Cash might be assumed from your Universal Credit payments to repay cash that you owe, or on the other hand in the event that you have a Fraud Penalty or Sanction.

When cash can be assumed from your Universal Credit Payments?

Cash can be assumed from your Universal Credit payments on the off chance that you:

- have had a Universal Credit advance or planning advance

- have had a difficulty payment

- have had a misrepresentation punishment

- have had an assent

- owe cash to outsider providers, for instance

Reimbursing a Universal Credit Advance:

A Universal Credit Advance is to assist with supporting you. You should reimburse the Advance inside the accompanying timescales:

- Universal Credit payments might consent to stretch out this cutoff time by as long as 90 days in case you are battling with cash.

- a Change of Circumstances Advance – reimburse inside a half year. Universal Credit might consent to stretch out this cutoff time by as long as 90 days in case you are battling with cash.

- a Budgeting Advance – reimburse inside a year. Universal Credit might consent to broaden this cutoff time by a half year in case you are battling with cash.

If you have more than one Advance to take care of, repayments will be assumed from your universal Credit payments in the request given.

In the event that an extortion punishment or approval is applied to your Universal Credit payments, advance repayments will be halted until the misrepresentation punishment or authorization closes. You will begin to repay the Advance once your extortion punishment or approval has finished.

Looking for all-inclusive monthly packages? Let us take care of your affairs so that you can focus on your business.

Reimbursing a Hardship Payment:

You might have difficulty payment if your Universal Credit payments were diminished on the grounds that you had an extortion punishment or authorization applied to them and you were unable to meet your and your family’s fundamental requirements.

You will begin to reimburse the difficult payment once your extortion punishment or approval has finished. Your difficulty repayments can be suspended for any appraisal period where your profit has arrived at a level essentially equivalent to the Conditionality Earnings Threshold.

The restriction income edge is the point at which your profit has arrived at a level where you don’t need to do any business-related movement (all in all, you are procuring enough). In case you are essential for a joint case, this will be on the off chance that you and your accomplice’s all-out profit arrive at the restriction income limit for couples.

On the off chance that your income stays at or over the limit for something like six appraisal periods after the last misrepresentation punishment or approval was applied, Universal Credit may not request that you reimburse the leftover difficulty payment.

Misrepresentation Penalty or a Sanction:

In the event that you purposely don’t give insights regarding an adjustment of your conditions that could influence your Universal Credit payments, or you give bogus data, this is extortion. An extortion punishment or assent will diminish your Universal Credit Standard Allowance.

On the off chance that a misrepresentation punishment or authorization is being assumed from your Universal Praise payments, no other repayment or allowance will be taken, with the exception after all other options have run out of derivations.

You will just suffer each misrepresentation consequence or one approval in turn. In case you are essential for a joint case, both of you can have a misrepresentation punishment or authorization applied to your Universal Credit payments simultaneously. In the event that both a misrepresentation punishment and an authorization are applied to your Universal Credit payments, the extortion punishment will take need and be taken care of first.

Interested in ACCOTAX? Why not speak to one of our qualified accountants? Give us a call on 0203 4411 258 or request a callback. We are available from 9:00 am – 05:30 pm Monday to Friday.

Outsider Deduction

An outsider deduction is a sum that is assumed from your Universal Acknowledgment payments and paid directly to the individual or association you owe cash to, like your landowner or your gas or power provider.

Outsider derivations can likewise be taken, without your consent, for things like:

- lodging costs (for instance, lease unfulfilled obligations for your present location)

- neglected rates, and

- youngster support.

A few allowances can be made for progressing costs, not simply late sums.

Final Resort Deduction

The Last Resort Deduction is a kind of outsider allowance assumed from your Universal Credit payments since you owe cash for:

- lease

- administration charges for a home you live in, or

- gas or power.

Final hotel allowances are made to assist with keeping you from being removed or having your gas or power cut off.

Advantage obligation

Advantage obligation is an overpayment of government advantages or tax reductions, advances, or advances that you need to repay.

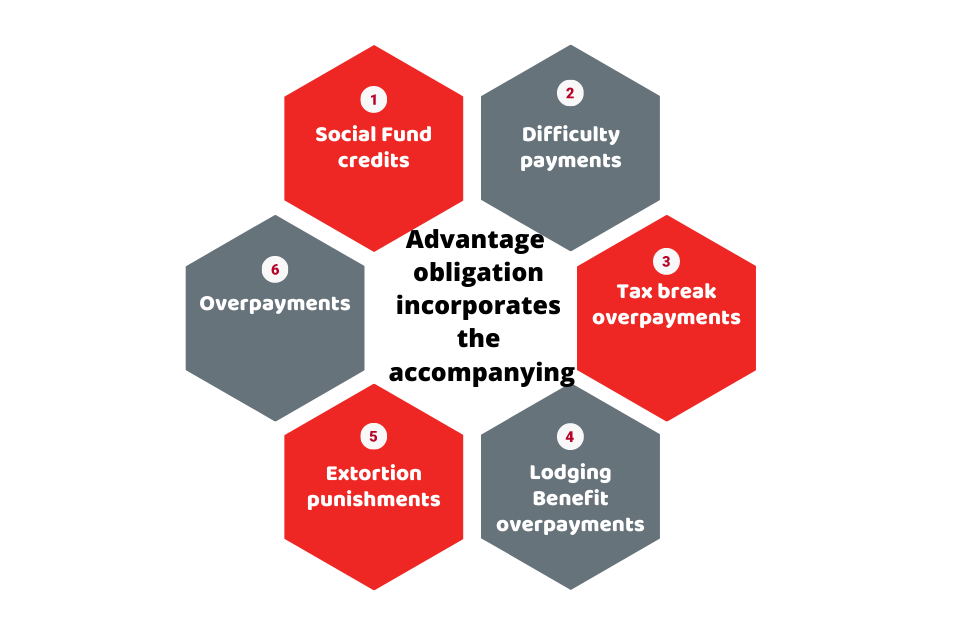

Advantage obligation incorporates the accompanying:

- Social Fund credits

- Difficulty payments

- Tax break overpayments

- Lodging Benefit overpayments

- Extortion punishments

- Overpayments

An overpayment is a sum that has been paid to you that you were not qualified for.

In the event that your family income is over a specific level, up to 25 percent can be assumed from your Universal Praise payments. You can address your work mentor at your nearby Jobs and Benefits office to discover more.

Overpayments of Tax Credits

In case you are getting tax breaks and you guarantee Universal Credit, HM Revenue and Customs (HMRC) will be advised to stop your tax reductions. On the off chance that you get tax reductions after you have made your case to Universal Credit, this could bring about you being paid a lot of tax breaks. Universal Credit will make a move to get this cashback just as some other tax reduction overpayments you have.

This will educate you regarding any tax break repayments that will be removed from your Universal Credit payments. Various overpayments might be reimbursed from your Universal Credit payments on various occasions, and you might get more than one letter.

On the off chance that you guaranteed tax reductions as a team, the overpayments will be parted similarly among you and your accomplice. Assuming you need to discover how the overpayment has been turned out, contact HMRC.

Get an instant quote based on your requirements online in under 2 minutes, Sign up online, or request a callback.

Conclusion:

To sum up the discussion we can say that if you are reimbursing a difficult payment and discover you can’t manage the cost of the repayments you should reveal it to Universal Credit. In the event that you have a Universal Credit Advance being deducted, a deferral will be thought of. You can then address Debt Management to have a reasonableness conversation about your Recoverable Hardship payments or potentially other advantage obligations and Social Fund credits.

Disclaimer: This article includes general information on Universal Credit payments.