It is the dream of every individual to flourish his business and make a mark in the business community. Proper direction and planning are the keystones of a successful business. For the success of every business, the accounting sector is the most imperative part. An excellent accounting system helps to boost your business. The two important methods of accounting to record accounting transactions are cash basis accounting and accrual basis accounting.

In today’s blog, we’d discuss what are they and what are the pros and cons of these methods.

Accotax has a team of expert accountants and tax consultants to help in flourishing your business.

Accounting Methods:

There are two most important and acknowledged methods of accounting for the business. One is cash basis accounting and the other is accrual basis accounting. The difference between the both lies in the recognition timing of expense and revenue.

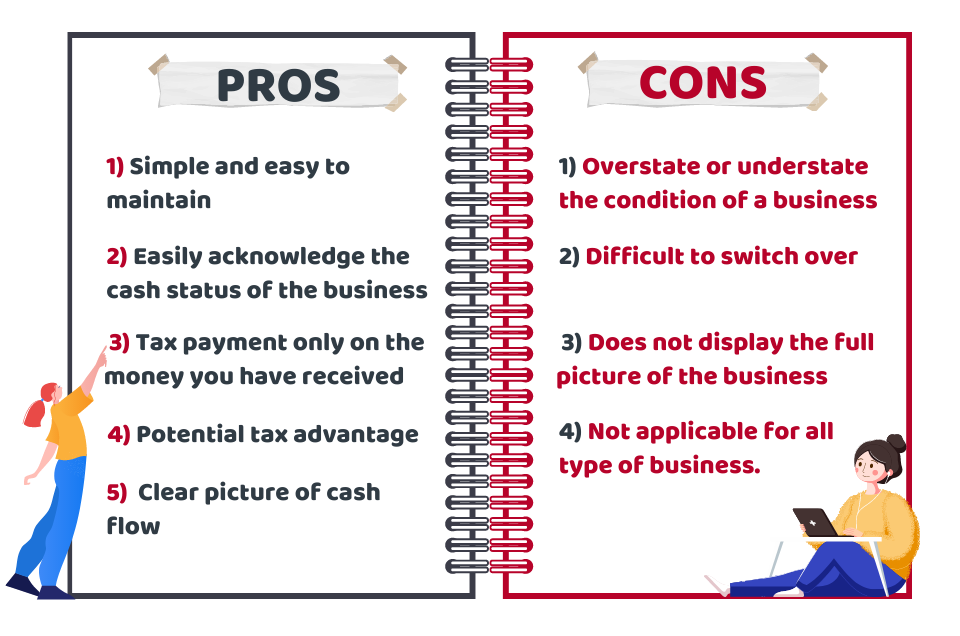

Cash Basis Accounting:

It is a simple and straightforward method of accounting in which revenues and expenses are recorded when payment is received and paid, respectively. This accounting method clearly describes the picture of how much cash a business has on hand. There are some advantages and disadvantages of cash basis accounting.

Pros:

- Simple and easy to maintain

- Easily acknowledge the cash status of the business

- Tax payment only on the money you have received

- Potential tax advantage

- A clear picture of cash flow

Cons:

- Overstate or understate the condition of a business

- Potentially difficult to switch over

- Does not display the full picture of the business

- Not applicable for all types of business.

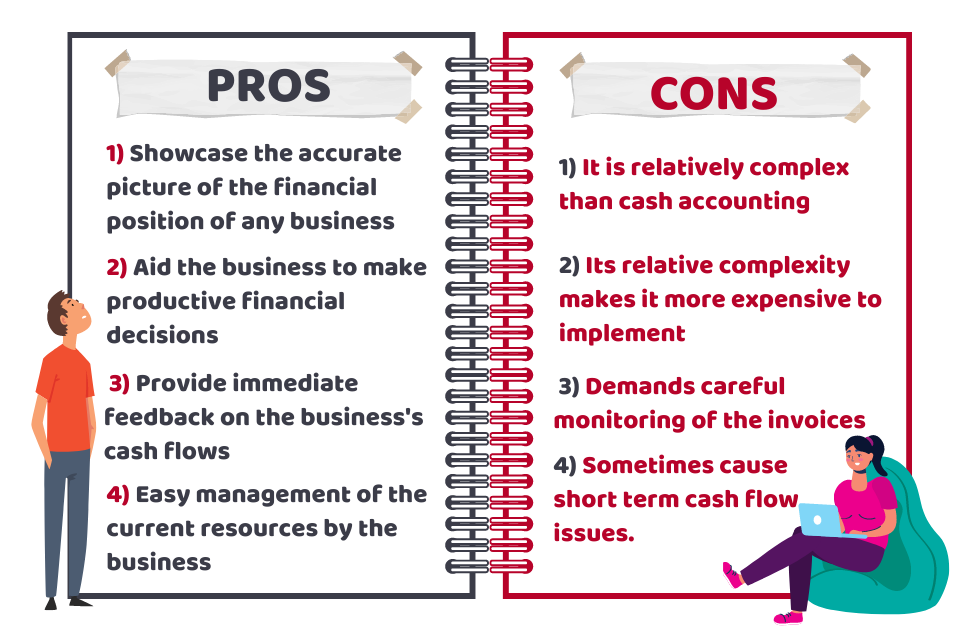

Accrual Basis Accounting:

It is a standard accounting method beneficial for most organizations and aims at providing an accurate picture of the company’s position in the business hub. This system works on the matching principle which states that the recognition period for revenue and expense must be the same. Accrual method aids in representing the underlying and actual economic reality of the business.

Pros:

- Showcase the accurate picture of the financial position of any business

- Aid the business to make productive financial decisions

- Provide immediate feedback on the business’s cash flows

- Easy management of the current resources by the business

Cons:

- It is relatively complex than cash accounting

- Its relative complexity makes it more expensive to implement

- Demands careful monitoring of the invoices

- Sometimes cause short-term cash flow issues.

Implementation of a strong accounting system based on any of the above methods will reduce your tax liability; eliminate your tax issues; help your business to flourish and save your precious time.

Cash Accounting vs Accrual Accounting- Comparison:

As we know the recognition timing of revenue and expenses creates the distinction between the primary tax accounting systems of cash accounting and accrual basis accounting. The former method allows the delayed recognition of revenue and expenses whereas the latter method focused on anticipated revenue and expenses. The accrual method is most commonly used by well-known business companies, whereas businesses working on a small scale use a primary tax accounting system based on cash accounting.

Accotax is a premium, contemporary and innovative accounting firm that gives financial consulting services across the UK. We have a team of professionals accountants specialized in providing accounting services and consultancy. Reach out to us to avail the best accounting services!

Conclusion:

To sum up the whole narration, we have come to the point that excellent accounting services analyze financial data to generate feedback that will help businesses to make productive decisions. We will be able to measure the financial performances of the organization through cash basis accounting or accrual basis accounting. You can go for any accounting method depending upon your business size and needs.

Accotax is best for resolving your tax issues with its wide range of all-inclusive packages, customized according to your business needs and give 360 coverage to your business.

Get your business flourished by using prestigious and excellent accounting services by Accotax.

Get an instant quote right now!

Disclaimer: This blog is written for general information on accounting methods.