To ensure the profitable functioning of a company, accountants play an important role. They are accountable to manage the business accounts. The tax legislation is ensured by the accountants as well to make the company tax-efficient. However, there are chances of switching accountants when your business grows or changes in a certain manner.

Several people tend to approach professional help to learn how to change the accountants for a new business line. Although switching accountants is an expensive and time-consuming process, however, this article will let you help to streamline the process. This will further help in order to carry out the process in a fair manner.

Before we delve into further discussion, we need to have a look at the point of discussion in this article. This includes the following:

- Switching Accountants – The Reasons

- Points to Focus before Switching

- Easy Steps to Switch your Accountant

- The Bottom Line

Want to switch accountant? Speak to one of our qualified accountants? Give us a call on 0203 4411 258 or request a callback. We are available from 9:00 am – 05:30 pm Monday to Friday.

Switching Accountants – The Reasons:

There can be multiple reasons to change the accountant from one to another. The popular reasons that come from the clients are the change in business to business growth and the accountant is no longer able to handle the accounts matter fairly or the accountant is not proactive to deal with the accounts well. Some more reasons that make you decide to change the accountant might include the following:

- The old accountant has reached the retirement age and you are looking for a fresh accountant.

- The accountant is not capable enough to deal with the current accounts efficiently.

- The bad advice of your accountant is making you suffer issues with HMRC

- The accountant is not responsive to the matters as required according to the situation.

Let us manage your practice from A to Z. We’ll take care of everything on your behalf.

Points to Focus before Switching:

The important thing to consider before you finally change the accountant is to decide without a rush and analyse the best time to hand over the business matters to the new accountant fairly.

It is wise to change the accountant in a low business activity time period so that the processing of business matters is not disturbed.

Ensure that all the delayed payments are taken into serious consideration so that the transfer from one accountant to the other accountant is done without any hurdles.

Looking for all-inclusive monthly packages? Let us take care of your affairs so that you can focus on your business.

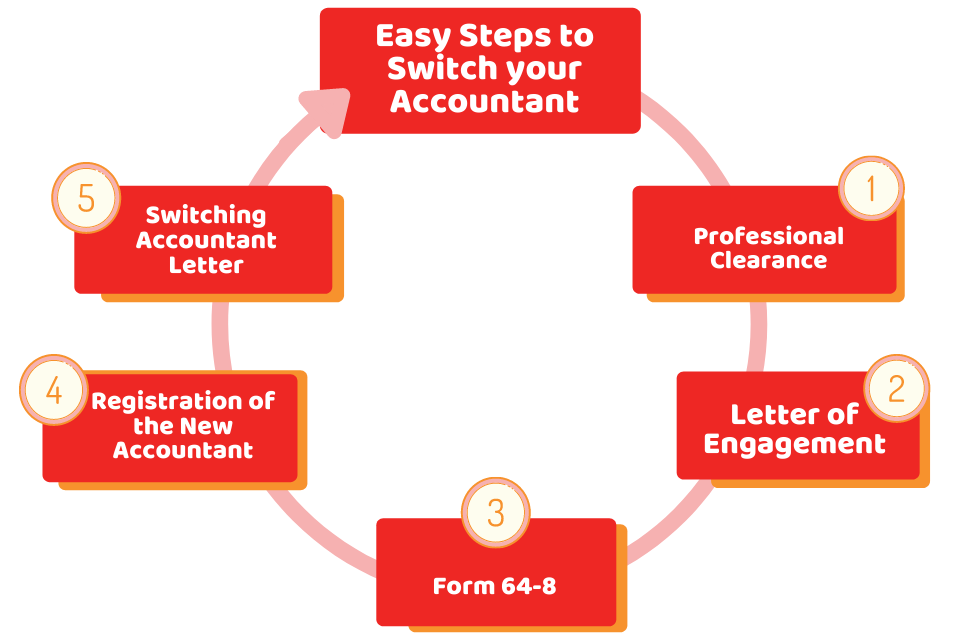

Easy Steps to Switch your Accountant:

Here is the discussion of the easy and simple steps that are required to change the accountant.

1- Professional Clearance:

The new accountant must write a letter to the old accountant and this letter is known as professional clearance in which he can demand the account records including tax details, tax returns, copy of the accounts and other relevant details of the business accounts.

2- Letter of Engagement:

The new accountancy firm must be part of a recognised professional body. A Letter of engagement is required to be sent by them which explains the requirements and expectations between both parties. Ensure carefully. to go through the letter of engagement

3- Form 64-8:

Form 64-8 must be signed by the new accountant which means that you have finally authorised this accountant to handle your business accounts and deal with HMRC as well. This process can be completed through online authorisation services by HMRC.

4- Registration of the New Accountant:

A registration form will be sent by the new accountant in order to ensure the authorisation. This form will require your company as well as personal information to be completed.

5- Switching Accountant Letter:

To inform the current accountant about switching to the other accountant firm is done through a switching accountant letter in which you also add the expectation to complete any task for instant completion of the financial year-end accounts.

Get an instant quote based on your requirements online in under 2 minutes, Sign up online or request a callback.

The Bottom Line:

Now that you have developed a better understanding of the process of switching accountants, we can sum up the discussion by saying that switching to a more suitable accountant for your business is an easy process if you follow the steps as per the requirement. This will save you from haphazard and ensure the seamless functioning of the process.

We hope this article helped to develop a better understanding of changing accountants.

Can’t find what you are looking for? why not speak to one of our experts and see how we can help you are looking for.

Disclaimer: This article intends to provide general information based on switching accountants and relevant details.