HMOs (House in multiple occupations) and multi-let properties have gained great popularity in recent times. According to an estimate (2018), there are over 497,000 HMOs from a total of 4.5 million households in the UK. HMOs offer affordable and quality accommodations, especially to students, and professionals. While they are a great source of income to the landlords. As they are long-term assets and investments that become challenging to manage a on large scale. Therefore, you should consider accountants for HMO in UK for professional support.

Reach out to our property accountants for help.

The Transformation of HMO:

The HMO properties in the UK have been transformed in the last ten years. Earlier, HMOs were considered poor accommodations with messy and undesirable areas run by landlords of questionable character. However, due to the strict legislation and licensing by the UK government, the quality of HMOs have improved to a great extent.

These measures have attracted social classes extending from students to professionals with a greater expectation for quality and affordable accommodation. On the other side, HMO landlords are working for the enhancement of their properties to generate high yields.

Reasons to Choose HMOs:

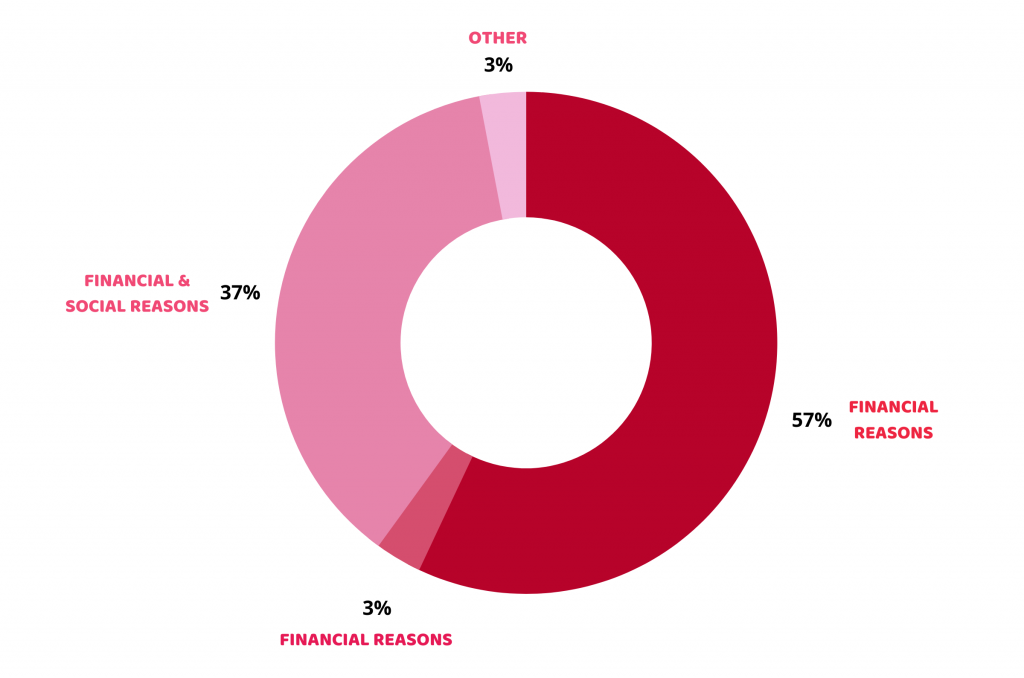

There are multiple reasons for which people want to live in HMO properties. Spareroom (UK) took a survey of 10,000 tenants who were living in the shared accommodation to find out the demand of HMOs. Amongst them, 57% of people prefer HMOs for financial reasons, 37% claim that they choose them for both social and financial reasons. And 3% people choose for social reasons and the rest for other reasons.

So these were the reasons that attract people towards HMOs.

HMO – Tax Consideration:

When it comes to tax implications, HMOs are pretty much similar to normal buy to let properties. Tax on profit received by HMOs is based on legal ownership.

The vast difference is there when you convert your normal property to HMO by adding items like furniture, fitting, fixtures, etc. If you’re willing to increase the number or size of rooms, bedrooms, bathrooms for the sake of local and international regulations, you need large capital expenditure for it. You should note that there is no tax relief on capital expenditure, however, it will lower down your tax liabilities while selling the property. If you want to convert properties to HMO on a larger scale, you may get a chance for tax relief in a communal area.

You can share your concerns with us, we’d love to help you.

Those HMO landlords who faced removal of mortgage interest relief are making their properties furnished holiday let, like holiday websites having serviced accommodation. If you have successfully achieved the criteria of the furnished holiday let, you can get relief on mortgage interest with extra tax reliefs that suit the model.

Let’s find out how accountants for HMO in UK can save you from the taxes. Contact now.

HMO landlords? Need help!

If you want to invest in HMO properties, we have a team of accountants for HMO in UK for professional help on ownership roles to boost your revenue. Additionally, if you want to convert your land to HMO, we can assist you with the tax implications and yield. We can also provide you a detailed list of the merits and demerits of converting HMOs into a furnished holiday.

Most people manage the HMO finances themselves, which ultimately causes errors and hence you are obliged to pay penalties and tax liabilities. For this reason, you can save your hard-earned money by taking the services of an accountant. The accountant will manage your taxes, file your tax return, and manage the company accounts (for companies).

In this regard, our tax advisors and accountants for HMO in UK are worth considering.

Accotax is known for quality accounting and taxation services at affordable rates.

Get an instant quote now!

Disclaimer: This informative blog contains general information about the topic.