Life is full of risks, so is your business. Therefore, it is imperative to have an insurance policy after setting up your business. If your business serves the public, whether you run a fashion store or real state office, it is recommended to have public liability insurance. People who’re going to get this insurance for the first time might be unaware of what is public liability insurance UK, how much it costs, how to calculate it and how to get it.

Let’s kick off with the introduction of public liability insurance.

What is Public Liability Insurance UK?

Though you are not legally bound to have public liability insurance, but you should go for it if your business deals with the public. It provides protection for the public against various damages and injuries. This insurance covers the legal cost and compensation cost if your business faces any unfavorable incidents like harm, or an injury of a member of the public while visiting your premises.

You need to note that if you run a horse-riding or aircraft business; it is compulsory to have public liability insurance in the UK.

Get in touch with our limited company accountant for tailored accounting services that your business need!

How much does Public Liability Insurance Cost in the UK?

The cost of public liability insurance varies based on the nature of the business you operate. You need to know that the prices are generally inexpensive. According to the estimates, the average annual cost of public liability insurance is around £120. This cost can go down up to £40 for the startups and newly established businesses and rise up to £450 a year for businesses with moderate risks.

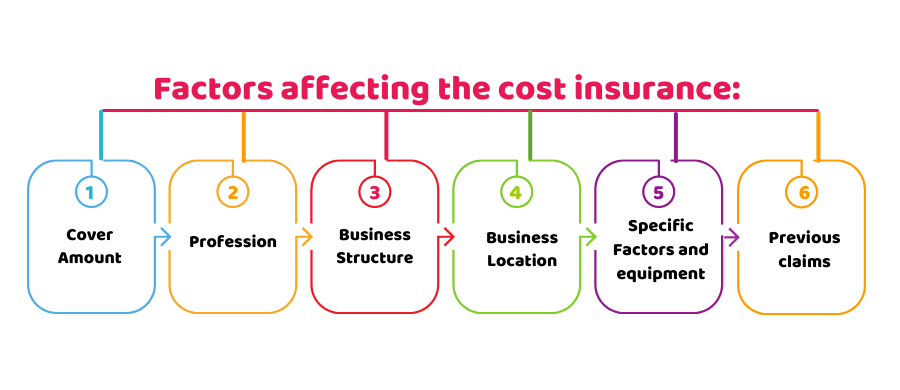

The factors that affect the cost of this insurance include:

- Cover Amount

- Profession

- Business Structure

- Business Location

- Specific Factors and equipment

- Previous claims

The insurance cost of small businesses is comparatively lower than large or medium-sized businesses.

How to Get Public Liability Insurance UK?

To get the insurance, you first need to compare the prices of each using insurance aggregator to find out the market rates and trends. For a better price, you should directly get in touch with your shortlisted insurer to get a good price. Here are few general steps to follow to get public liability insurance:

- Use a price comparison aggregator for the best price

- Go through different comparison sites

- Contact directly for comprehensive quotes

- Find specialist insurers

Save your time, money and energy by focusing more on your business and allowing us to handle your business finances. Contact us today!

How much Insurance my Business need?

Generally, there are three insurance levels with a cover of £2m, £5m, and £10m. Small businesses prefer to take £2m, but you’d have to do a risk assessment and potential claim that your business could face. If you’re dealing with a business with high chances of injury, you’ll need to have insurance with high cover.

While deciding the cover amount, you need to list down the ways your business could harm the members of the public. It can either be an injury or property damage to find out which insurance coverage will be suitable for your business.

The types of cover by public liability insurance are:

- Legal Expenses

- Cost of Compensations

- Repair and Medical Costs

What things are not covered by Public Liability Insurance?

You need to bear this in your mind that this insurance won’t cover:

- Personal accidents that happened to you and your staff

- Damage to your property and business assets

For staff claims, you need to have employer’s liability insurance. Besides, you need general business insurance for any theft, damage, or accidents to business assets like laptops, vehicles, and plant, etc.

Quick Sum Up

To conclude, we have discussed what is public liability insurance UK, how much it costs, how to calculate it and how to get it. You must note that while buying your insurance, you must answer all the questions accurately to avoid future troubles. Besides, you need to take enough cover as per your business needs to keep your business protected.

For the long-term sustainability of your business, you need to keep track of your finances. Contact our chartered accountants in London for any financial help or query. Get an instant quote!

Disclaimer: This blog is intended for general information on public liability insurance.