If you’re working or planning to work as a self-employed in the UK, you can receive Working Tax Credit (WTC). However, you need to comply with the strict criteria to qualify for it. In this blog, we’re going to explore:

- What is WTC?

- What are the eligibility criteria?

- How much amount you will get?

- How you can claim WTC?

- What if you take leave or gaps?

Want to minimize your tax burden? Accotax is here for your help. Contact us today!

What is Working Tax Credit?

It is a tax credit (money) provided by the government to facilitate people who’re earning a low income. It works the same whether you’re self-employed or working for someone else or both.

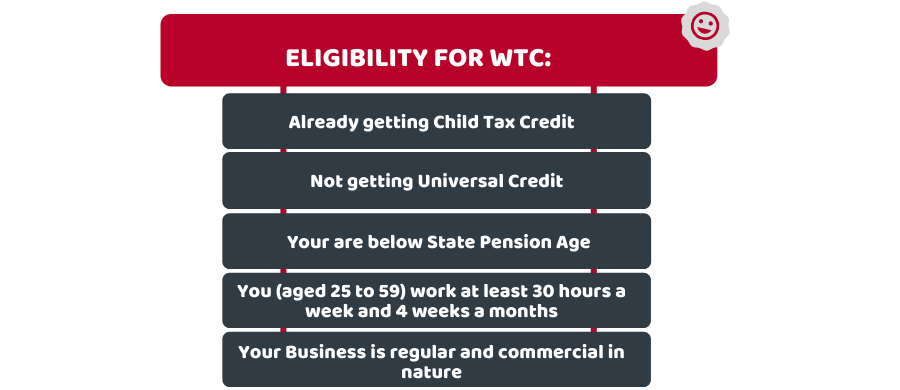

Eligibility for WTC:

You can apply for Working Tax Credit only if:

- You are already getting Child Tax Credit

- You are not getting Universal Credit

- Your age is below the State Pension Age (66).

Hours of Work

You must work for certain hours a week depending on your circumstance to qualify for WTC:

- If your age is between 25 to 59, you need to work at least 30 hours a week.

- If you are over 60 or single with 1 or more children or disabled, you need to work for at least 16 hours a week.

- If you’re a couple with 1 or more children, you need to work for at least 24 hours (one of you need to work for a minimum 16 hours)

For checking the right number of hours you work, you can use tax credit calculator. If you’re on a leave, you can still apply for WTC.

Self-Employed

Some self-employed individuals can’t claim Working Tax Credit. To apply, you need to prove that you aim to work for making a profit. Your business needs to be organized, regular and commercial in nature. You can’t qualify if:

- You don’t make a profit or don’t have a solid plan to do so.

- You don’t work on a regular basis

- You don’t maintain business records like invoices or receipts

- You don’t follow your work regulations like a license or insurance etc

If your average hourly profit as a self-employed is below the National Minimum Wage, HMRC may ask you to provide your business documents for verification.

Pay

You must work at least 4 weeks and must be paid. This also includes payment in kind. It doesn’t include:

- Money paid on a rent room scheme (less than £7,500 or £3,750 for joint owners)

- Pay you to get, while working in prison

- The money you receive as a grant for studying or training

- Money received as a sports award

Income

There is no standard income to qualify for WTC as it depends on your circumstances. Like £18,000 for a couple with no children or £13,000 for a single person. it can be higher for people with children.

Contact our startup accountant advisory for the best financial services for your new business!

How much Credit you’ll get?

With WTC, you get a basic amount with an extra. Your Working Tax Credit is provided based on your circumstances and income. The basic amount for a year is £2,005. For a couple (applying together) and single parent it is up to £2,060 a year. People who’re working for at least 30 hours can get up to £830 a year.

People with disabilities can get £3,240 a year. In case of severe disability, you can get an extra amount of £1,400 a year.

Money is going to be paid directly to the bank or building society account on weekly basis or after every 4 weeks. If you’re a couple, you need to choose only one account. After the claim, you will be paid up to the end of the tax year.

If you want to claim for WTC, update your tax credit claim on the government website.

What if you take Leave or Gaps in Employment?

If you’re on maternity leave, sick pay, or any other, you can get a certain amount of pay depending upon the time limit of the lead or gap. For instance, you’d be paid for 4 weeks if you leave or lose your job. On maternity leave, you can get WTC for the first 39 weeks.

For further details of the time period and qualifying rules, you can visit the HMRC website.

Quick Sum Up

After applying for Working Tax Credit, HMRC may inquire about your employment status or business for verification purposes. If you think that the amount provided to you is not correct due to a mistake, you can ask HMRC for mandatory reconsideration. After this, if your problem is still unsolved, you can appeal it to an independent tribunal. Remember, you can only get thirty days to challenge the decisions.

If you’re looking for expert financial advice to flourish your business, reach out to us for affordable accounting and taxation services!

Get an instant quote right now!

Disclaimer: This blog post is intended to provide general information on the above topic.