes, Accotax is here to assist you. We’d love to hear your queries and provide you with expert financial advice to save you from extra taxes.

Get in touch with us anytime, we’d get back to you as soon as possible!

Disclaimer: This blog is written for general information about the Unique Taxpayer Reference.