VAT rules and procedures can be complicated and burdensome, particularly for charities and non-profit organisations. Therefore, in this blog, we’re going to answer some of the most commonly asked questions when it comes to VAT on charities. We’ll be going to discuss: do charities have to pay VAT, whether can charities claim back VAT and so on. After reading this post, you’d be able to know whether charities are VAT exempt, whether they qualify for VAT reliefs, and how you can claim back VAT on charities.

Let’s kick off with the VAT exemptions for charities!

VAT Exemptions for Charities

Generally, VAT rules apply to charities the same as any other organisation. Just like a non-charitable business, a charity must register for VAT. The condition is that it generates taxable sales that exceed the VAT threshold (£85,000). Once registered, they can charge VAT on goods and services they provide. Moreover, they have the responsibility to submit VAT returns after three months.

Charities also need to pay VAT on the standard-rated goods and services they buy from businesses that are VAT-registered. However, there are a number of VAT reliefs and exemptions that are specifically available for charities. Hence, they’re allowed to pay VAT at a reduced rate of 5 percent or zero rates when they make purchases.

Looking for a VAT accountant? Look no further than Accotax for affordable services!

VAT Relief for Charities

Normally, non-charity organisations don’t get VAT relief and need to pay the full 20% of the VAT to their supplier. But a charity organisation – even if it is not registered – can request its suppliers to charge the reduced rate of 5% or zero rate (0%) of VAT for some goods and services. Moreover, charity organisations also don’t need to pay VAT for qualifying goods that are imported from outside the EU.

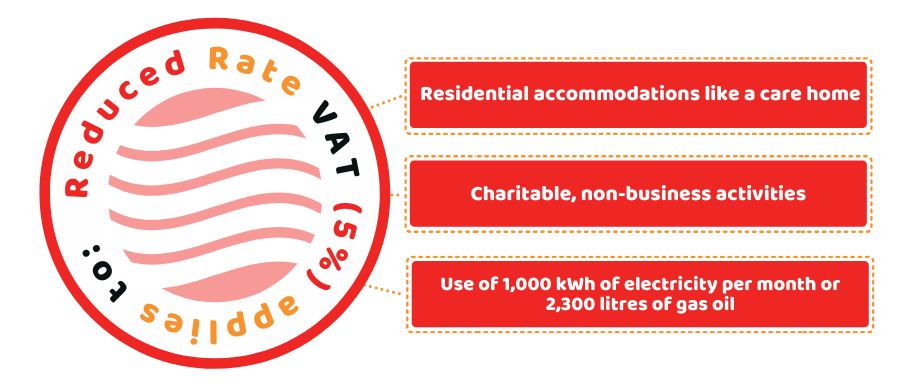

Goods and Services Taxed at Reduced Rate (5%)

VAT on qualifying fuel and gas is charged to charities at a reduced rate of 5%. But to qualify for the discounted rate of VAT, the resources need to be used for:

- Residential accommodation, like a care home or children’s home

- Charitable, non-business activities like providing free childcare

- Use on a small-scale up to a maximum of 1,000 kWh of electricity per month or 2,300 litres of gas oil

Note: You need to keep in mind that qualifying fuel and power don’t include vehicle fuel.

If you are using the energy supply for both business and charitable purposes, you need to pay the standard rate on the portion of your bill that is used for business purposes. If less than 60% of the energy you consume qualifies for reduced-rate activities, you have to pay the standard rate of 20% VAT for the rest. However, if you’re using over 60% fuel and power on reduced-rate activities, the reduced rate is chargeable on your whole bill.

Goods and Services Taxed at Zero Rate (o%)

Charity businesses may also qualify for purchasing a wide range of goods and services at zero VAT, including:

- Medical supplies and equipment

- Aid for disabled people

- Construction and building work

- Scientific equipment

- Advertising

- Rescue equipment

- Vehicles, such as ambulances and lifeboats

You can get the list of qualifying goods and services at a zero rate on the HMRC website.

Imported Goods

Charity organisations are exempt from VAT on goods that are imported from outside the UK, provided they benefit people in need. HMRC defines those as:

- Basic necessities

- Equipment and office materials for needy people

- Goods that are going to be used or sold at charity events

Get in touch with our VAT accountants now!

How Charities Can Claim VAT Relief?

To get goods and services at zero-rate VAT or a reduced rate, charity organisations should provide evidence of their charitable status. You can either provide a recognition letter from Charity Commission Registration or HMRC if your organisation is located in England or Wales.

Can Charities Claim Back VAT?

If a VAT-registered charity organisation is paying input tax (standard rate VAT) on some goods and services, it may qualify to claim back VAT. However, you need to remember that if your charity organisation is not VAT registered, it won’t be able to reclaim VAT charged on the purchase of goods and services from VAT-registered businesses.

Registered charity organisations can reclaim VAT if:

- They fall within the definition of charity for charity discounts

- Recognised for tax purposes (recognised by HMRC and registered with the Charity Commission)

- Goods and services they bought qualify for reduced or zero rate

If you meet the above conditions, you can reclaim up to four years of the back pay you made for VAT. The amount that you will recover will be the difference between the standard rate and the zero or discounted rate. You’d be happy to know that if you were eligible for discounted or zero rate VAT and had been paying the standard rate.

For professional advice on reclaiming VAT, reach out to Accotax instantly!

You need to bear in mind that if your charity organisation is erroneously paying zero or discounted rate, HMRC may reclaim the amount that is due on your for the past years. And you might be charged with hefty tax charges. So, to be protected you need to make sure that you are eligible for charity VAT relief.

Quick Sum Up

To sum up the discussion, we hope that you have got the answer to can charity claim back VAT. Charity organisations that are VAT registered can reclaim the VAT on purchases of goods and services. Unlike non-charity businesses, charities enjoy the discounted and zero rate VAT on many goods and services, along with some items that are imported to the UK.

If you’re looking for further help on VAT implications for charity organisations, don’t hesitate to get in touch with us. Let us handle it for you, contact us now!

Disclaimer: This blog is written for general information on reclaiming VAT for charities.