You might be aware of the fact that you’re not allowed to reclaim VAT on private vehicles like personal cars. But, can you reclaim VAT on commercial vehicles? The answer to this question is a big YES.

If you’re a VAT registered business and use vehicles for work, you can claim back VAT on commercial vehicles. Now there comes a question that what is classed as a commercial vehicle as per HMRC. Let’s find out all the answers in this short post.

Looking for a VAT accountant? Look no further other than Accotax for affordable services!

What are Commercial Vehicles?

Generally, a commercial vehicle is a vehicle that is used for business purposes like HGV, coach, lorry, tractor or transit van. However, there are some vehicles that are used for both commercial and private purposes. These vehicles include vans with rear seats and car-derived vans. Combi vans and dual-cabs are typical examples of dual-purpose vehicles.

Dual Purpose Vehicles

These vehicles look similar to cars from the outside, but their interior is altered to be sold as commercial vehicles. For instance, to make a load area the manufacturer or converter might remove the rear seats and seat belts and fit a new floor panel. HMRC considers such vehicles as commercial vehicles under certain circumstances.

You can visit the HMRC website to get details of car derived vans and combi vans.

With these details, you can get to know whether a vehicle is classed as a commercial vehicle or how it would be treated for VAT purposes. You need to remember that with time the specifications of the cars might change and the list might not be updated, therefore businesses need to contact HMRC before they reclaim VAT.

For professional advice on reclaiming VAT on commercial vehicles, reach out to Accotax instantly!

Reclaiming VAT

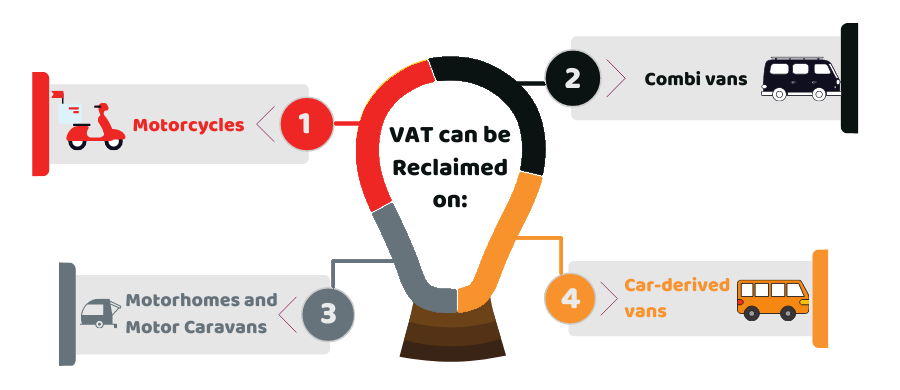

If you’re a VAT registered business, you can reclaim VAT on commercial vehicles that are exclusively used for business purposes. They include:

- motorcycles

- vans with rear seats (combi vans)

- motorhomes and motor caravans

- car-derived vans

If the following vehicles are only utilised for business purposes, you can recover all the VAT on their purchase. If the vehicles are occasionally used as ‘de minimis’, HMRC allows it but you need to provide proof that they’re used for occasional use only. However, HMRC considers the intended personal use of commercial vehicles for private purposes. If there is a significant private use, it would be essential to:

- divide the portion of the tax on the purchase and only claim for milage used for a business

- reclaim the full input tax and keep a record of output tax for each period as per the Lennartz principle

Still, confused about reclaiming VAT on business vehicles? Find the answers to commonly asked questions here with Accotax! Get in touch today!

How HMRC Performs VAT Inspections?

Whilst carrying out the inspection, HMRC will inspect the VAT reclaim on commercial vehicles. It will check the level of private use if there is a full claim on dual-purpose vehicles.

HMRC strictly deal with vehicles used for dual purposes and it might not allow all or part of the VAT if it has been claimed back in full. Sometimes, HMRC may inquire if there is a direct tax benefit in kind’ and might disallow VAT recovery in full.

Nevertheless, if there is occasional use, you can make the VAT recovery in full.

Quick Sum Up

Hopefully, you have got enough information on claiming back VAT on commercial vehicles in full provided if certain conditions are met as per the HMRC guidelines. However, if the vehicle is dual-purpose and it has considerable private use, you have to face the restriction to reclaim input tax on those vehicles.

Contact our qualified VAT accountants for further help!

Disclaimer: This blog provides general information on reclaiming VAT on commercial vehicles.