Along with enjoying lots of advantages as a contractor, you also have to face a trade-off sometimes. One of which can be the payment of sick leaves. If you don’t work, you won’t get paid while facing any medical issue. Although there is a quality healthcare system called NHS in the UK that is free, however, delays are common there. As a contractor, taking sick leaves for days while waiting for the treatment implies that you are losing new opportunities and income streams. Therefore, private health insurance ensures swift treatment to get back to work on time.

In this blog, we’re going to know about private insurance, what does it cover, why should you get it, and what are the tax-efficient ways to pay it.

We are offering affordable accounting services for contractors. Find out the details.

What is a Private Health Insurance?

If you don’t want to wait for NHS treatment, private insurance can be the best option. It provides the cost of your medical treatment that is done privately. For availing this insurance, you have to pay a monthly or yearly premium. On the basis of that premium, you can claim the charges when you get sick or injured. The policy also covers the doctors’ charges and medicine costs.

There are three types of private insurance as per the aspect it covers:

- Inpatient cover pays the cost of your hospital stay

- Outpatient cover, it pays for treatment, diagnosis test, doctors’ appointments that don’t need a hospital stay

- Day patient cover pays the cost of normal appointments and tests

What Does Private Medical Insurance Cover?

The cost covered by private medical insurance varies as per the insurance type and level you choose. A policy might only cover your hospital stay and cheap insurance might provide you a certain amount of cost. On the other hand, an expensive scheme may cover treatment charges, diagnosis, treatment cost, and the costs of the hospital without payout caps.

You should remember that this insurance only covers acute conditions like infection etc. These conditions usually appear suddenly and worsen within a short time. It doesn’t cover:

- Emergency Treatment

- Chronic Conditions

- Treatment due to the use of alcohol and drug

- Non-essential treatments like cosmetic surgery etc

- Treatment-related to pregnancy and delivery

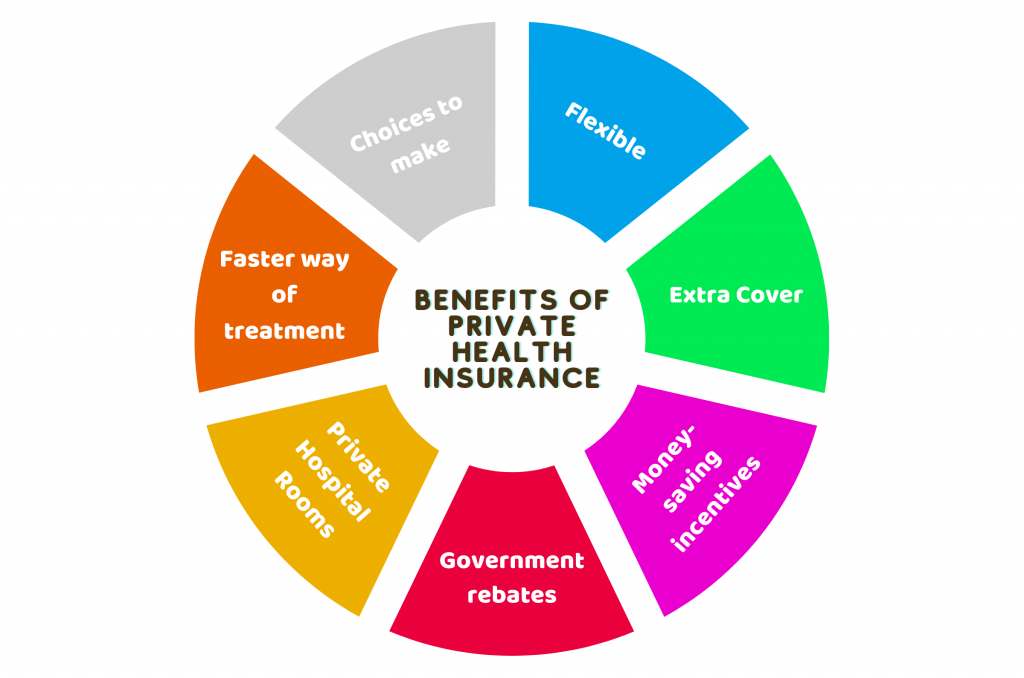

Benefits of Private Medical Insurance:

Here are the reasons for choosing private medical insurance:

- Faster way of treatment

- Private hospital rooms

- Government rebates

- Money-saving incentives

- Extra cover

- Flexible

- Choices to make

Our accountant can manage the finances of your insurance. Get in touch now!

Choosing Private Medical Insurance:

Along with the fast, convenient, and cost-friendly benefits of this insurance, you can choose as per your will and needs. According to ActiveQuote, the average premium of private medical insurance is £1,435 a year and £120 a month. However, you can bring the cost down by compromising the quality of your cover:

You should consider the following things before choosing private insurance:

1. What policy and cover do you need?

Are you looking for a comprehensive cover? Or would you go for some type of treatment? A comprehensive policy will be expensive for you as it covers many things. That’s why you should choose the cover that fulfills your needs. To reduce your premium or to take optimal benefit from it, you should select a policy covering in-patient treatment or such treatment that is not available on NHS.

2. How much excess do you want to pay?

If your policy can’t cover any specific expense, you have to pay for the excess amount. You can pay the excess amount annually in private medical insurance. An excess amount is not much useful when you’re young, but it will be effective at old age as you would be able to claim insurance multiple times.

3. What choice do you want to make?

Are you happy with a single hospital? Or you want to choose from hundreds of clinics and hospitals? You might think that you are limiting yourself. But unless you travel too often, normal policies cover the hospital nearby your residence. If your insurance policy offers you more choices, it will cost you more than a policy with a fixed choice.

Quick Wrap Up:

If you’re a limited company contractor, private medical insurance can provide you faster and flexible treatment opportunities. You might not find those treatments at NHS that are available in private health insurance. However, you have to pay for the special privileges. Therefore, before making the choice you should consider multiple factors to find out the affordable policy that is worth the cost.

Accotax is providing affordable accounting, bookkeeping, and taxation services to contractors. Get an instant quote now!

Disclaimer: This blog provides general information on private medical insurance.