If you’ve decided to venture into the world of buy to let, you need to consider a lot of things beforehand. But the most important factor that requires foremost consideration is whether your property investment will pay off or not and how much return you’d receive. Whether you’re a new or existing landlord, before investing on buy to let, you should determine what rental yield you’ll get. Read on to find out what is rental yield, and how to work out rental yield.

Let’s kick off with what exactly rental yield is.

What is Rental Yield?

Rental yield is the annual financial return you get on a monthly basis that is compared to the total value of the property/price. If you are a buy-to-let investor or a landlord, you can work out your rental yield to find out whether it’s a good investment option or not. Besides, it is also used to calculate the affordability of buy to let mortgage. However, you need to consider other factors as well to get a good return on your investment.

Worried about the tax implications on rental yield, don’t be! Just let us know to handle it!

How to Work out Rental Yield?

Calculating the rental yield of a property is a simple process. You just need to calculate the annual rental income of the property, then you need to divide it by the value of your property and finally, you can multiply it by 100 to get the percentage.

Here is the simple formula of it:

Annual rental income / total property value x 100 = Gross yield

Mortgage lender uses gross yield to consider the affordability of buy to let mortgage.

To find the net yield after deducting necessary expenses like insurances, maintenance and repair cost, management fee or mortgage payments etc. You can calculate the net yield to get a clear picture of your rental yield. Here is the formula for it:

Annual rental income – annual operating costs / total value of property x 100 = Net yield

For example, if you are getting a rental income of £9,000 and the value of your property is £150,000. Your annual rental yield would be 6%.

This process might be complex if you haven’t bought a property yet and want to work out the estimate of its rental yield. In such a case, you need to consider average rent in your area and other factors like schools, transportation links, hospital and local amenities etc.

For expert assistance, get in touch with our certified accountants for help!

Best Areas for Rental Yield

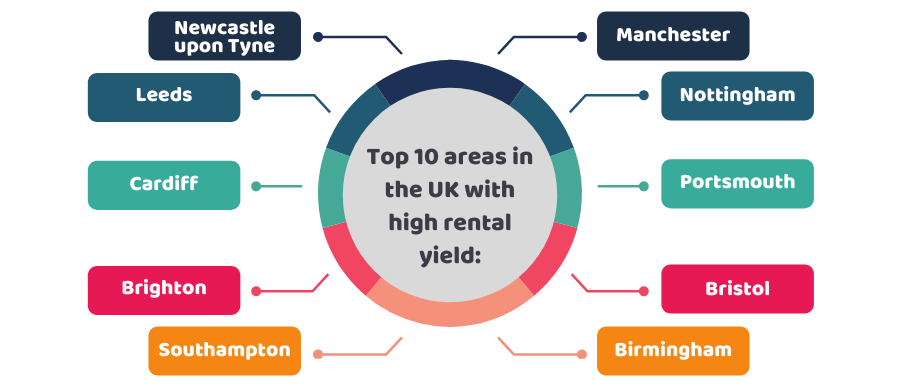

Want to find out the areas where you can get the maximum benefit out of your rental property? You need to know that if your rental yield is around 7% or more, it is considered good. Here is the list of the top 10 areas that have high rental yields in the UK. Manchester tops the list following Nottingham, Portsmouth, Bristol, and Bermingham:

- Manchester

- Nottingham

- Portsmouth

- Bristol

- Birmingham

- Newcastle upon Tyne

- Leeds

- Cardiff

- Brighton

- Southampton

Capital gains is another important aspect that has significantly raised the value of the South East towns’ properties. Here is the list of the top 10 areas with the most capital gains in the UK:

- Dartford

- Watford

- Ilford

- Enfield

- Bromley

- Romford

- Southall

- Twickenham

- Luton

- East London

Capital gains tax can be complicated. So it’s advisable to take the help of an expert accountant. Reach out to our accountants today!

Quick Sum Up

So now that you have got to know how to work out rental yield, you can easily gauge what rental yield is profitable and what is not. If you are looking for expert financial advice to find the best investment options in buy to let properties, our accountant for the landlords would be glad to help you with deep insight on tax implications and compliances.

We will provide tailored accounting and taxation services for you. So feel free to get in touch with us anytime!

Disclaimer: This blog provides general information on the rental yield.