Being a small business owner, you know the challenges, risks, and obstacles that come along when you embark on your business venture. These things may be great setbacks for achieving business success. Among others, unstable cash flow is one of the biggest challenges that small business owners face. Let’s dive into: what is negative cash flow, what are its causes and effects and how to recover from it.

Find out how our Chartered Accountants can help you to improve your business cash flow. Call us at 0203441 1258 or send us an email at [email protected]. Contact us now!

What is a Negative Cash Flow?

If your business spends more than it generates in a particular period, it may indicate it is suffering from a poor cash flow. It means that the total cash inflow generated from the business activities is less than the total outflow in a specific period. It shows an imbalance in the revenue stream of a business.

Generally, it doesn’t indicate a loss or bad financial performance, however, long-term negative cash flow could be a warning sign that a business is not efficient enough to use its assets effectively to generate revenue. Most often, it is a common financial occurrence with many new businesses.

What Does Negative Cash Flow Mean for your Small Business?

It shows an imbalance between your revenue and expenses. If your cash flow is negative, it may indicate that your business is losing money. Sometimes, it shows that the poor timings of incoming and outgoing money. You can still make a net profit with an unstable cash flow. For instance, you have not paid your bills before your customers pay an invoice. In such cases, you don’t have any cash in hand to meet the expenses.

If your cash flow is negative, you cannot invest back cash into your business. So, as a result, your goal becomes to keep your business afloat rather than its growth.

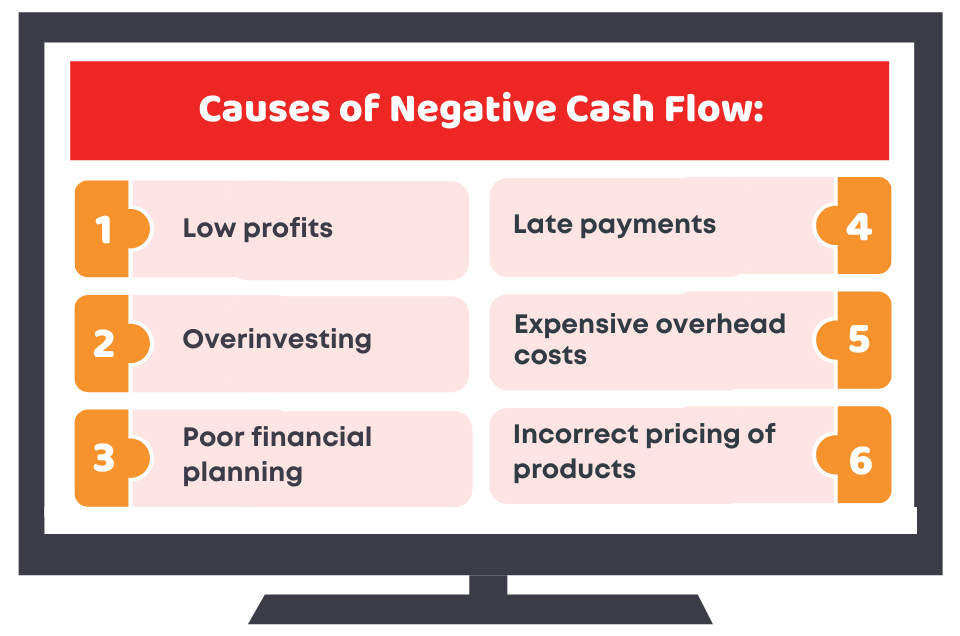

Causes

Several miscalculations, mistakes, and barriers cause more expenses against the revenue. Here is the list of the most common causes that make your cash flow negative:

- Low profits

- Overinvesting

- Poor financial planning

- Late payments

- Expensive overhead costs

- Incorrect pricing of products

Accotax offers a full range of accounting and bookkeeping services to our clients. Give us a call on 02034411 258 or request a callback.

Effects

Managing the cash flow of the business is as critical as supervising a company’s revenue and expenses. You may face some negative consequences with a bad cash flow. If not countered early, these effects can jeopardise the success of your business. Here are the effects that you may face with a bad cash flow:

- Hampered growth

- Stymied dividends

- Promotional deficiencies

Let’s see how you can recover from a poor cash flow.

Tips to Recover From Negative Cash Flow

If you are suffering from a poor cash flow, here are the tips you can use to recover:

- Analyse where you are spending and investing

- Manage your cash flow and forecast regularly

- Monitor and review your outgoing expenses

- Reduce your operating expenses

- Keep some money aside to meet unexpected expenses

- Boost the sales of your business

Learn: how to manage your cash flow!

Quick Sum Up

Although negative cash flow is common with new and emerging businesses, however, if it exists for the long term, it can be a barrier to your business growth. It indicates that you are unable to balance your revenue and expenses effectively. Therefore, you just need to quickly recognise it and find the appropriate remedy to achieve long-term business success.

Rely on Accotax to sort out your cash flow issues! Get an instant quote based on your requirements online in under 2 minutes, Sign up online or request a callback.

Disclaimer: This blog is intended to provide general information about the topic.